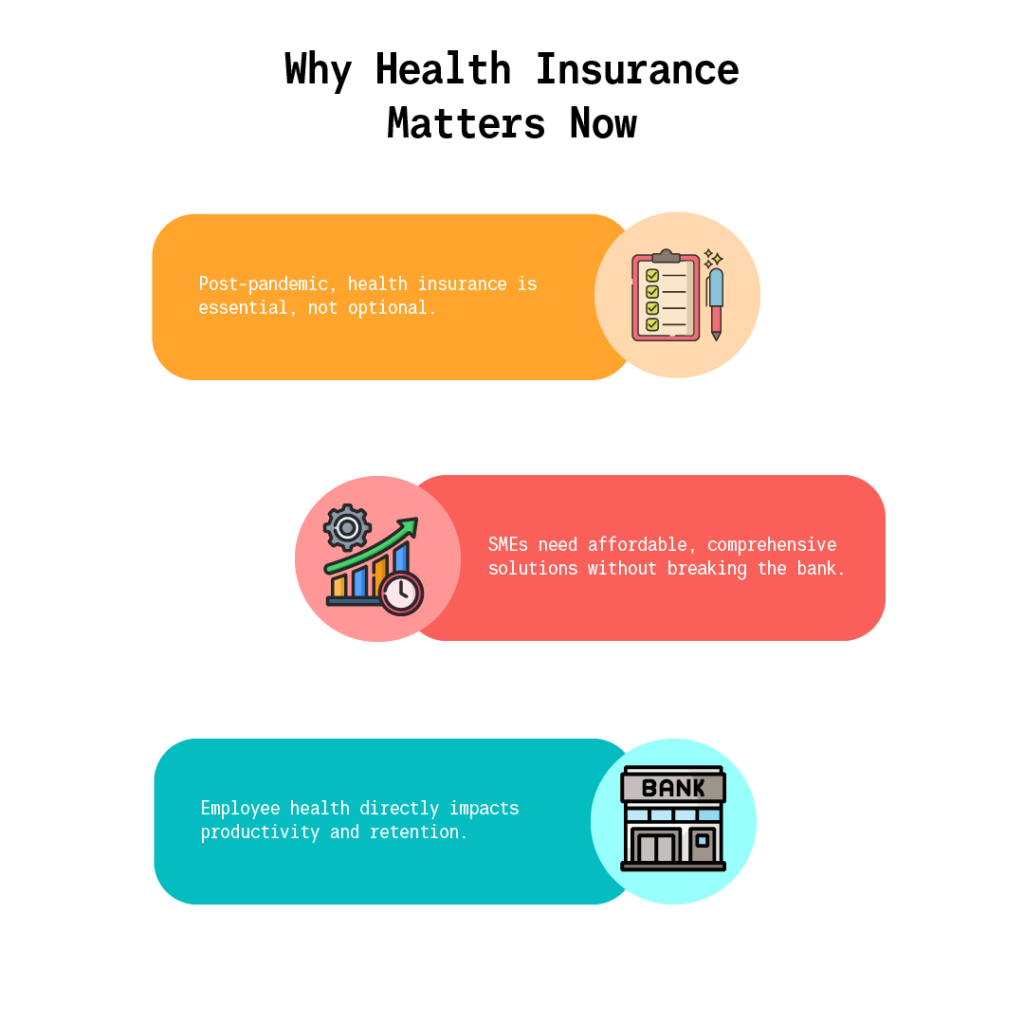

In the rapidly evolving business landscape of India, providing comprehensive group health insurance has become a necessity for small and medium-sized enterprises (SMEs). No longer seen as a luxury or an optional benefit, robust health coverage is now crucial for attracting, retaining, and supporting talented employees. This shift has become particularly evident following the COVID-19 pandemic, which reshaped how businesses think about employee welfare.

As the workforce’s health needs continue to evolve, businesses must find creative, sustainable solutions to ensure that their teams are well-protected without jeopardizing their financial stability. Enter PlanCover, a game-changing insurance marketplace specifically designed to simplify the process of securing group health insurance for SMEs.

