Employer healthcare insurance provides financial support during medical emergencies to the employees. Any organization or business enterprise can provide the group healthcare plan as a service benefit to the employees. The employer can buy the insurance from any leading insurance company and pay the premiums so that the employees and their family members can enjoy the plan benefits.

Table of Contents

A note before you buy the insurance

As an employer, finding the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for your employees can be a troublesome task. There are different factors attached to the selection. Whether it is the type of the group healthcare plan or the associated features, the decision-making is indeed tough. Before you purchase any insurance, you should have an overall idea about the insurance and its features.

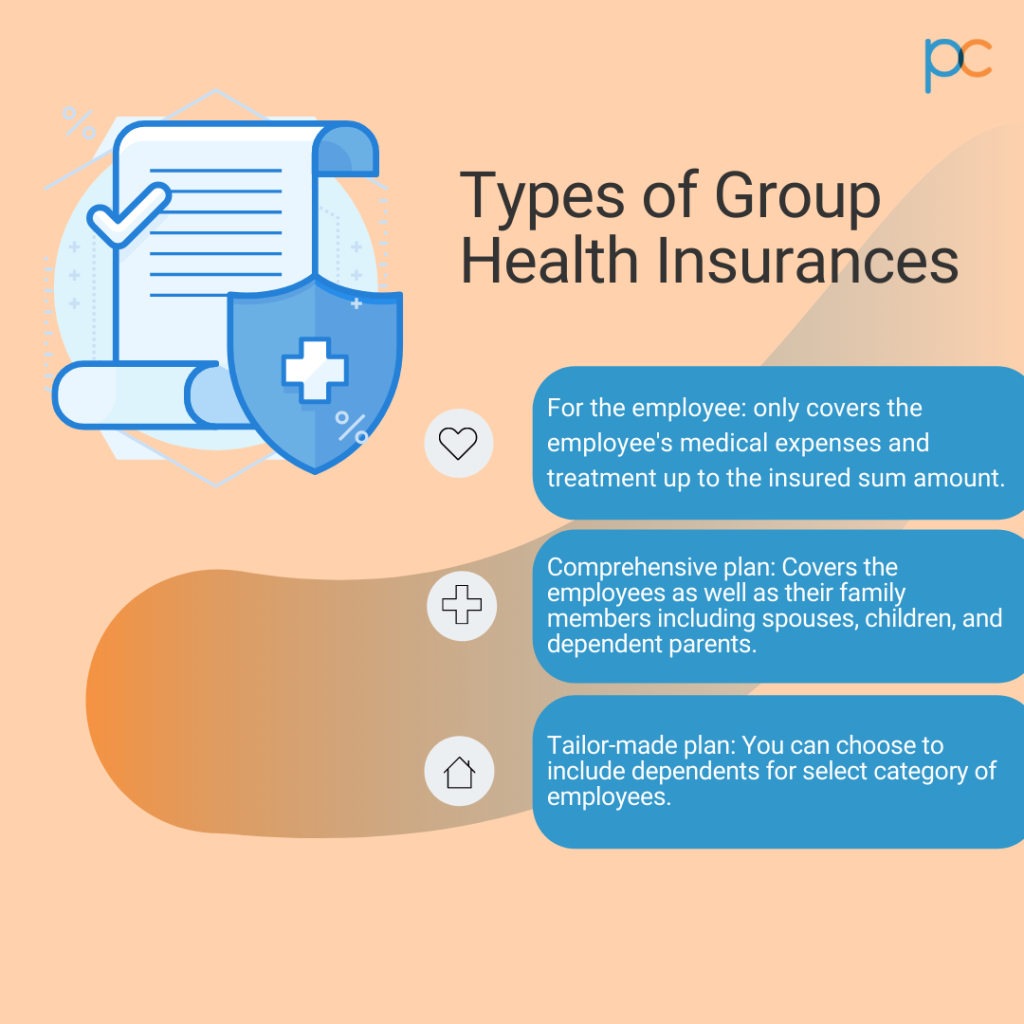

Know the types: Group healthcare policies can be of three types if you consider the plan coverage and associated features:

- For the employee: A group health insurance where the employer purchases the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More only for the employee working under the organization is the most basic healthcare plan. Here, the employer pays the insurance premium for annual renewal. In return for their services, the employee can enjoy the plan benefits. The employer decides the sum to be insured and other features. The employee can enjoy medical expense coverage limited to the insured sum amount only for their treatment. It does not include other family members as the employee is the sole policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More. In these plans typically employers pay the entire cost of insurance and hence these will be fully-funded insurance programs.

