In today’s competitive business landscape, organizations are constantly seeking effective ways to attract and retain top talent. One of the most powerful tools in an employer’s arsenal is a comprehensive group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. As India’s leading insurance marketplace, PlanCover has helped numerous businesses implement successful group health insurance programs, managing over 300,000 claims and witnessing firsthand how these benefits transform workplace satisfaction and loyalty.

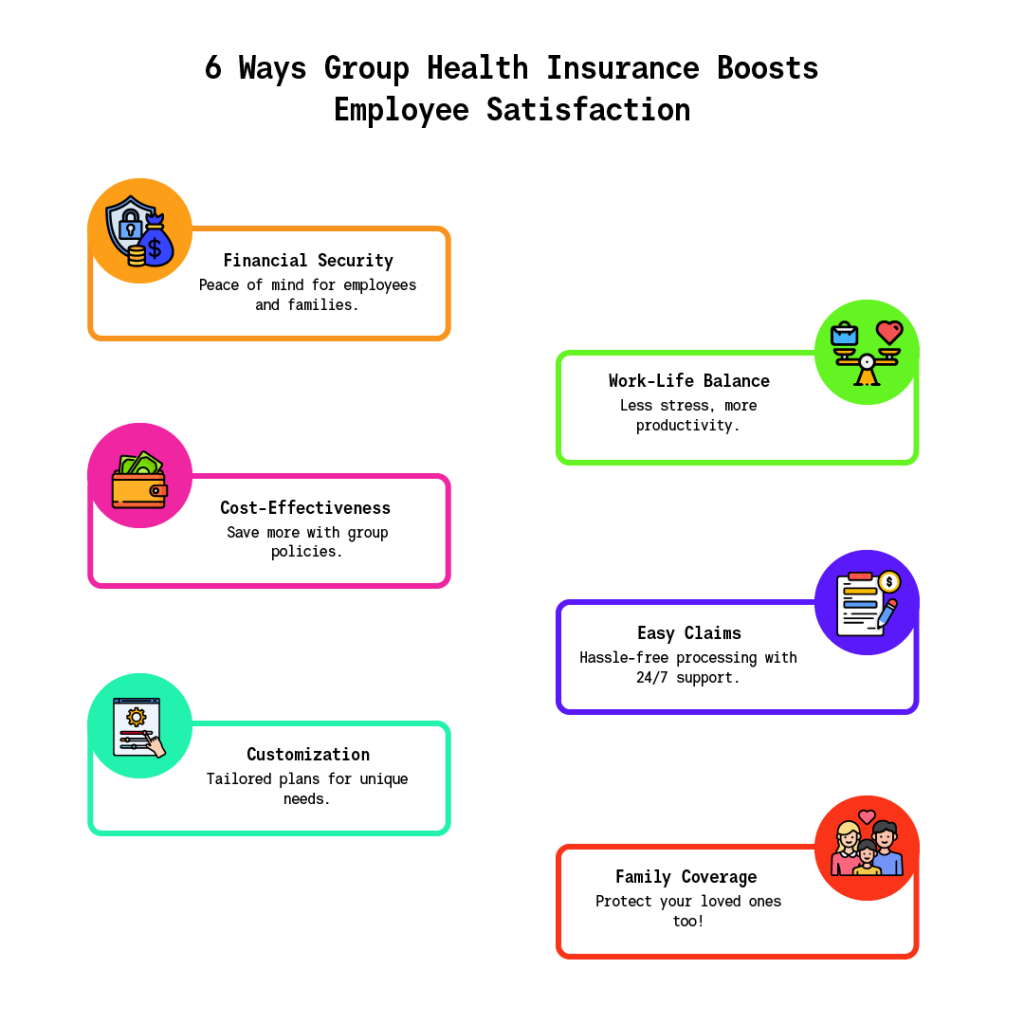

Let’s explore six significant ways that group health insurance contributes to employee satisfaction and retention, backed by our extensive experience in serving small businesses across India.

Table of Contents

1. Financial Security and Peace of Mind

One of the most immediate and tangible benefits of group health insurance is the financial security it provides to employees and their families. In an era where medical expenses can be substantial, having comprehensive health coverage offers invaluable peace of mind.