Table of Contents

The Changing Landscape of Employee Health Benefits

The pandemic has highlighted the importance of employee health, creating a new set of expectations for organizations. Where once healthcare benefits were optional, they have now become essential. For small businesses, navigating the world of health insurance can be overwhelming. Many small business owners face financial constraints that make it difficult to offer comprehensive coverage without sacrificing other critical aspects of their operations.

In addition to these financial concerns, there are many other challenges businesses face, such as finding the right insurance provider, understanding policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More terms, and ensuring the coverage suits the workforce’s needs. With this in mind, businesses need a reliable partner that can provide affordable and comprehensive health insurance solutions tailored to their specific needs. This is where PlanCover comes in.

PlanCover: Your Strategic Insurance Partner

PlanCover is an innovative insurance marketplace designed to meet the unique needs of small businesses. With a proven track record of managing over 300,000 claims, PlanCover offers businesses an intelligent, cost-effective way to secure the best health insurance solutions for their teams.

What sets PlanCover apart from other insurance providers is its ability to simplify the entire insurance procurement and management process. PlanCover’s platform uses advanced technology to provide transparency, real-time updates, and seamless management for both business owners and employees. Whether you are new to group health insurance or looking for a more efficient way to manage your current policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, PlanCover stands ready to be your trusted insurance partner.

Why PlanCover Stands Out

Several factors distinguish PlanCover from traditional insurance providers. These include:

- Technology-Driven Platform: PlanCover leverages advanced digital platforms to streamline the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration process, giving business owners easy access to essential information and documents. The platform is intuitive and user-friendly, allowing for hassle-free policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More tracking, claim management, and documentation.

- Partnership with Top Providers: PlanCover collaborates with leading insurance providers, ensuring that businesses have access to competitive, comprehensive health coverage options. Their partnerships enable PlanCover to offer tailored packages that suit the specific needs of various industries.

- 24/7 Dedicated Support: PlanCover provides continuous support through dedicated channels. Whether it’s issuing a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, managing claims, or helping businesses make sense of their coverage, PlanCover’s support ecosystem is always available to assist.

