Group Mediclaim PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is a health plan offered by an employer, which provides coverage to all of its employees under the same insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Employees who are above the age of 18 and below 70 and are employed with a company are eligible for a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. It is a common health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that is extended by every organization in India today.

In any insurance, premium and risk move in a parallel direction. The insurance premium is totally based on the amount of risk covered in a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. However, different factors play a crucial role in evaluating the premium cost for a specific policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. These aspects rely on the classification of insurance such as travel, vehicle, corporate etc.

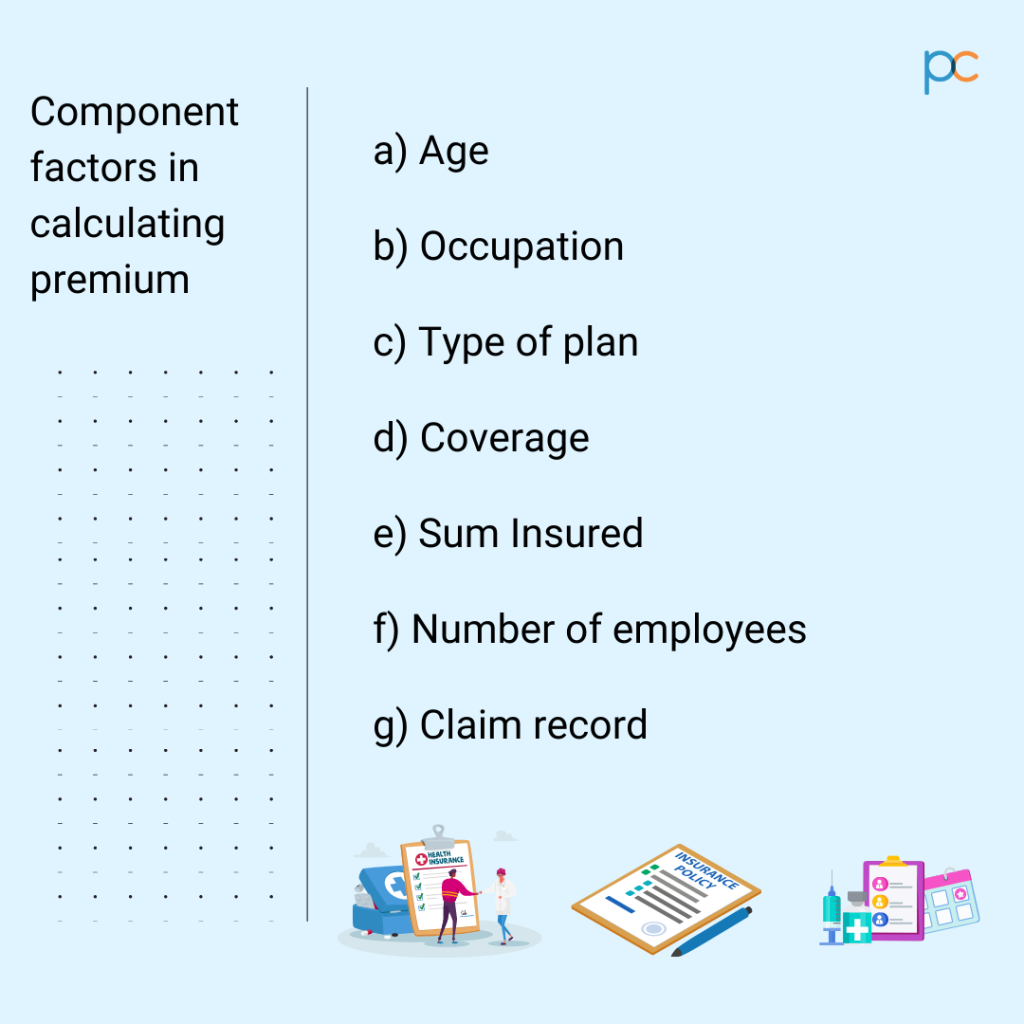

Here is the list of factors that determine the calculation of a premium for a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Table of Contents

Age

The average age of the total employees in a company is considered while assessing the premium. This aspect helps in differentiating the risk involved. Mostly, people of lower age are considered to have better immunity and are less inclined to chronic diseases compared to the older ones. Thus, less the average age, less the premium. Higher the average age of employees results in higher premiums.