How PlanCover Makes a Difference:

- Our partnerships with top-ranked insurance companies ensure employees get access to the best products at competitive rates

- Transparent pricing and policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More terms help employees understand their coverage better

- 24/7 claims support means employees never have to worry about emergency situations

When employees know they’re protected against medical emergencies without having to worry about the financial burden, they can focus better on their work and feel more secure in their position. This security often translates into longer tenure with their employer.

2. Enhanced Work-Life Balance

Group health insurance contributes significantly to better work-life balance by reducing stress related to healthcare management. This benefit becomes even more crucial in the post-COVID era, where health consciousness has reached new heights.

PlanCover’s Approach:

- Comprehensive coverage options that include both routine and emergency medical needs

- Special consideration for COVID-19 coverage, addressing contemporary health concerns

- Technology-enabled policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration that simplifies healthcare management

When employees can easily access healthcare services without administrative hassles, they experience less stress and greater job satisfaction. This improved work-life balance often results in higher productivity and stronger commitment to their employer.

3. Customization and Flexibility

Modern employees value benefits that can be tailored to their specific needs. Group health insurance plans that offer flexibility and customization options tend to generate higher satisfaction levels.

PlanCover’s Edge:

- Access to multiple insurance providers allowing for plan comparison and customization

- Expert brokers who help businesses select the most appropriate coverage options

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews and updates to ensure coverage remains relevant

By working with PlanCover, businesses can offer their employees health insurance plans that truly meet their needs, rather than one-size-fits-all solutions. This level of personalization significantly impacts employee satisfaction and their decision to stay with the company.

4. Cost-Effective Healthcare Solutions

Group health insurance often provides better value for money compared to individual health insurance plans, making it an attractive benefit for both employers and employees.

How PlanCover Delivers Value:

- Strong relationships with insurers enabling better premium rates

- Expertise in finding cost-effective solutions for small businesses

- End-to-end support in policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration to reduce overhead costs

When employees realize the significant cost savings they receive through their employer’s group health insurance plan, it becomes a compelling reason to remain with the organization. This is particularly true for small businesses where every benefit matters.

5. Simplified Claims Processing

One of the most stressful aspects of healthcare is dealing with insurance claims. A well-managed group health insurance program can significantly reduce this burden.

PlanCover’s Claims Excellence:

- Dedicated 24/7 call center support for claims processing

- Experience in handling over 300,000 claims successfully

- Technology-enabled claims management system

- Expert team providing end-to-end claims assistance

The ease of claims processing can significantly impact an employee’s overall satisfaction with their benefits package. When claims are handled smoothly and efficiently, employees feel more valued and supported by their employer.

6. Comprehensive Family Coverage

Group health insurance plans often extend coverage to employees’ family members, making them particularly valuable for workforce retention.

PlanCover’s Family-First Approach:

- Plans that cover spouse, children, and dependent parents

- Flexible coverage options to accommodate different family sizes

- Special considerations for maternity and child-care benefits

When employees can protect their entire family through their employer’s health insurance plan, it creates a stronger bond with the organization and increases the likelihood of long-term employment.

