In today’s competitive business landscape, attracting and retaining top talent has become more challenging than ever. One of the most powerful tools in your recruitment and retention arsenal is a comprehensive health benefits package. With PlanCover, India’s #1 Insurance Marketplace, you can create a benefits strategy that not only protects your employees but also helps your business stand out in the job market.

Table of Contents

The Strategic Importance of Health Benefits

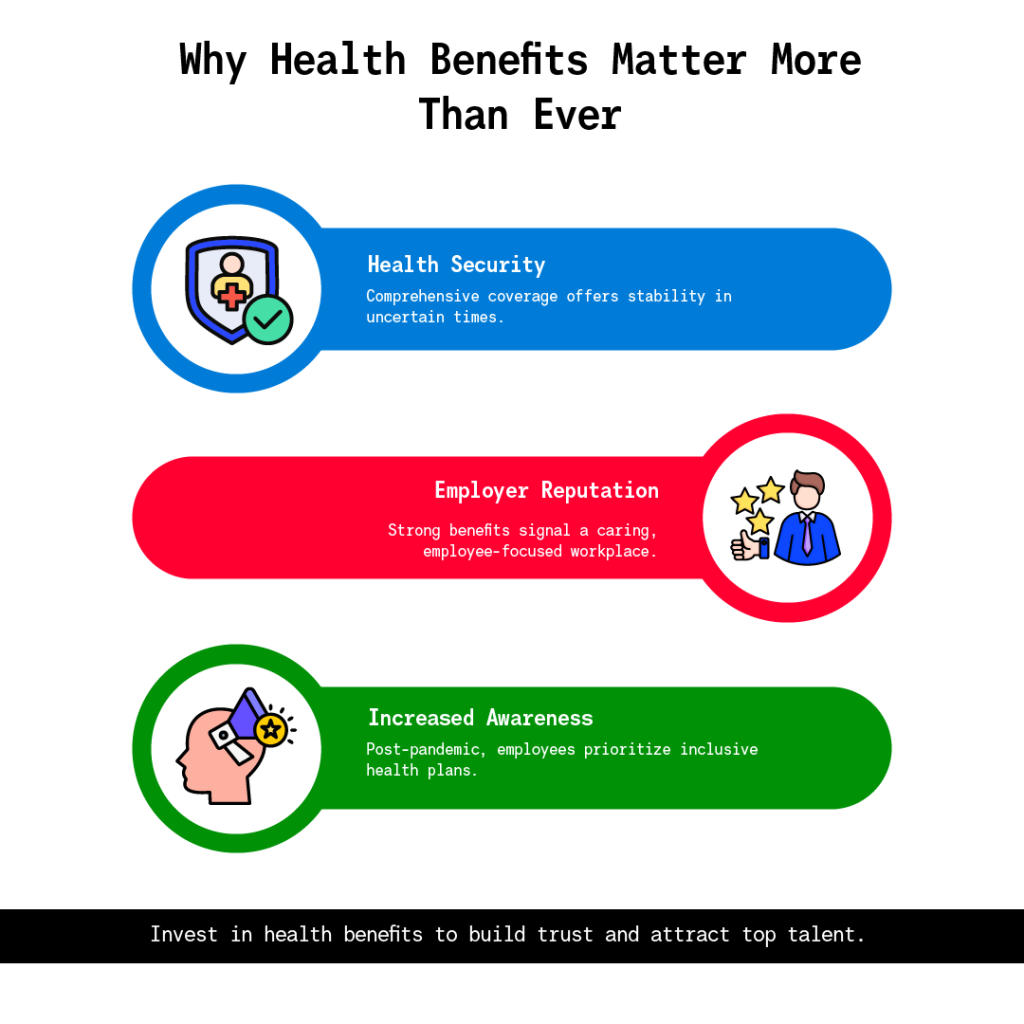

Why Health Benefits Matter More Than Ever

The COVID-19 pandemic has fundamentally changed how employees view health insurance benefits. What was once considered just another workplace perk has now become a crucial factor in job selection and retention. According to recent trends, employees are increasingly prioritizing comprehensive health coverage when making career decisions, making it essential for businesses to offer robust health insurance packages.

- Health Security: Employees seek stability in uncertain times, and comprehensive health benefits provide a sense of security.

