Medical expenses have increased largely, and you require a steady plan to avoid financial distress. An emergency medical condition can bring financial uncertainty and cause a stressful situation. Health insurance is your rescue during such cases. But which one is helpful for the need, a group health insurance or a personal plan?

Table of Contents

Understand the needs

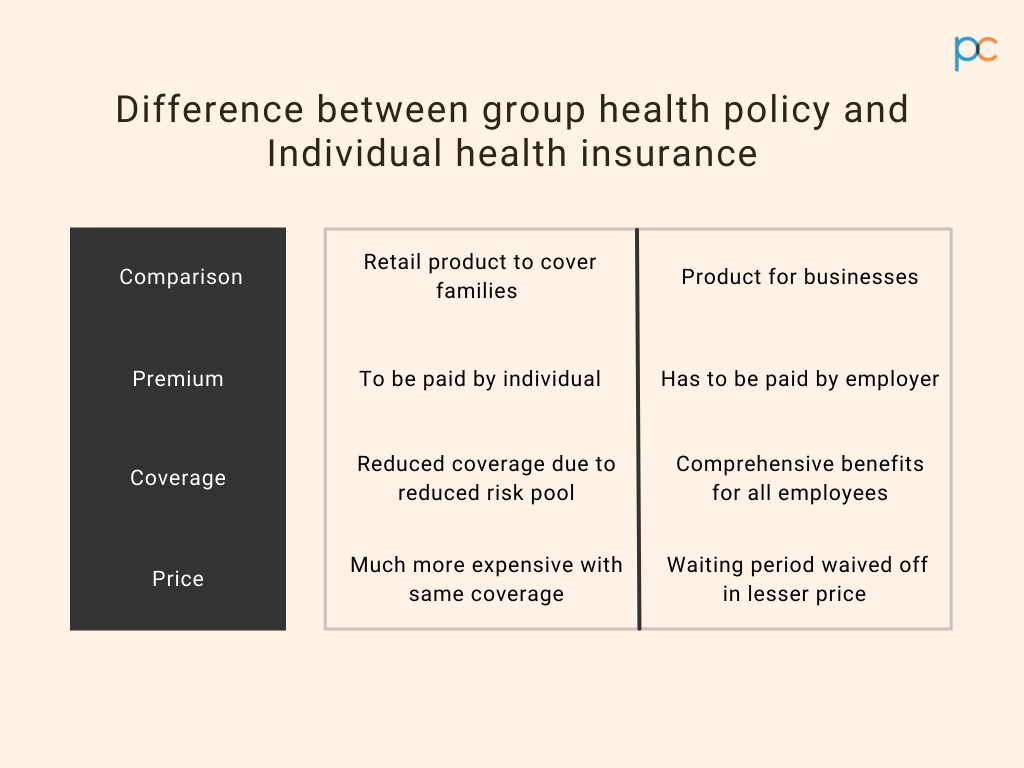

When you think of health insurance, two names pop up. One is the employer health insurance, and the other one is the individual health insurance plan. Both are policies that meet the health expenses and medical charges depending on the sum insured and policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits. But there is a lot of difference in both the plans. If you are in doubt about the features of the plans, give this a quick read to eliminate all the doubtful questions.

Points to discuss

A group health insurance plan or an employer health insurance is a service benefit that the employer of the organization offers to their employees. Under this plan, the employer is responsible for paying the premiums while the employee and their dependent family members can enjoy policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits. In contrast, individual health insurance is a personal purchase for enjoying medical benefits. Here you buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and pay the premium as per the selected plan.

Although the prime function of the two policies is to bear the medical costs during emergencies, there are multiple differences between the policies.

Who pays the premium?

In both policies, you have to pay a premium to avail of the benefits for coverage. In individual health insurance, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More is responsible for paying it. They can pick the plan as per their affordability and pay a premium from their end to continue the insurance benefits. In contrast, the employer is the decision-maker in the case of a group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The employer of the organization or business you are a part of decides the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and sum of insurance. They pay the premium on your behalf, and the employees get to enjoy the plan benefits without paying a penny for the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Who gets the insurance coverage?

The insurance coverage is the basic utility, why most people opt-in for health policies. By producing the insurance card, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can get admitted and undergo treatment. The insurance coverage also allows reimbursement of medical expenses if you produce genuine and relevant documents. But in both the policies, there is a difference in terms of plan coverage.

In individual health insurance, only the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can enjoy the benefits. If the insurance plan is under your name, then you can enjoy the coverage. No one in the family or dependent members can enjoy the coverage benefits. While in a group health plan, you get comprehensive coverage. In the employer health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, you and your family members, including spouse, children and parents, can enjoy the coverage benefits.

What about terminating the policy?

Exit criteria in a health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More mean the tenure of plan coverage. It is the period till which the insurance company will bear the cost for your medical expenses in return for the premium payment. On the other hand, terminating a health plan means where the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More surrenders the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and stops paying the premium. The regulations of surrendering the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and exit procedure are different in the two health insurance plans.

In an employer health insurance plan, the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is valid till the active service period. It means if an employee leaves the job, then the benefits of the plan will get cancelled. Here an employee cannot stop the premium payment upon their wish and will continue to get the plan coverage till the last day of their service. In contrast, for an individual plan, the decision is completely yours. You can terminate the plan by not paying the premiums or surrendering the papers to the insurance company. The exit criteria of the personal plans can vary depending on the norms of the insurance company.

Eligibility criteria for policies

For becoming a policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More, there are some eligibility criteria in both insurance plans. If you do not suffice any one of the given eligibility norms of the selected insurance plan, then your policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More will not get approval. The best method to find out if you are eligible to buy the insurance or not is by connecting to a representative of the insurance company or by consulting with an insurance broker.

