Group health insurance is a necessary part of employee benefit packages. Most employees, currently looking for a package that offers them excellent financial support in every way. An employer healthcare plan acts as an attractive package for fresh recruitments.

The real estate industry is flourishing in India at a rapid pace. Real estate startups are emerging in every corner of the country. The growing startups require employee strength to ensure maximum operability. Group healthcare insurance for real estate employees motivates them to work harder to ensure the benefits. But as an employer, can you randomly select any insurance plan? No. You have to look for a few customized features that make the insurance apt for your employees.

Table of Contents

Enormous opportunities awaiting

Before getting started with the insurance details, first, take a look at why this professional sector is gaining such importance. The real estate business is not a new professional sphere in India; it has been present for a long. But in the last one or two decades, India has witnessed certain major investments in the sector. The real estate sector in India stands as the second-highest employment-generating professional field after agriculture.

With a growing number of startups, huge investments are expected from NRIs and businesspersons in the short-term and long term. Some of the leading names in the sector are – NestAway, PropTiger, Strata, etc. The inclusion of technology in properties has also opened newer opportunities in the field.

Understanding the Needs

The vital factor in buying the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for your employees is understanding their needs. What the employees need or may necessitate in the future determines the utility of the plan coverage. You have to consider every essential factor related to employee preference and probabilities to find the best among the rest.

Age band of employees

The age group of the employees is important when you consider the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More alternatives. Why? Because the offering is related to healthcare. Usually, a person requires medical attention and treatment while belonging to the upper age band. The chances of coverage claim get more when anyone crosses fifty. The insurance companies are well-aware of this factor. Hence, they increase the premium amount according to the age band.

In real estate, you cannot define the majority age band. Suppose in the IT firms, the average age group of employees is around thirty, for which you get a probable idea of what plan features you require.

- With real estate employees, there can be no such average age calculation. What you require as a real-estate startup founder, is to check what your office needs. If the average age band in your startup is around forty-five, then check policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features that have a lower waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More or better coverage for pre-existing ailments.

- In contrast, if the average age is around thirty, you can go for plans that may have a long waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More or lesser coverage for pre-existing ailments as the need for enjoying these benefits is less.

Plan coverage features

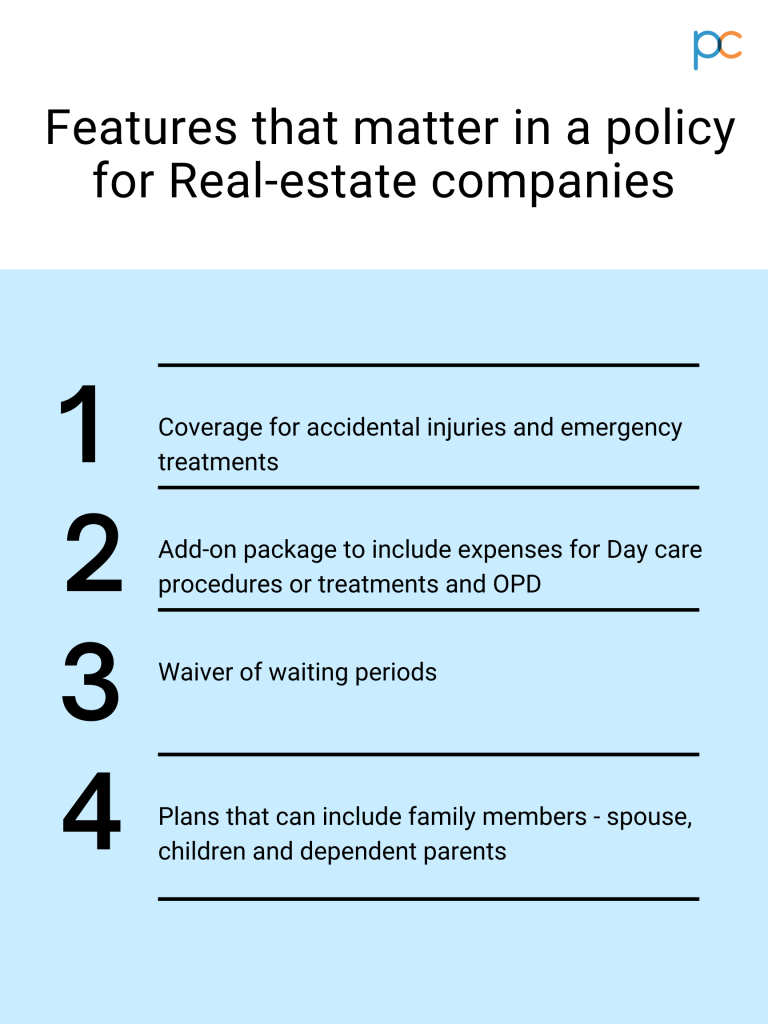

- Accidents and emergencies: Real estate startups have employees responsible for outdoor and indoor work. Thus, they may require coverage for accidental injuries. While many policies do not offer accidental injury expense but as a real estate professional, you may need it. Check for a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More offering such accidental coverage and emergency treatments.