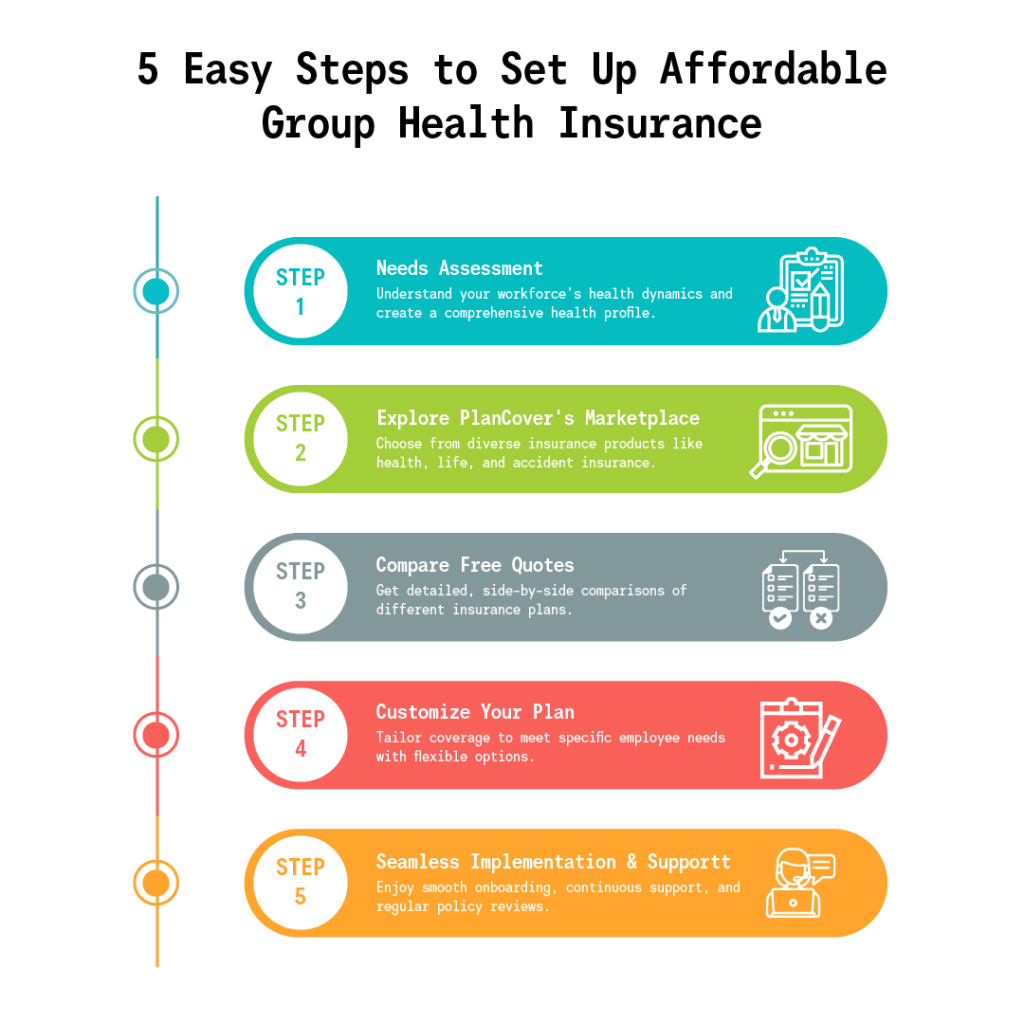

Step 1: Comprehensive Needs Assessment

Your Workforce Dynamics

The first step in securing the right group health insurance is conducting a comprehensive needs assessment. This process involves gaining a deep understanding of your workforce’s health needs, which will inform your coverage decisions.

- Demographic Analysis: The needs of your employees are influenced by factors such as age, family structures, lifestyle, and job roles. For example, a workforce with young families may require more extensive coverage for dependents, while employees in physically demanding roles may benefit from accident-related coverage.

- Health Risks and Requirements: Employees working in certain industries may face specific health risks that need to be addressed through tailored health insurance solutions. For example, factory workers or construction employees may be more prone to injuries, requiring a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers strong accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More coverage. Understanding these nuances allows for more informed decisions.

- Creating a Health Profile and Benchmarking: After gathering demographic and health information, businesses should create a comprehensive health profile of their workforce. This profile, complemented by benefits benchmarking against industry peers and best practices, serves as the foundation for strategic decision-making. Benchmarking allows businesses to assess how their offerings compare with competitors and identify gaps or areas of improvement. Together, the health profile and benchmarking insights inform key decisions, such as whether to include dependent coverage, selecting appropriate insurance types, and determining optimal coverage levels.

Strategic Coverage Planning

Strategic planning is vital in determining the appropriate health insurance for your team:

- Sum Insured Amounts: One of the most critical decisions is setting the right sum insured, which should be sufficient to cover potential medical emergencies without overburdening the business financially.

- Dependent Coverage: With the rise in family-based insurance needs, providing coverage for employees’ dependents can enhance the overall value of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and improve employee satisfaction.

- Industry-Specific Risks: Depending on the nature of the business, it might be essential to include specialized coverage options that address the unique health risks associated with particular industries.

Step 2: PlanCover’s Comprehensive Insurance Marketplace

PlanCover offers an expansive marketplace of insurance options that businesses can choose from, ensuring they get the best value for their money.

Diverse Insurance Product Portfolio

PlanCover’s insurance offerings include:

- Group Health Insurance: This is the foundation of employee health coverage. It provides comprehensive medical care for employees and their families, offering protection against hospitalization, outpatient expenses, and more.

- Group Term Life Insurance: Life insurance for employees ensures that their families are financially secure in the event of their untimely death, offering peace of mind to both employees and employers.