In an employer health insurance plan, the eligibility criteria are more complex. As an organization employee, your eligibility criteria are to stay as a full-time staff in the organization or business. Only then you can avail of the benefits. As an employer who wishes to provide the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits to their employees, you have to also tick off certain rules that IRDAI sets. For example, the minimum employee strength has to be seven for getting approval for the group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

In contrast, the personal health plan eligibility is simple. You have to be an adult( 18 years old) for getting the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More in your name. For health policies for minors, there should be a legal guardian to take responsibility for the premium and other essential formalities.

What about the sum insured?

The amount insured in the health policies may be different depending on the plan you pick. In group health policies where the employer is the key decider, the sum gets decided by them. The amount is lower than individual policies and usually ranges between Rs.1 lakhs to Rs.5 lakhs.

On the other hand, in personal health policies, the insurance amount is much higher as the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More decides the amount for their treatment. Usually, the average range that most personal policies fall under is between Rs.5 lakhs to Rs.15lakhs.

Any option to customize?

Customizing health policies means the scope to add plan benefits or increase the insured amount. The deciding head of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More plans is different from the employer and personal insurances, so the customizing scopes also vary at large.

The employer ( the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More) does have the option of selecting the benefits/coverages as within a defined category of employees including offering variable sum insured limits. If the employer wishes to add on benefits, they can do it, but it depends on the norms of the selected insurance company.

In contrast, with personal insurance, you have little freedom of choosing the custom add-on benefits. The policies are standardised and coverages are predefined.

The claim procedure

If the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More opts for cashless policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage, then there is no difference in the claiming process. The payment gets managed by the TPA and the hospital executives without any hassles. But if you are opting for a reimbursement procedure after the medical treatment, the procedure is distinct.

In an employer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, the claims get made by a third-party administrator. You have to inform your company or organization for getting the claims and then take the suitable steps. With personal policies, there are no indirect steps that you need to incorporate. Here you can directly approach the insurance company representatives for claiming the reimbursement.

Tax benefits and deduction

Health insurances certainly provide tax benefits, but there is a prime difference in the group and personal plan. How? In both insurances, there is a provision of tax deduction, but the receiver is different. In employer insurance, the purchaser, the organization’s head, enjoys a tax cut in their income tax returns. The employees cannot avail of any tax reliefs for the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More registered in their names. While in individual policies, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More enjoys the tax cut as there is no indirect purchasing.

Is there a no-claim bonus?

A no-claim bonus in health policies refers to a sum ( typically expressed as a % of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More sum insured value) that gets added to the insured sum at the year-end if you do not apply for plan coverage expenses. The no-claim bonus is not applicable in employer health insurance, and you can only enjoy the coverage benefits. While in personal health plans, there are provisions for availing the bonus sum at the end of the year. However, depending on the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you pick for individual insurance, the regulations may differ about the no claim bonus.

Coverage for pre-existing diseases

Coverage for pre-existing ailments or critical illnesses may fall under the employer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. In the case of individual insurance, you can avail of coverage benefits for pre-existing diseases but after a waiting tenure. For employer health plans, you can avail of the benefits from day 1 into the coverage. The same goes for the medical expense coverage for critical diseases. Also, for employer policies, you do not have to undergo a medical checkup for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval. In a personal plan, you may or may not need a checkup, depending on the company norms.

Can you keep both?

As an individual, you can relish the benefits of both insurances. If you work under an organization that offers a group health plan facility, you can additionally buy a personal health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for yourself. Both are very useful in times of medical emergencies and keeps you financially stress-free.

Take a wise call

Insurance brokers are your one-stop solution when it comes to buying policies. An employer who wants to offer group health insurance can always reach out to a top-rated insurance broker. PlanCover makes it easy for the buyers by offering several insurance options. We have compiled in a simple to understand tabular format on the differences between an individual and a group health insurance program.

| Parameter | Group Health PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More | Retail health policy |

| PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More issuance and conditions | Tailor-made, convenient and flexible | Health underwritingUnderwriting is the process through which an insurance company evaluates the risk of insuring an applicant and determines the terms, More and healthcare tests are required for certain age bands. Not flexible |

| 1st And 2nd Year Exclusion | Covered from day 1 | Covered after 2 years. Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More of 2 years applicable |

| 30 Days Exclusion | Covered from day 1 | Covered after 30 days. Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More of 30 days applicable. |

| Pre-Existing Disease Waiver | Covered from day 1 | Covered after 4 years. Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More applicable. |

| Maternity Benefits from Day 1 | Covered; For Metro 50,000-50,000 for both Normal & C- Section | Not covered from day 1. Only select plans provide this benefit after 12 months in to the policy |

| Pre Post Natal Cover | Pre-Post Natal Expenses to the limit of Rs 5,000 is covered Within Maternity Limit | Not covered |

| New Born Baby Coverage from day 1 | Baby covered from day 1 available | Not default cover |

| Ambulance Charges | Covered | Covered |

| Room Rent Restriction | No capping | Capping applicable at 1% of sum insured in some policies. |

| ICU Restriction | No capping | Capping applicable at 2% of sum insured in some policies. |

| Age Limit | 1 day to 80 years | Not flexible |

| Pre And Post Hospitalization Coverage | 30 & 60 days | Covered. |

| Disease Capping | No capping | Specific diseases capped for a lower limit and covered only after 2 years. |

| Co-Pay Clause | No co-pay | Some policies have co-payment |

Connect to the PlanCover team and get to know about the beneficial aspects related to the different policies.