In today’s competitive business landscape, offering group health insurance isn’t just a benefit – it’s a necessity for attracting and retaining top talent. As a small business owner, navigating the complex world of group health insurance can seem overwhelming. However, with the right approach and knowledge, you can implement a comprehensive health insurance plan that protects your employees while maintaining your bottom line.

Table of Contents

1. Understand Your Legal Requirements and Obligations

Before diving into group health insurance options, it’s crucial to understand your legal obligations as an employer. While requirements may vary by location and company size, being aware of these regulations helps you make informed decisions and avoid potential compliance issues.

Key Considerations:

- Familiarize yourself with local insurance regulations and mandates

- Understand the minimum coverage requirements for group health insurance

- Be aware of documentation and reporting requirements

- Stay informed about annual compliance updates and changes

Remember that working with certified insurance brokers, like PlanCover’s expert team, can help you navigate these legal requirements effectively. Their expertise ensures that your chosen insurance plan meets all necessary regulatory standards while providing optimal coverage for your employees.

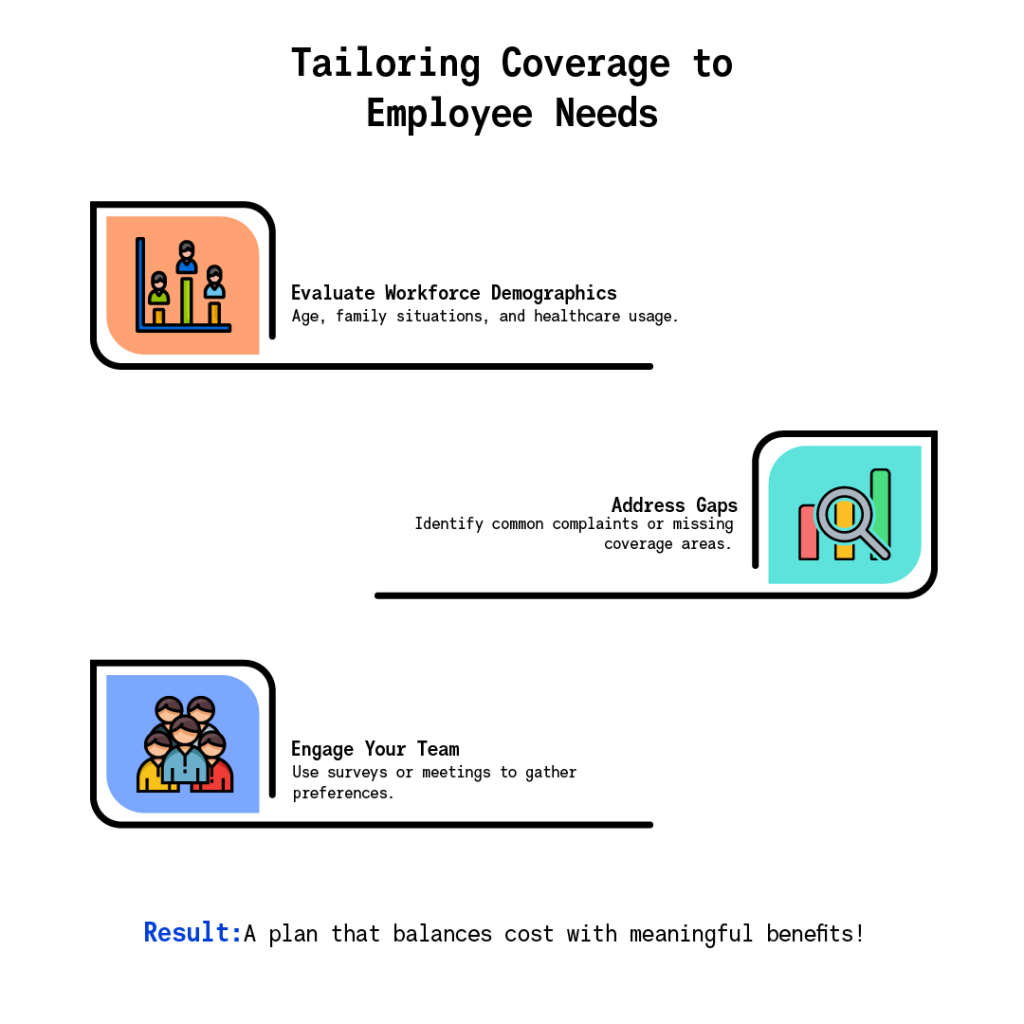

2. Assess Your Workforce’s Needs and Preferences

One size doesn’t fit all when it comes to group health insurance. Understanding your employees’ specific needs and preferences is crucial for selecting the right coverage options.