- Group AccidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More Insurance: Accidents happen, both at the workplace and outside of it. Group accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More insurance helps mitigate the financial strain of accidents, whether they happen on the job or during personal time.

- Group Travel Insurance: For businesses that require employees to travel frequently, this insurance covers the medical needs of employees while they are on the move, ensuring they are protected during business trips.

Technological Innovation in Insurance Management

PlanCover simplifies the complex world of insurance with its user-friendly platform. Features include:

- Real-Time Updates: Businesses can access real-time updates about their policies and claims.

- PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More Administration: PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management, including renewals and claims tracking, is simplified through PlanCover’s advanced digital tools.

- Clear Information: All insurance terminology is presented in easy-to-understand language, ensuring that businesses and employees fully comprehend their coverage.

Step 3: Obtaining and Comparing Comprehensive Quotes

The Free Quote Ecosystem

One of the most significant advantages of PlanCover is its ability to provide free, no-obligation quotes instantly. Business owners can access detailed quotes directly from the platform and receive side-by-side comparisons of different plans. This allows businesses to make informed decisions without the pressure of traditional sales tactics.

Expert Comparative Analysis

When comparing quotes, it’s not just about price; it’s also about value. PlanCover provides expert analysis on:

- Premium Costs and Benefits: PlanCover analyzes each quote for cost-effectiveness, ensuring that businesses get maximum value from their premium payments.

- Claim Settlement Ratios: The reputation of the insurer is vital. PlanCover offers insights into the insurer’s claim settlement ratio, ensuring businesses select a provider known for efficient claims processing.

- Coverage Limits and Add-OnsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More: Comparing the sum insured, network hospitals, and additional benefits can help identify which policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More best suits your business.

Step 4: Customizing Your Ideal Insurance Solution

Tailored Insurance Architecture

Every business is unique, and so are its insurance needs. PlanCover offers businesses the ability to customize their policies to match their specific requirements. This includes:

- Flexible Coverage: Customize the sum insured based on the company’s needs.

- Add-OnsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More: Businesses can opt for additional coverage options, such as maternity or critical illness insurance, depending on employee needs.

Comprehensive Customization Dimensions

Businesses can fine-tune their coverage to fit different needs, such as:

- Individual vs. Family Coverage: Flexible plans that allow businesses to choose coverage based on family size and individual needs.

- Add-On Benefits: Specialized add-onsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More such as dental, maternity, and wellness programs can be included to enhance employee satisfaction.

- Premium Management: Businesses can implement strategies to manage premiums more effectively, balancing cost with adequate protection.

Step 5: Seamless Implementation and Continuous Support

Smooth Onboarding Process

PlanCover ensures a smooth onboarding process by minimizing administrative overhead. Key features include:

- Digital Documentation: All paperwork is handled digitally, reducing the complexity of paperwork.

- Clear Communication: PlanCover helps businesses communicate policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits clearly to employees, ensuring they understand their coverage.

- Training Programs: Employee training on how to use the insurance platform and maximize their benefits is available.

Sustained Support Ecosystem

PlanCover’s support doesn’t end once the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is in place. It offers:

- Ongoing PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More Management: 24/7 support for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management and claims assistance.

- Annual Reviews: PlanCover conducts regular reviews of policies to ensure they continue to align with business needs.

- Proactive Recommendations: PlanCover helps businesses identify coverage gaps and offers recommendations for optimization.