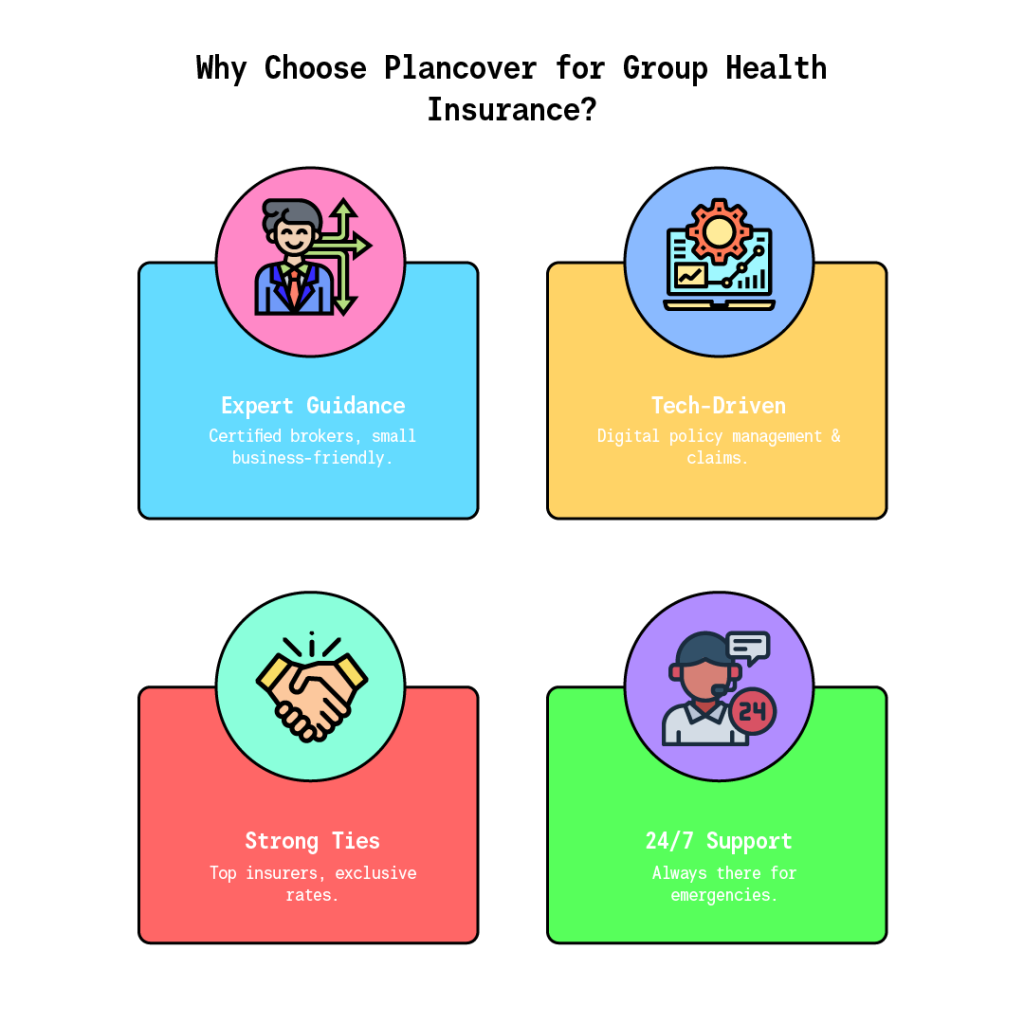

The PlanCover Advantage for Employers

As India’s #1 Insurance Marketplace, PlanCover brings several unique advantages to businesses looking to implement or upgrade their group health insurance programs:

1. Expert Guidance

- Certified insurance brokers with deep industry knowledge

- Understanding of small business needs and constraints

- Regular updates on insurance industry trends and changes

2. Technology-Driven Solutions

- Online policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management and administration

- Digital access to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More documents and information

- Streamlined claims processing systems

3. Comprehensive Support

- End-to-end assistance from policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More selection to claims

- 24/7 customer support for emergencies

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews and optimization recommendations