How to Evaluate Employee Needs:

- Consider the average age and health status of your workforce

- Take into account family situations and dependents

- Analyze current healthcare utilization patterns

- Gather feedback through surveys or team meetings

- Review any existing coverage gaps or common complaints

This assessment helps you choose a plan that provides meaningful coverage while ensuring that your investment in health insurance delivers real value to your employees.

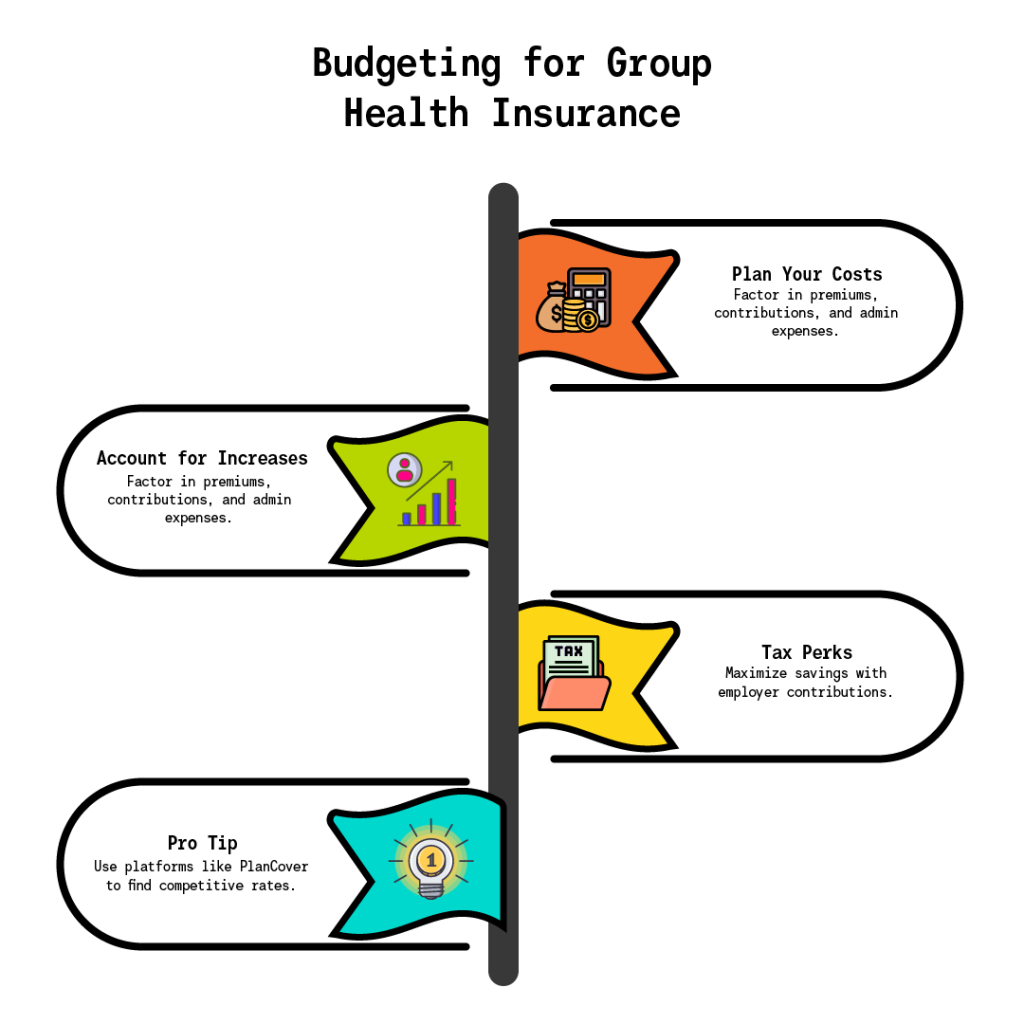

3. Calculate Your Budget Realistically

Implementing a group health insurance plan is a significant financial commitment. Creating a realistic budget helps you balance comprehensive coverage with fiscal responsibility.

