Table of Contents

An Overview Of Group Healthcare Plans For Non-Profit Organizations

Having a healthcare plan is a must in the current scenario. Amidst the covid ridden world, a healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be your only support system to manage the financial needs in medical emergencies. Like other corporate offices, non-profit organizations also need to look after the welfare needs of the team in service. A group health insurance can be an appropriate way to take care of the requirements of the people working in the NPO. The team of volunteers or workers in the non-profit organizations or NGOs may not be termed as employees, but they can qualify for getting the group health insurance plan.

A brief outline on the non-profit organizations in India: Non-profit organizations in India have tremendous scope of expansion in the near future. Especially with the covid-ridden situation, the population of the country requires such philanthropic activities to uplift the overall conditions. In 2020, 100,873 NGOs have registered in the NGO Darpan portal of the government body, Niti Ayog.**

The non-profit sectors in India have been helping the people in need with funds and support to improve the quality of health, nutrition, education, and overall survival. The top names that come in the frame with non-profit organizations in India are – SERUDS charity, Save the children, Uday Foundation, Milaap, Smile foundation, etc.

In 2009, the Central Statistical Institute of India brought study-based research that, for every 400 Indian citizens, there is one actively running NGO. Since then, the number of organizations has only increased and is still expanding with more people joining the tribe.**

Why should NPOs go for group healthcare insurance plans?

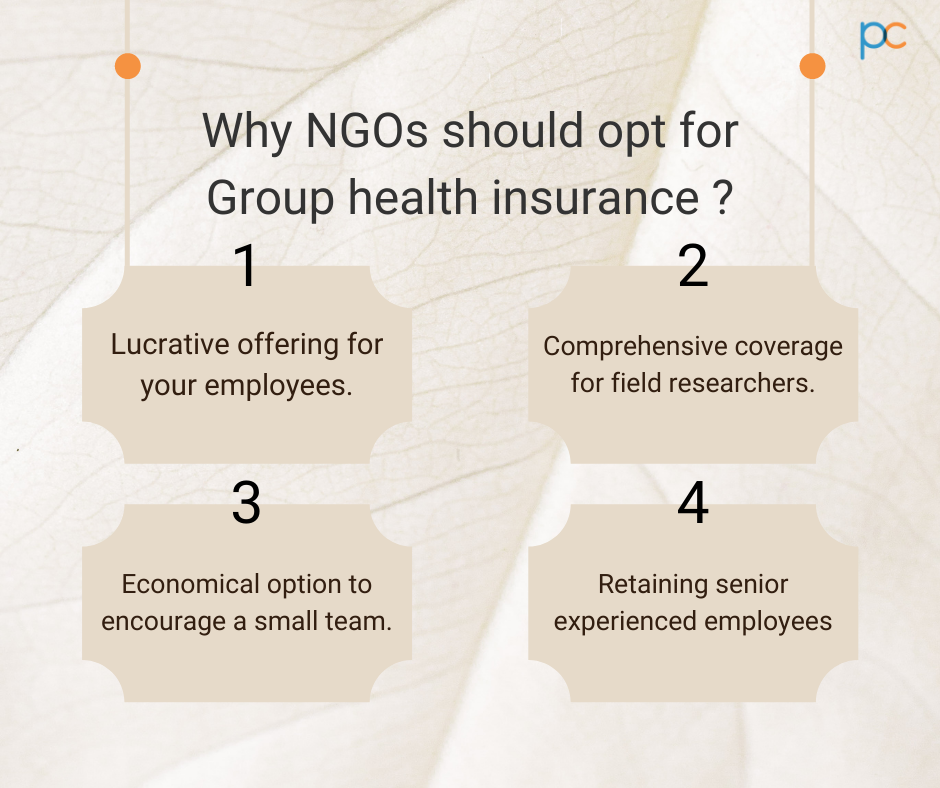

Like every other sector, non-profit organizations have to bring certain service benefits to attract more people into joining their professional sect. A group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be beneficial for various reasons. Here are a few pointers that explains why a non-profit organization should offer group healthcare policies to the employees –

- Look after the overall wellbeing of the employees by managing the healthcare necessities.

- Recruit new resources by offering lucrative service bonuses and expanding the organizational reach.

- An economically suited option for small capacity NGOs to encourage the existing workforce into staying loyal to the organization.

Know about the eligibility

Many are unaware that any group of people can apply for health insurance plans. For getting the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, it is not necessary to be a part of an organization or startup. The insurance policies can be bought by formal and informal groups where the group dynamics can be diverse.