- Increased Awareness: The pandemic brought health issues to the forefront, driving demand for inclusive coverage.

- Employer Reputation: Companies offering strong benefits are perceived as caring and employee-focused.

The Business Case for Comprehensive Health Coverage

Investing in employee health benefits isn’t just about attracting talent—it’s a strategic business decision that can:

- Reduce absenteeism and improve productivity: Healthy employees are more focused and efficient.

- Boost employee morale and job satisfaction: Feeling valued translates into higher performance.

- Lower turnover rates and associated recruitment costs: Retaining staff is more cost-effective than hiring.

- Create a positive company culture: A focus on well-being fosters loyalty and engagement.

- Demonstrate your commitment to employee welfare: This commitment builds trust and long-term relationships.

PlanCover’s Comprehensive Solutions

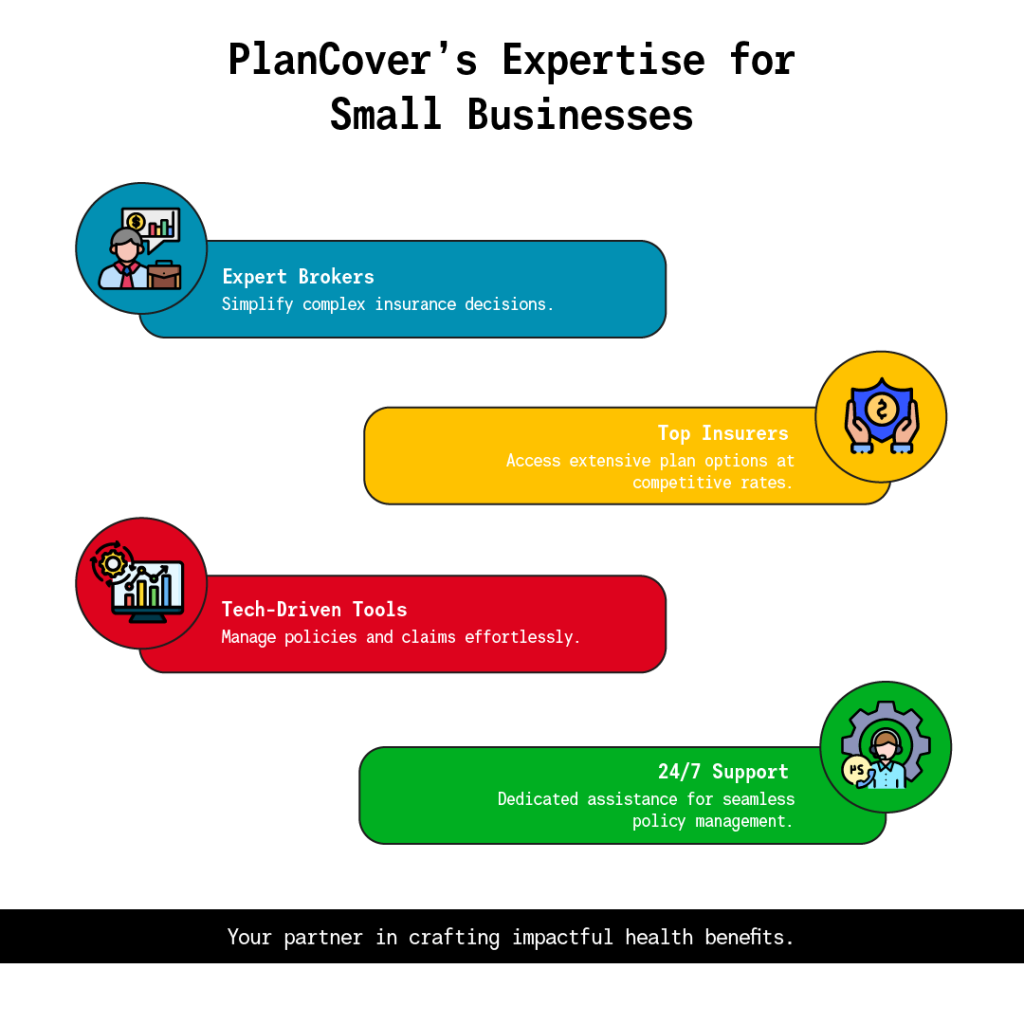

End-to-End Support for Small Businesses

PlanCover specializes in providing small businesses with complete insurance solutions. Their platform offers:

- Expert guidance from certified insurance brokers who simplify complex choices.