For Example, A couple of marketing firms are looking to insure their employees. The average age of the employees of Company A is 28, while the average age of Company B is 37. Thus, the group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More premium for Company A would be lower because of the lower average age compared to Company B, assuming the rest of the factors to be the same for both the companies.

Occupation

The degree of risk exposure in the work environment of the employees affects the cost of the premium. The more the risk associated with the job performed by the employees, the more will be the premium required to insure them. To ensure a professor will cost less because of the nature of the job. However, securing the life of a firefighter will cost more.

For Example, Two companies apply for a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to insure their employees. Company A is into construction, in which its employees work on various sites, while Company B is into software development, in which its employees are primarily on desk jobs. As the level of risk exposure in construction sites is more than as compared to desk jobs, the premium for Company A will be more than Company B.

Type of Plan

Premium charges depend on the insurance plan chosen by the employer. A basic group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is offered to all employers. However, if they wish to increase the coverage of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, they can choose from different add-on covers provided by the insurer. However, it will increase the cost of the premium depending on the add-on to cover the employer selects.

For Example: Company A and Company B are offered basic coverage under the group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. However, Company A wants an add-on of consumables coverage along with the basic one for its employees. Whereas, Company B decides on the basic coverage plan. Thus, the premium charges for Company A will be more because of the additional coverAdditional cover refers to the extension of a standard insurance policy to protect the insured against specific additional risks or More selected.

Coverage

In group mediclaim policies, the scale for coverage broadens concerning the number of people covered under the plan. Different coverage policies are extended to employees that ensure the employee and its close family members. However, some policies additionally cover parents-in-law. The premium entirely depends on the scale of the coverage selected by the employee and the employer.

For Example: PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More A offers coverage for the employee, their spouse, children and parents whereas, PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More B covers the insurance for the employee, its spouse, children, parents and in-laws. Thus, the premium for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More A will be less than the coverage is less compared to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More B, where the coverage is more.

Sum-Insured

The monetary limit up to which an employer can bear the health-related cost of the employee is termed sum-insured. The organizations can brainstorm considering their financial capability and decide the amount of sum insured of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The sum-insured selected will be applicable to all of its employees. The larger the sum insured, the more will be premium.

For Example, Company A selects a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More where every employee is covered with sum-insured of 5 lakhs whereas, Company B selects a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to cover its employees with a sum insured of 7 lakhs. Thus, the premium for Company B will be more than for Company A.

Number of Employees

The total number of employees to be covered in the group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can affect the overall cost of the premium. If the size of the company seeking a health plan is of large scale, its premium charge will be more compared to the company with a small number of employees.

Example: The insurer receives an application from two companies. Company A has 947 employees to be insured under a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, whereas Company B has 250 employees that require the group plan. Thus, the premium for Company B will be less because the total number of employees to be insured are less compared to Company A.

Claim Record

While renewing the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, the claim record of an insured organization is evaluated in determining the premium. If the record indicates numerous claims raised during the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More tenure, the insurer might decide to go over and increase the chargeable premium of the organization.

For Example: During the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More tenure of 5 years, Company A claimed less than its expectation, while Company B claimed frequently and exceeded the expected numbers. Thus, the insurer may consider increasing the premium of company B based on their claim record.

Calculation of Policy Premium

The underwritingUnderwriting is the process through which an insurance company evaluates the risk of insuring an applicant and determines the terms, More teams of the insurance companies are experts in analyzing the risk of monetary loss from a particular organization. They use various mathematics and statistics to help the insurance company to anticipate the probabilities of the claim. Based on the above-mentioned factors, they produce an actuarial table which is further provided to the insurance company’s underwritingUnderwriting is the process through which an insurance company evaluates the risk of insuring an applicant and determines the terms, More department. The same department uses that data to set a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More premium for a particular organization.

Considerable group mediclaim policies are available for employers and employees in the market. However, an adequate mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More delivers sufficient coverage to the employee and the family members. It provides a decent sum insured and has a reasonable premium for the employer along with other benefits. And an impressive plan provides a hassle-free claim process with additional services and benefits along with the above points.

PlanCover, is a health insurance specialist broker with decades of experience in crafting and creating health insurance for companies of all sizes and industries. Their experience has made them work on underwritingUnderwriting is the process through which an insurance company evaluates the risk of insuring an applicant and determines the terms, More and risk evaluation. The basic scrutiny of the risk parameters is helpful for insurers in pricing the risk and computation of the premium. PlanCover is the right plan to bring the most appropriate plan. Connect to their team now.