- A comprehensive plan: Like the floater individual Mediclaim plans, group health insurance policies also have a family package. Here the employer purchases a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More covering medical expenses for the employee and their dependent family members. The family members generally included in the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More list are – spouse, children, and dependent parents. While the company decides to cover the entire expenses for an employee only plan, dependent family coverage can come under partial-funding plans with employers charging the premium cost on to the employees for covering dependents. However, the decision of including any family member is upon the employer as they pay the premium for annual recharge. Adding more people to the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More increases the expense to the organization. Therefore, not every organization can afford to bear the cost of comprehensive group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More.

- Tailor-made group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More plan: Different insurance companies have different group healthcare plans. The plan benefits range from basic medical expense coverage to specialized disease care. The premium amounts also increase or decrease depending on the features included in the insurance.

How do you know the best type?

Identifying the best group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More requires proper evaluation. The employer has to understand what the employees need before finalizing the purchase. Without a careful decision, a service benefit like the group health insurance will be useless to the employees. The best way to understand the suitable policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More type is to go through the plan features in detail. Read along to know which policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is recommended for employers or startup founders.

Read the terms to find the right type.

Every insurance provider should offer a detailed representation of the policies at their end while selling them to the employers. It helps the employers to understand the plan benefits and overall costing. By evaluating the points mentioned in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features, you can pick the type that suits your needs.

For example, if yours is a small-scale organization with an employee strength of less than fifty, you can pick the comprehensive plans (employee and their family members). Again it is always recommended to include only immediate family members in the plan which include spouse and children. In contrast, if the organization has more than 100 employees with different age bands, then it is better to opt for group plans only for the employees and have the dependents covered by the employee. The company can facilitate the platform for employees to purchase health insurance for dependents. The ability of the employer to bear the expenses determines which type is right for them.

Extensive plan coverage

How does a healthcare plan help the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More? By offering extensive plan coverage to meet the medical treatment expenses and emergencies. A wide network of hospitals with cashless and reimbursement facilities is necessary for any type of group healthcare plan. Whether you choose a comprehensive plan or solo insurance for the employees, it should offer maximum disease support and hospitalization cost coverage. So, check the inclusion and exclusion points in the plan coverage section of the opted insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Least waiting period

The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More refers to the span when the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More does not get any expense support from the insurance company. It is a setback for those having a pre-existing ailment. Most insurance companies have a waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More of 24months for initiating the plan benefits for the treatment of such pre-existing diseases. However, the time varies depending on the group healthcare plan you choose. Go for a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More the has the least waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for providing plan coverage.

Comprehensive insurance coverage

Selecting the facilities of a group healthcare plan depends on the employer. The employer will decide whether they want to offer a comprehensive healthcare plan or not. But, if you consider from a long-term perspective, providing a comprehensive group healthcare plan can be beneficial for employers also. How? As it provides steady financial support for the family members of the employees, thus they do not want to discontinue the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The only way to continue the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is by sticking to the existing company. So as an employer, you can increase employee retention and motivate them to work harder to continue policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage for the long term.

Recommended features in group healthcare plans

Employers may get confused about the versatile plan benefits offered by the many insurance companies. There are different customizable plans with add-on and top-up features. These are additional plan benefits that you may or may not include with the base plan. But there are a few recommended policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features that are indispensable. Read to know the top three must-have attributes in any group healthcare insurance, irrespective of the type.

- Cashless and reimbursement facilities: Both cashless and reimbursement procedures are important to ensure a useful medical facility to the employees. It is helpful during emergencies and planned medical treatment.

- Efficient functioning for easy processing: A swift functioning insurance company and an efficient TPA to manage the claim and settlement make the insurance better than the rest. It ensures a hassle-free service and relieves the financial burden of the employees.

- Low cost and high convenience: Lastly, the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More should not have an expensive premium cost as it can become a financial liability to the employer. You have to find the right balance between the premium prices and plan offerings to ensure a justified deal.

Seek expert assistance

Experts are the ones to rely on for insurance recommendations. But who are these insurance experts? They are insurance brokers who sell different group healthcare policies to employers and business owners. As they deal with several insurances from the leading insurance companies in India, they can recommend you the best plans based on your specific needs. They determine the right plan by matching the premium charges to your budget and expected plan coverage benefits. You should always seek the advice of an expert in the business to buy the best group healthcare plan.

Find what you need with PlanCover

Get the best insurance recommendations from PlanCover, a reputed insurance broker company in India. They are the experts in the field of group Mediclaim plans and offer the best policies at the most profitable cost. Any employer or startup founder with an employee strength of 7 to 450 can approach the team of PlanCover to purchase the healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. They present a tailor-made plan as per your expectations and estimates to meet the requirements. Connect to the proficient team of PlanCover to find the most effective Mediclaim for your employees.