Budget Considerations:

- Premium costs and employer contribution levels

- Administrative expenses

- Potential annual increases

- Cost-sharing arrangements with employees

- Tax implications and benefits

- Reserve funds for unexpected expenses

Working with insurance marketplace platforms like PlanCover can help you access competitive rates and compare different plans within your budget. With their strong relationships with top insurers, they can help you secure the best possible rates for your desired coverage level.

4. Choose the Right Insurance Partner

Selecting the right insurance partner is crucial for long-term success. Look for providers and brokers with:

Essential Qualities:

- Strong track record in small business insurance

- Comprehensive support services

- Transparent pricing and policies

- Efficient claims processing

- 24/7 customer service

- Technology-enabled solutions

PlanCover, for instance, has managed over 300,000 claims and provides round-the-clock support for policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy issuance and claim servicing. Their end-to-end solutions cover everything from initial purchase to policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy renewals, making them a reliable partner for small businesses.

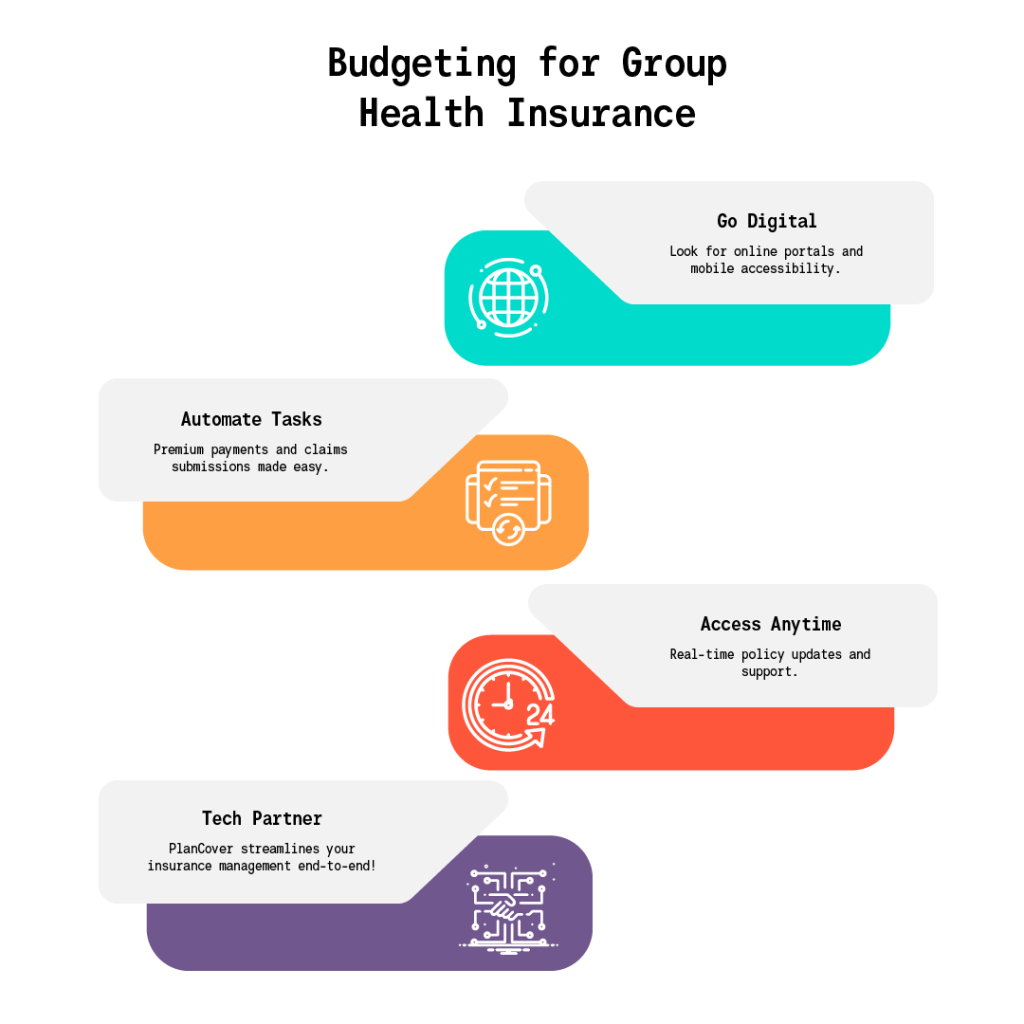

5. Leverage Technology for Efficient Administration

Modern group health insurance management requires robust technological solutions. Look for providers that offer:

Key Technology Features:

- Online policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy management portals

- Digital documentation and storage

- Automated premium payments

- Easy claims submission processes

- Mobile accessibility

- Real-time policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy information access

PlanCover’s technology deployment for business administration includes login access and comprehensive claim support, streamlining the entire insurance management process for small businesses.

6. Plan for Special Circumstances and Emergencies

Recent events like the COVID-19 pandemic have highlighted the importance of being prepared for unexpected health challenges. Your group health insurance strategy should include:

Emergency Preparedness Elements:

- Coverage for emerging health threats

- Pandemic-related medical expenses

- Mental health support

- Telemedicine options

- Emergency medical evacuation

- Critical illness coverage

PlanCover specifically addresses these concerns with their Coronavirus Insurance coverage, helping businesses protect their employees during unprecedented health crises. Their expertise in handling pandemic-related claims provides valuable support during challenging times.

7. Implement a Clear Communication Strategy

Effective communication about your health insurance benefits is crucial for maximizing their value and ensuring proper utilization.

Communication Best Practices:

- Provide detailed plan information and documentation

- Organize regular benefits orientation sessions

- Create easy-to-understand benefit summaries