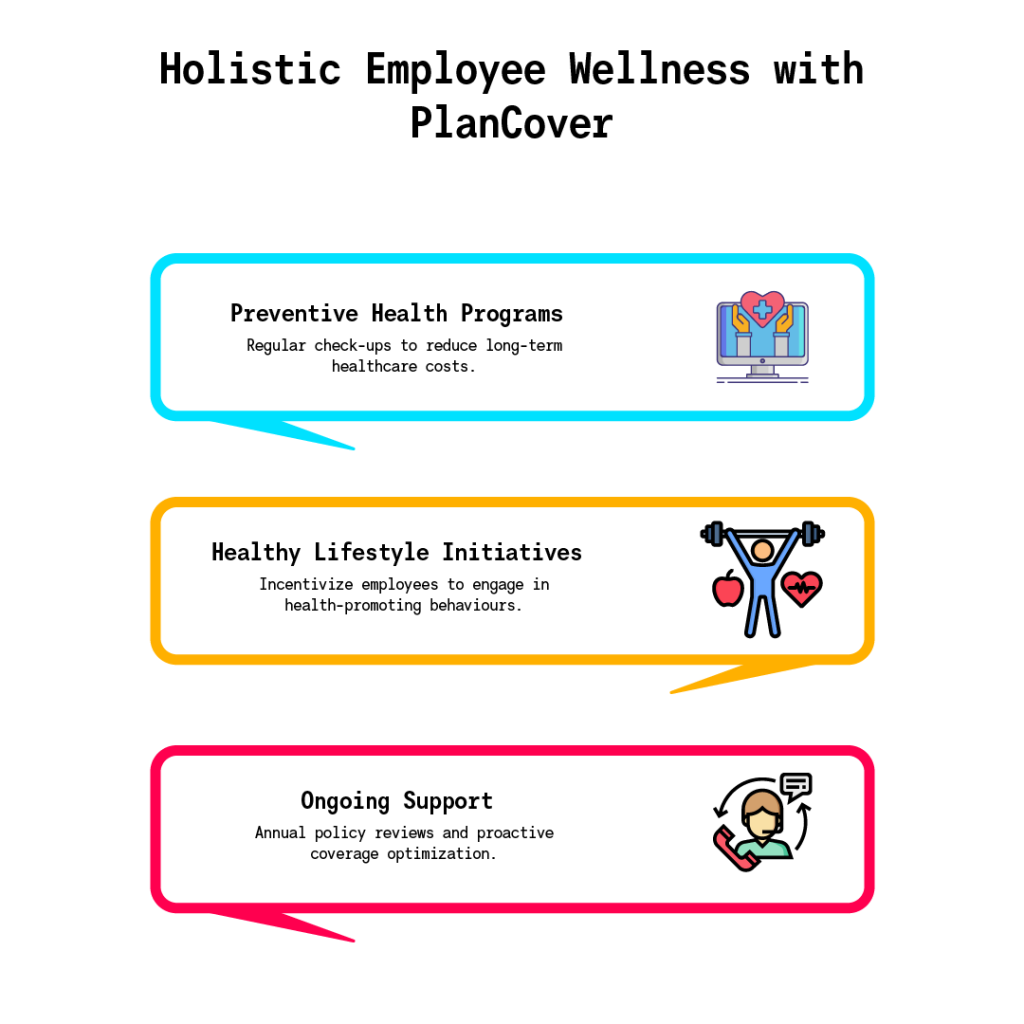

Beyond Insurance: A Holistic Approach to Employee Wellness

PlanCover’s approach extends beyond just health insurance. The platform also encourages businesses to implement wellness initiatives, such as:

- Preventive Health Programs: Offering employees regular health checkups and wellness initiatives can reduce long-term healthcare costs.

- Promoting Healthy Lifestyles: Businesses can offer incentives to employees who engage in healthy living practices, further reducing the risk of illness and promoting a positive work culture.

Conclusion: Why PlanCover Is the Future of Group Health Insurance for SMEs

In today’s competitive business environment, offering group health insurance is more than just a benefit; it’s a key component of employee satisfaction and retention. PlanCover is revolutionizing the way small and medium-sized businesses approach employee health insurance by offering a streamlined, affordable, and customizable solution.

By following these five easy steps, businesses can take control of their group health insurance needs, ensuring they offer comprehensive coverage to their employees while maintaining financial sustainability. With PlanCover’s technology-driven platform, personalized support, and competitive pricing, securing the right health insurance has never been easier.