The non-profit organization can get registered under a Non-Profit Private Limited Company or Section 25 or 8 of The Company’s Act, 1956, Trust Act, Society Registration Act. Thus, the organization can be considered a small company to qualify for the eligibility norms of the group healthcare policies. By registering the organization under the Society Registration Act, the non-profit organization has to follow the other criteria as well. For example, the charitable organization has to maintain a certain number of group members to get insurance approval.

Essential insurance features

Now that you know whether your non-profitable organization is eligible to get policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval, it is time to figure out the plan features. Unlike the usual corporate organizations and businesses, NGOs have financial boundaries. They do not generate profit to take care of the welfare of the employees. So, the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More should be a compact package with reasonable premium rates. Read along to find what features to look for while finding the right insurance for the non-profit sector.

- Comprehensive package: A group healthcare plan can cover the family members of the employee. Most organizations and businesses offer comprehensive family health coverage to their employees. Under the Mediclaim plan, the dependent family members (spouse, children, and parents) can also enjoy treatment coverage. It is better for non-profit organizations to look for this feature in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to ensure overall financial support during medical emergencies.

- Affordable premiums: The cost factor can be a major setback for non-profit organizations and NGOs. As they do not function like professional organizations or businesses, so managing the expenses can be tough at times. For continuing the group health insurance plans, the organization has to clear the annual renewal charges or premium amounts and extend them for another year. Go for a basic to moderate plan coverage with Rs.3lacs to Rs.5lacs insurance coverage limit for each member in the organization. Check the different price rates offered by different companies to compare and figure out the best one.

- Extensive coverage: Cashless treatment, reimbursement facilities, pre-and post-hospitalization expenses, and day-care coverage are some of the basic necessities with group healthcare insurance. It ensures easy and convenient insurance utilization. The non-profit organization should focus on including such beneficial features into the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. As the employees and team members of the NGOs may have to travel frequently, cashless facilities are a must.

- Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More: The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More in a group healthcare insurance is the time during which the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More cannot claim the treatment expenses. Many insurance companies have an initial waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More of seven to thirty days. Besides this, there is specific waiting tenure for specific diseases like – cardiac ailments, kidney issues, diabetes treatment, and many more. The policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can only claim such treatment expenses after completion of the waiting term as mentioned in the healthcare terms of the associated insurance company. Thus, it is better to look for a healthcare plan having the least waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More to ensure effective treatment.

- Hospital network and customer assistance: A vast network of cashless treatment facilitated hospitals under the insurance company helps the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More in more than one way. They can produce the insurance documents for getting treatment under emergencies and planned medical treatments. An efficiently functioning customer assistance team of the insurance company assures swift claim settlement and cashless approval. Thus, it is necessary to find group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More where the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can get a hassle-free service and efficient processing.

How to buy the insurance?

There are two ways through which a non-profit organization can purchase the group healthcare insurance for the employees. The head of the organization, who will be paying off the insurance premium charges annually, can directly speak to the salesperson of an insurance company. Or, you can find an insurance broker to guide you with the different policies. Having an insurance broker will help your case as they can present the best plans in the market without exceeding the budget. You can also connect to an insurance consultant to understand the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval norms and eligibility rules for a non-profit organization.

Know the process in detail

The first step is to clear the eligibility needs for applying for the group healthcare insurance. There need to be at least seven employees under the non-profit organization or NGO. The head of the organization has to purchase the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More through an insurance broker or from the insurance company. They can pick the plan based on the premium charges and associated policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features.

Getting the best plan

How do you find the best group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More among so many options? The best way is to seek the assistance of an expert. Find an experienced and reputed insurance broker. They have the most useful policies that match your budget and expectations. As they have been a part of the business, they are the best ones to guide you with the essentialities of the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for non-profit organization members. Buy the right combination of extensive plan coverage attributes and a reasonable price.

Reasons to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

- Ensure financial stability for the people working in the non-profit organization.

- Provide financial support amidst the pandemic to manage the needs during a medical emergency.

- Group healthcare insurances also have add-onsPurchase of additional benefits or cover on the existing policy. More and customizable facilities depending on your specific needs.

- Get a flexible premium structure that does not exceed the budget to help the employees.

- Earn tax reliefs by purchasing the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More for the employees in the NGO.

Find the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More with PlanCover.

PlanCover, the reputable insurance broker, brings the most reasonable group healthcare policies for small to mid-capacity organizations. If your non-profit organization has 7 to 450 members, there cannot be a better option than PlanCover. They listen to your requirements and fetch the appropriate group healthcare plan that matches your requirement. Connect to their team and buy the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More without any hassles.

** https://www.icnl.org/resources/civic-freedom-monitor/india