4. Strong Insurer Relationships

- Partnerships with top insurance providers

- Access to exclusive products and rates

- Better negotiating power for claims resolution

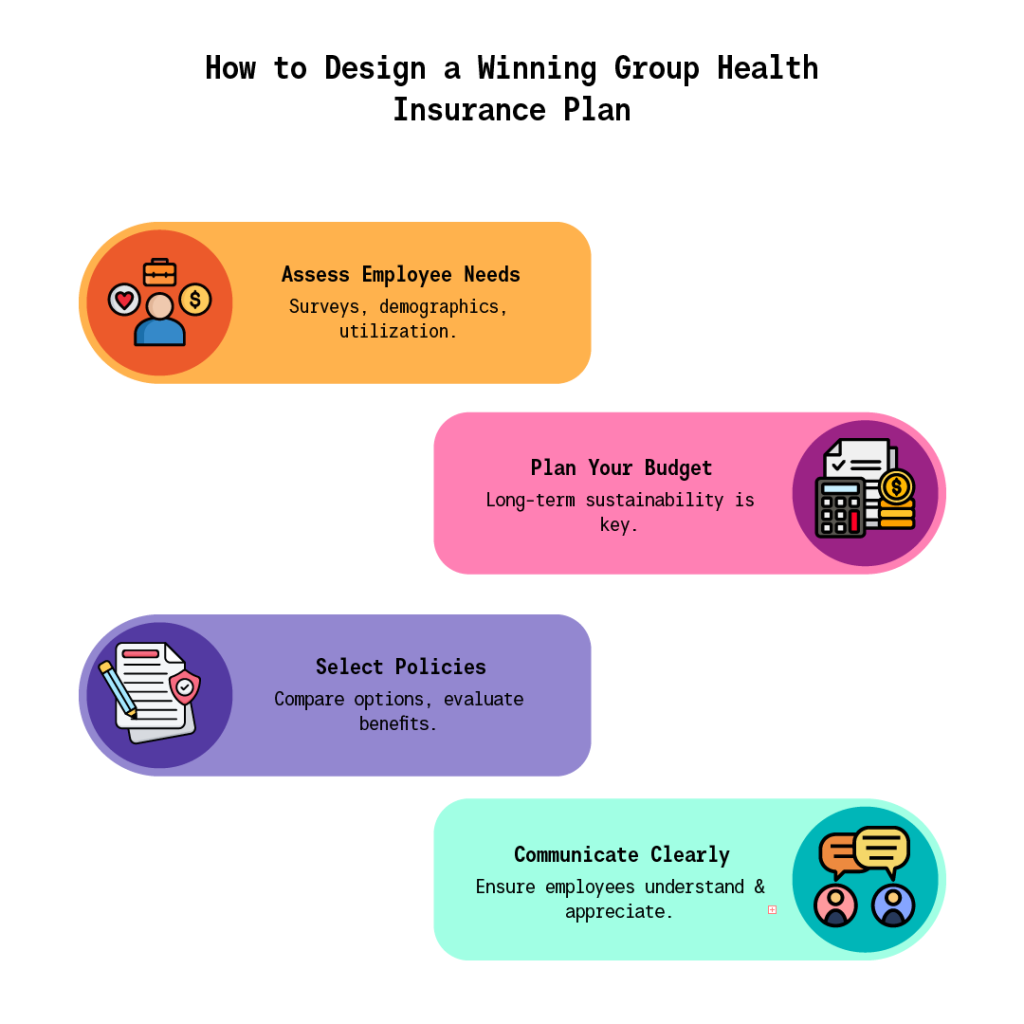

Implementing Successful Group Health Insurance Programs

For businesses considering implementing or upgrading their group health insurance programs, here are some key considerations:

1. Assessment of Employee Needs

- Conduct surveys to understand employee healthcare requirements

- Consider demographic factors and family situations

- Evaluate current healthcare utilization patterns

2. Budget Planning

- Determine sustainable premium contributions

- Consider long-term cost implications

- Plan for potential premium increases

3. PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More Selection

- Compare different insurance providers and plans

- Evaluate coverage options and limitations

- Consider additional benefits and riders

4. Communication Strategy

- Clear explanation of benefits to employees

- Regular updates about policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features and changes

- Easy access to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More information and support

Measuring the Impact on Employee Satisfaction and Retention

To ensure your group health insurance program is achieving its objectives, consider tracking these key metrics:

Employee Satisfaction Indicators

- Regular feedback surveys

- Utilization rates of health benefits

- Claims satisfaction levels

- Healthcare-related grievances

Retention Metrics

- Employee turnover rates

- Exit interview feedback

- Comparison with industry benchmarks

- Cost of replacement hiring

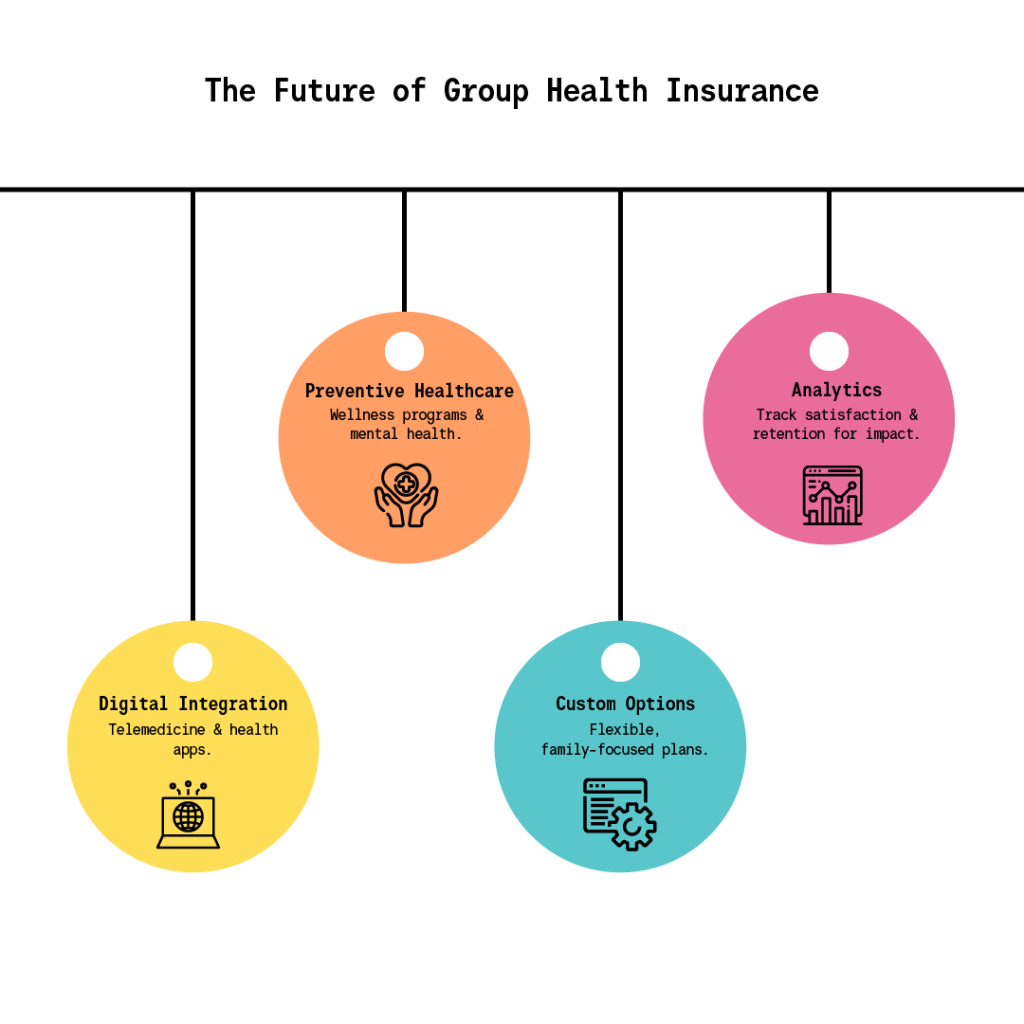

Looking Ahead: The Future of Group Health Insurance

As the healthcare landscape continues to evolve, group health insurance programs must adapt to meet changing needs. Some emerging trends include:

1. Digital Health Integration

- Telemedicine services

- Health monitoring apps

- Digital claims processing

- Online policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management

2. Preventive Healthcare Focus

- Wellness programs

- Health checkup benefits

- Lifestyle disease management

- Mental health support

3. Customization Options

- Flexible benefit structures

- Add-on coverage options

- Family-specific plans

- Age-based coverage variations

Conclusion

Group health insurance is more than just a standard employee benefit – it’s a strategic tool for building a satisfied, loyal, and productive workforce. Through PlanCover’s expertise and comprehensive support, businesses can implement effective health insurance programs that contribute significantly to employee satisfaction and retention.

With our track record of managing over 300,000 claims and serving countless small businesses across India, PlanCover understands the unique challenges and opportunities in this space. Our commitment to providing transparent, affordable, and convenient insurance solutions helps businesses create a stronger, more secure work environment for their employees.

For businesses looking to enhance their employee benefits package, investing in a well-designed group health insurance program through PlanCover can be a game-changing decision. It not only protects your employees’ health but also strengthens your organization’s foundation through improved satisfaction and retention rates.

Remember, in today’s competitive job market, the quality of employee benefits can make the difference between retaining top talent and losing them to competitors. Make group health insurance work for your organization by partnering with PlanCover – India’s trusted insurance marketplace for small businesses.