- Day-care and OPD expenses: Real estate employees like property brokers do not have a fixed schedule. They have a hectic routine for which they may not get a chance to get hospitalized for a minor day-care treatment. Some insurance companies do not bear expenses for day-care treatment where the patient does not need to get admitted. But as a considerate employer, you have to check the convenience factor. Choose the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers similar day-care and OPD treatment coverage to ease their financial distress.

- Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More and other factors: The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More is the specified time during which the insured person will not get any plan coverage for a particular treatment. There are varied waiting periods for different diseases. Usually, the average waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More is around 24 months. But you have to find the one that has the least waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for pre-existing ailments or general treatment of different diseases. But this decision depends on your workspace scenario. If the average age band is around thirty, you may not have to worry much about the waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More. But if it is over fifty, discuss this factor with the insurance seller to find a suitable one.

- Inclusion of family members: Employer healthcare policies may or may not offer plan coverage for the employee’s family members (spouse, children, and dependent parents). As real estate is a high-paying field, thus most employees settle down with their families by the age of thirty. That is why most employees may require a family-inclusive plan for their spouses and dependent parents. Thus, as a good leader, you should ensure that your employees do not face financial stress. Check for a comprehensive policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers effective plan benefits within an affordable plan.

Features of the insurance company and plan

Now that you have an overall idea of what your employees may expect from the health plan, it is time to review the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More properties. Read at a glance so that you can ask the right questions to the insurance seller. It will help you pick the best plan from so many options they present in front of you. Keep a mental note of every said pointer.

- Network of hospital

Cashless facilities are a must for real estate employees. Why? Because they do not have the spare time to file for a reimbursement procedure by organizing all the medical bills in a place! For employees whose lives are always at a high pace, you have to ensure a cashless facility so that they do not have to wait to get the best treatment. How is it possible to offer excellent cashless treatment? The policies that offer a wide network of hospitals offer easy cashless facilities. Thus, check this point thoroughly to ensure policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More utility.

- Coverage for critical ailments

Critical ailments do not occur with a prior intimation. Especially for dependent parents, plan coverage for critical ailments is a must. Treating such diseases can lead to financial distress. Here, a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More helps manage the funds without making it a burden. Check for the coverage facilities for such critical diseases to offer your employees nothing but the best.

- Pre-existing diseases

As discussed earlier, real estate professionals do not have an average age band for which, coverage of pre-existing diseases may become a serious factor. If the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More does not cover pre-existing disease treatment expenses (for example – diabetes, hypertension, etc.), what is the point of keeping such insurance? These days people barely in the age band of the thirties are getting affected with such diseases for increasing stress. Hence, take a benevolent decision in selecting the features.

- Easy claiming procedure

As discussed, real estate professionals do not have spare time to invest in policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More claims and settlements. Thus, a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More having an easy claiming process is a boon to them. It is also easier on your part as you can manage the needs easily when an employee connects to you about the claim process. Look for an efficient processing feature in the insurance company profiles by reviewing their market reputation.

- Premium cost under the budget

Lastly, as a startup founder, you cannot omit the budget factor. With lockdown all over the country, the real estate market had faced a sudden halt in 2020 and is recovering now. So, you cannot ignore the financial conditions and go for an expensive plan which you may not afford in the near future. Find the right combination of premium charges and best features that offers a comprehensive package for your employees.

Found the right one yet?

As a founder of a real estate startup, have you found the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More yet? If yes then why wait anymore? Connect to the insurance company sales executive and get started with the process. However, if you are still on the fence, it is time to seek expert advice.

Insurance brokers have the best plans that suit the needs of your employees based on preferences. Thus, if you want to provide a useful service benefit to your employees, it is better to find an insurance broker to proceed with the process.

PlanCover – One-stop solution for policy purchase.

PlanCover the reputed insurance broker company offers group health policies for small to mid-scale startups and companies. As a real estate startup founder, PlanCover is the solution that you have been searching for. They have group healthcare policies from the leading IRDAI-approved insurance companies in India. With them, you only have to specify your budget and features and the rest they will manage. Get a clear idea about the right insurance that nurtures the needs with PlanCover.