- Establish clear points of contact for questions

- Maintain open channels for feedback

- Regular updates about policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy changes or enhancements

Consider working with insurance brokers who provide support in employee communication and education. PlanCover’s expert team of certified brokers can help explain complex insurance terms and processes to your employees, ensuring they understand and appreciate their benefits.

Making the Most of Your Group Health Insurance Investment

Implementing group health insurance is more than just checking a box for employee benefits. It’s an investment in your company’s future and your employees’ well-being. By following these tips and working with experienced partners like PlanCover, you can create a sustainable and effective health insurance program.

The PlanCover Advantage

As India’s #1 Insurance Marketplace, PlanCover offers several unique advantages for small businesses:

- Comprehensive Support: From initial consultation to ongoing claim support, their team provides end-to-end assistance throughout your insurance journey.

- Expert Guidance: Their certified brokers help you navigate complex insurance decisions with professional expertise and industry knowledge.

- Technology Integration: Advanced technological solutions simplify policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy administration and claims management.

- Strong Insurer Relationships: Access to top-ranked insurance companies ensures competitive pricing and premium products.

- Dedicated Customer Service: 24/7 support ensures your insurance-related queries are addressed promptly and effectively.

Conclusion

Offering group health insurance is a significant step for any small business. While the process may seem daunting, following these seven tips and partnering with experienced insurance brokers like PlanCover can make it manageable and successful. Remember that the right health insurance plan not only protects your employees but also strengthens your business by improving employee satisfaction and retention.

The key is to approach the process systematically, staying focused on both your employees’ needs and your business objectives. With proper planning, expert guidance, and the right insurance partner, you can implement a group health insurance program that provides valuable protection for your employees while maintaining financial sustainability for your business.

Next Steps

If you’re ready to explore group health insurance options for your small business, consider reaching out to PlanCover’s expert team. Their comprehensive support and expertise in small business insurance can help you navigate the selection process and implement a plan that works for both your employees and your bottom line.

Contact PlanCover:

- Sales: +91 9711059159

- Claims Support: +91 11 411 82287

- Email: assist@plancover.com

Remember, investing in your employees’ health is investing in your business’s future. Take the time to research, plan, and implement a group health insurance program that meets your unique needs and objectives.