“The greatest mistake is to imagine that we never err.”

There are times when a professional error or negligence on the part of a company could cost a customer reputational and monetary losses. At such times, the company is legally liable to pay for damages incurred by the customer. This could run into lakhs and crores of rupees and could financially cripple a company.

Let’s look at a few examples to understand this.

Example 1: Company X is the insured – an IT software services company that sells and installs a computerized system for a client – an e-commerce company. As the IT services provider, company X is also responsible for regular maintenance and system support.

A software upgradation lead to erratic behavior and eventually, the complete failure of the portal. As a result the e-commerce company had to shut down the portal access and suffered loss of finances. The client sued company X for negligence in service performance.

The claim was filed under the E&O Insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for “Professional Negligence” and “Failure to perform” and the damages claimed were for the loss of revenue and damage to reputation.

Example 2: A well-known clothing brand employs a freelance fashion designer to design a new collection. The freelancer uses the image of an artist’s painting as a print on one of the textiles. The clothing brand introduces the new collection. The artist gets to know that her painting has been used without her permission. She sues both, the freelance designer and the clothing brand.

Circumstances and nature of incidents may vary across different industries, but it is essential for enterprises to have some kind of cover that can protect them during these sort of trying times. This is where having an errors and omissions insurance cost could prove to be particularly beneficial.

Small business errors and omissions insurance India can ensure that companies are able to deal with setbacks and can avoid adverse effects on their business. Errors and Omissions policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is one of the most common liability business insurance that is suitable for small business owners, large corporations and even individual contractors and professionals.

If you need an e & o insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and want to know more about it, this article is perfect for you. And even if you haven’t considered or have decided against purchasing one, read on further to understand why you might want to reconsider your decision.

Table of Contents

What is Errors and Omissions Insurance?

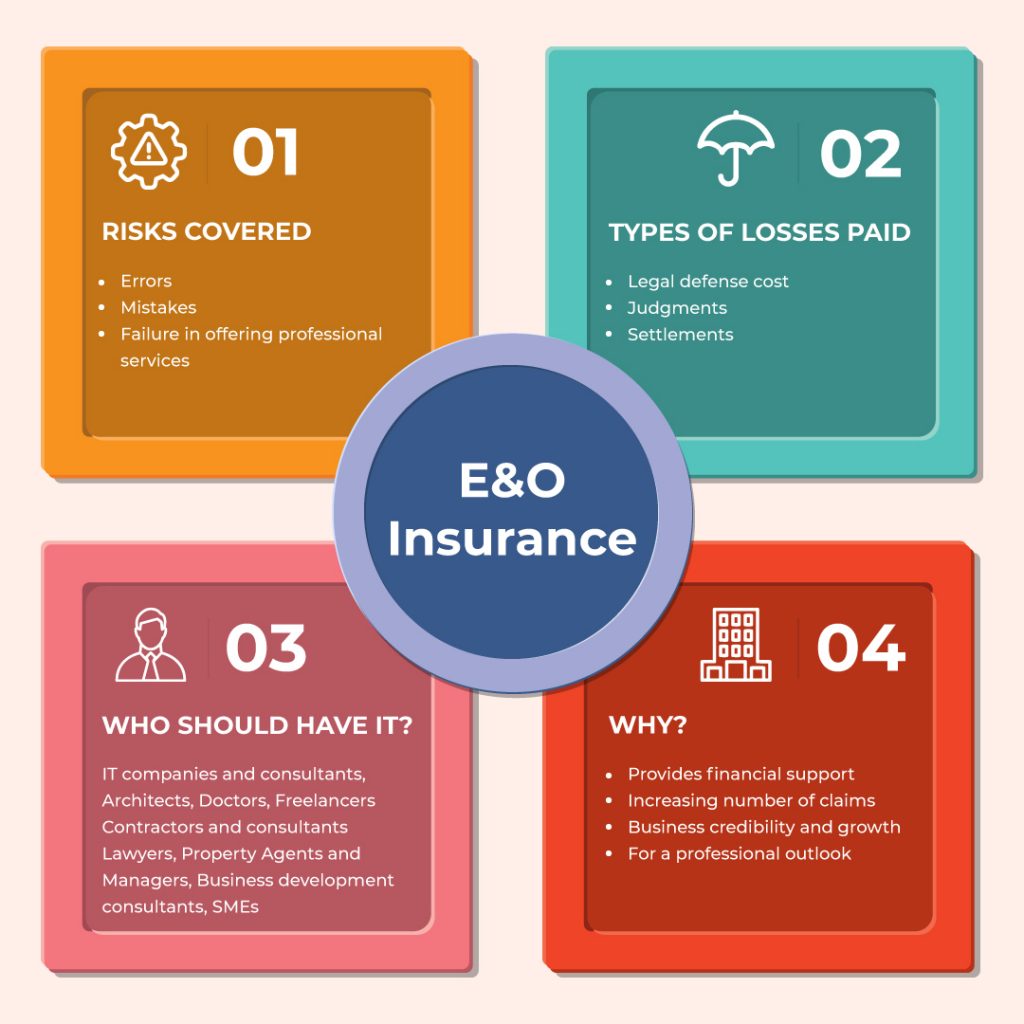

Also known as Professional Indemnity Insurance or Professional Liability Insurance, it is an insurance that provides financial coverage in the case of claims against errors, omissions, negligence and wrongful acts. This insurance pays for compensation for lawsuits from third parties and defence costs.