- Access to top-ranked insurance providers with extensive plan options.

- Competitive rates through strong insurer relationships.

- 24/7 dedicated support for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management.

- Streamlined claims processing with over 300,000 claims handled efficiently.

Technology-Driven Administration

Modern employees expect convenient access to their benefits information. PlanCover delivers this through:

- User-friendly login access for streamlined policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration.

- Digital tools for managing benefits and claims easily.

- Real-time support to address employee queries and concerns.

Designing an Attractive Benefits Package

Core Health Insurance Components

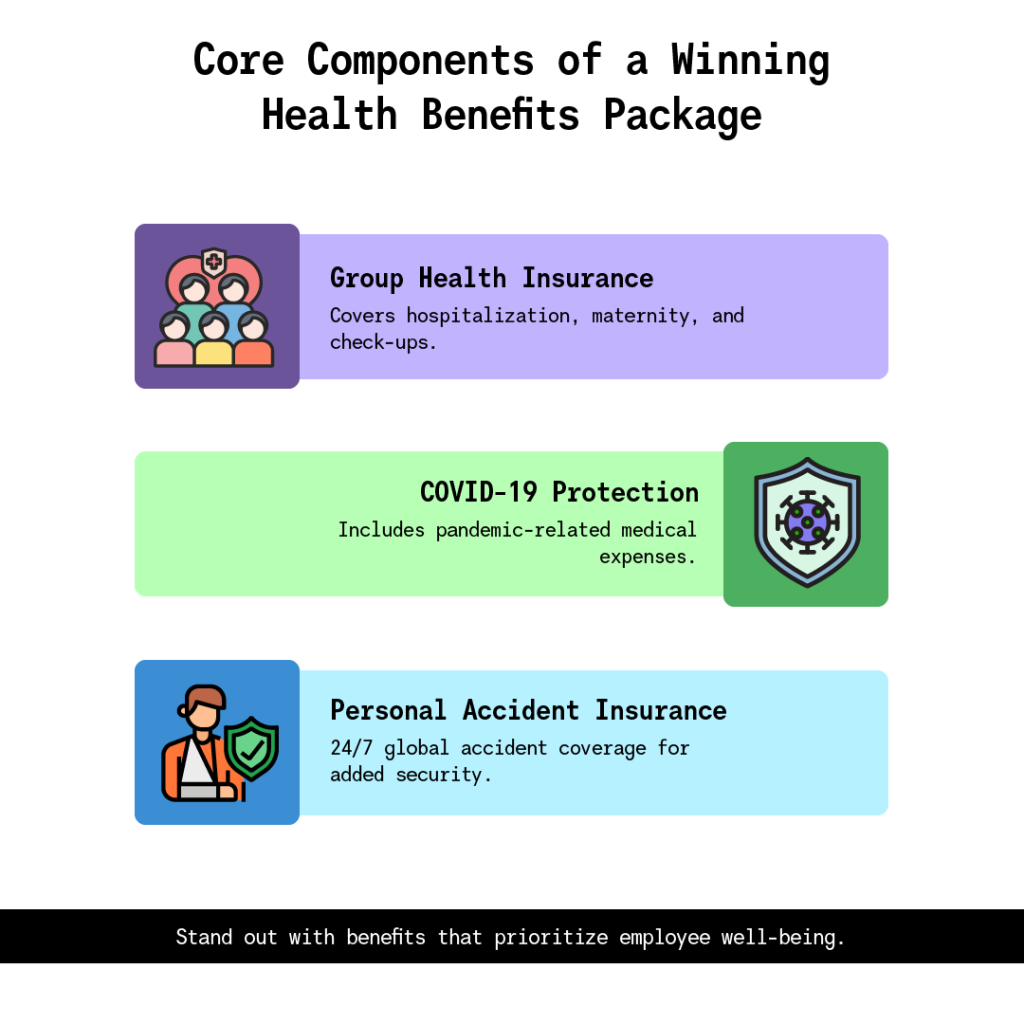

When crafting your health benefits package through PlanCover, consider including:

1. Comprehensive Group Health Insurance

- Coverage for hospitalization expenses

- Pre- and post-hospitalization care

- Day-care procedures

- Maternity benefits

- Regular health check-ups

2. COVID-19 Protection

- Specific coverage for coronavirus-related treatments

- Pandemic-related medical expenses

- Additional support during quarantine periods

3. Group Personal AccidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More Insurance

- Coverage for accidents leading to disability or death

- 24/7 worldwide coverage

- Additional financial security for employees and their families

Enhanced Benefits to Stand Out

To make your benefits package more attractive, consider adding:

- Family coverage options: Include spouse, children, and even parents.

- Mental health support services: Offer counseling and stress management resources.

- Preventive care benefits: Encourage regular check-ups to maintain health.

- Wellness program integration: Promote fitness and healthy lifestyles.

- Flexible coverage limits: Tailor plans to diverse employee needs.

Implementation Strategies for Maximum Impact

1. Clear Communication

The best benefits package is only effective if employees understand and appreciate it. Implement a strong communication strategy that includes:

- Detailed benefit orientation sessions

- Regular updates about coverage options

- Easy access to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More information

- Clear explanation of claim procedures

- Regular reminders about available benefits

2. Smooth Onboarding Process

PlanCover’s expertise helps ensure a seamless transition when implementing new health benefits:

- Step-by-step guidance through the selection process

- Support for employee enrollment

- Training on policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration

- Access to a dedicated support team

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews and updates

3. Maximizing Return on Investment

Cost Management Strategies

PlanCover helps businesses optimize their health benefits investment through:

- Competitive premium rates

- Bulk discount negotiations

- PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More customization options

- Cost-sharing structures

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews for optimization

Measuring Impact

Track the effectiveness of your health benefits program by monitoring:

- Employee satisfaction rates

- Retention statistics

- Recruitment success metrics

- Usage patterns and claim rates

- Cost per employee versus industry standards

PlanCover’s Expertise

Expert Guidance

Take advantage of PlanCover’s experienced team:

- Certified insurance brokers

- Industry specialists

- Claims processing experts

- Customer support professionals

- PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration experts

Ongoing Support

PlanCover’s commitment to service excellence includes:

- 24/7 call center support

- Dedicated claim assistance

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews

- Updates on new benefits options

- Continuous improvement recommendations

Future-Proofing Your Benefits Strategy

Staying Ahead of Trends

Work with PlanCover to ensure your benefits package remains competitive:

- Regular market analysis

- Industry benchmark comparisons

- New product updates

- Emerging risks coverage

- Technology integration options

Adaptation and Flexibility

Maintain flexibility in your benefits strategy to address:

- Changing workforce needs

- New health challenges

- Regulatory requirements

- Market conditions

- Employee feedback

Best Practices for Small Businesses

Getting Started

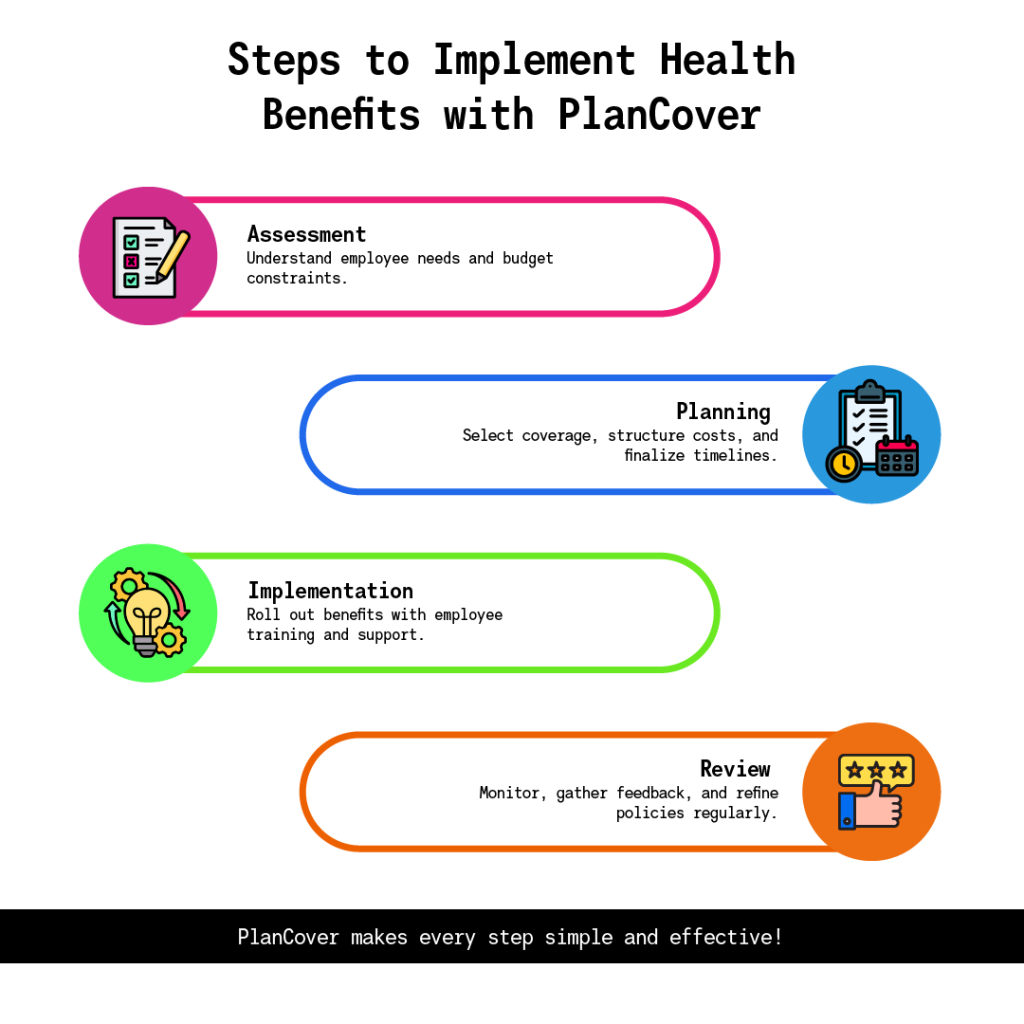

Follow these steps to implement an effective health benefits program:

1. Assessment Phase

- Evaluate current employee needs

- Analyze budget constraints

- Review competitor offerings

- Consider industry standards

- Define objectives

2. Planning Phase

- Select appropriate coverage levels

- Choose additional benefits

- Structure cost-sharing

- Plan communication strategy

- Set implementation timeline

3. Implementation Phase

- Roll out new benefits

- Conduct employee training

- Establish support systems

- Monitor initial response

- Gather feedback

Maintaining Success

Ensure long-term success through:

- Regular program reviews

- Employee feedback sessions

- PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More adjustments as needed

- Continuous communication

- Performance monitoring

The PlanCover Advantage

Why Choose PlanCover

PlanCover stands out in the insurance marketplace through:

- Comprehensive product offerings

- Strong insurer relationships

- Technology-driven solutions

- Dedicated support systems

- Proven track record

Success Stories

PlanCover’s effectiveness is demonstrated through:

- High client satisfaction rates

- Successful claims processing

- Positive testimonials

- Long-term client relationships

- Industry recognition

Conclusion

In today’s competitive business environment, providing comprehensive health benefits is no longer optional—it’s a necessity for attracting and retaining top talent. PlanCover offers small businesses the expertise, support, and solutions needed to create and maintain effective health benefits packages that make a real difference in employee satisfaction and retention.

By partnering with PlanCover, you gain access to:

- Expert guidance in selecting the right coverage

- Competitive rates from top insurers

- Streamlined administration processes

- 24/7 support for your team

- Continuous improvement opportunities

Take the first step toward strengthening your employee benefits package by connecting with PlanCover’s team of certified brokers. With their support, you can create a health benefits strategy that not only protects your employees but also helps your business thrive in an increasingly competitive marketplace.

Contact PlanCover today:

- Sales: +91 9711059159

- Claims Support: +91 11 411 82287

- Email: assist@plancover.com

Remember, investing in employee health benefits is more than just a business expense—it’s an investment in your company’s future success and growth. Let PlanCover help you make that investment count.