What does an E&O Insurance cover?

Errors & Omissions insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More covers the professionals, employees, partners, and a professional’s company or partnership for damages directly caused by providing or failing to provide professional services.

What are the third party expenses or losses that can be compensated by E&O?

- Expenses towards settlement and judgment charges

- Court, legal representation expenses and lawyer fees

What are the exclusionsExclusions in insurance refer to specific conditions, treatments, or circumstances that are not covered under a policy. These exclusions define More of E&O Insurance?

- Intentional and wrongful acts

- Illegal acts, criminal acts

- Violation of law

- Services provided under a different name than the one in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

- Fines and penalties

- Bodily harm or property damage

- Illegal discrimination

- Insolvency or bankruptcy

- Copyright or trademark infringement

- Liabilities against any other person insured in the same policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

Reasons why you should have Errors and Omissions Insurance

When starting a business or conducting one, it is important to have a good understanding of the professional liability risks involved. It would help companies and individuals to plan their insurance needs.

It will provide financial support against intangible property

Whereas the General Liability Insurance covers damages that arise out of bodily injury and property damage to the third party, E&O Insurance helps in covering liabilities arising out of intangible damages such as infringement of intellectual property, damage to reputation, breach of data, plagiarism and slander, among others.

If you (company) have been sued, the insurance will pay for your court and legal expenses incurred and any settlement costs if you are proven liable to the third party. Even if you aren’t held responsible, the E&O policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More will compensate for your legal and lawyer expenses. Companies that operate in high-risk industries such as media and entertainment could face legal claims for small errors, too, that could prove extremely expensive.

Similarly, those companies in the tech industry that provide services such as IT, Consulting, AI, among others, should definitely consider this insurance because the chances of risks related to malfunction, errors, and breach are higher in this sector.

It protects individual consultants

Doctors, lawyers, freelance professionals, contractors, architects, business development consultants, and dieticians, among others, who offer professional services and consultancy, are especially prone to the risk of getting sued for negligence and failure to provide the expected services. Thus, it’s imperative for them to buy a Professional Liability Insurance that can protect them in case of a lawsuit.

It can benefit small business owners

Small business owners may not want to avail themselves of every kind of business insurance plans. For example, contractors and freelancers who work from home or shared office spaces might not want to purchase business property insurance or commercial liability insurance plans. However, purchasing an E&O Insurance can protect them against personally paying hefty amounts of money to a client, who legally demands compensation for perceived service-related damages.

Rising awareness has increased claims

There have been several cases involving claims against hospitals and medical experts on the grounds of negligence. The number of cases is on the rise as consumers are now more attuned to expecting the highest quality of professional service and are quite willing to take legal recourse for promised services that are not up to scratch.

E&O is most beneficial to companies that work in the media and entertainment industries, where the risks of copyright infringement, defamation, and privacy violation are rampant. Errors committed unknowingly can cost media and entertainment industries a truckload of money, in either settlement cases or paying damages due to a lawsuit and on legal fees.

It can help you get more business

Not many do it, but some potential customers might ask companies and contractors to show their E&O Insurance before signing a contract with them. The reasons: it gives clients the confidence that the company/contractor can be trusted. It could be a big source of relief that they will be covered in the event of damages due to negligence on the part of the vendor providing them the service.

How to buy errors and omissions insurance in India?

Errors and omissions insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is one of the most important liability policies for many businesses. And it’s very likely your business requires E & O insurance as well to protect against legal liabilities.

In that, the most obvious question that comes is how to purchase errors and omissions insurance?

The process isn’t as simple as it may look; especially if you’re looking for the right coverage at the right price. It involves doing extensive research for informed decision-making.

As a first step, while you know your business needs omissions and errors insurance, what kind of coverage does it require? The larger businesses are at a higher risk of being sued; so their coverage needs are big. In comparison, the small businesses might not be exposed to the same number and extent of legal liabilities; in this case, small business errors and omissions insurance coverage requirements would be less. So, based on your risk exposures, you need to determine your coverage requirement.

Next, find an insurance that can deliver errors and omissions insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More per your needs and budget. Browse through different e and o policies to find a good plan.

In between these steps and after, you would also require to attend various other aspects when you purchase errors and omissions insurance. This can be a confusing affair for many business owners who don’t have proper experience and expertise on liability insurance. This is why it’s recommended to get help from an insurance broker.

If you’re looking to buy the best errors and omissions insurance plan, PlanCover can help. With a team of licensed insurance brokers, we offer end-to-end solutions, taking care of all your needs. Get in touch with us today and buy the right errors and omissions insurance in India.

Are you still wondering if you should purchase e&o insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for your business? If you’re looking for insurance companies in India to seek business insurance advice, you can explore the insurance policies offered by PlanCover to protect your small businesses. For more details visit our website.