Selecting a group health insurance plan is a significant decision for small business owners. A well-chosen plan not only offers employees essential health coverage but also plays a crucial role in attracting and retaining talent. With numerous options in the market, it can be overwhelming to find the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that balances both cost and coverage. This guide will help small business owners navigate their choices and choose a plan that fits their business and benefits their employees.

Table of Contents

Why Group Health Insurance Matters for Small Businesses

Providing health insurance can be a game-changer for small businesses, as it adds value to the employer-employee relationship. Group health insurance not only supports employee well-being but also offers tax benefits to employers. Employees with good health coverage tend to have better morale, reduced absenteeism, and higher productivity, which collectively benefits the business in the long run.

Benefits of Group Health Insurance for Employees and Employers

- Health Coverage: Comprehensive group health plans protect employees from high medical expenses, making health services more accessible.

- Tax Advantages: Small businesses offering group health plans can often take advantage of tax deductions, and in some cases, tax credits.

- Employee Retention and Attraction: Health insurance is a key benefit that candidates look for when choosing a job, making it easier for small businesses to compete with larger organizations.

- Enhanced Productivity: Healthier employees often mean higher efficiency and less time lost to illness.

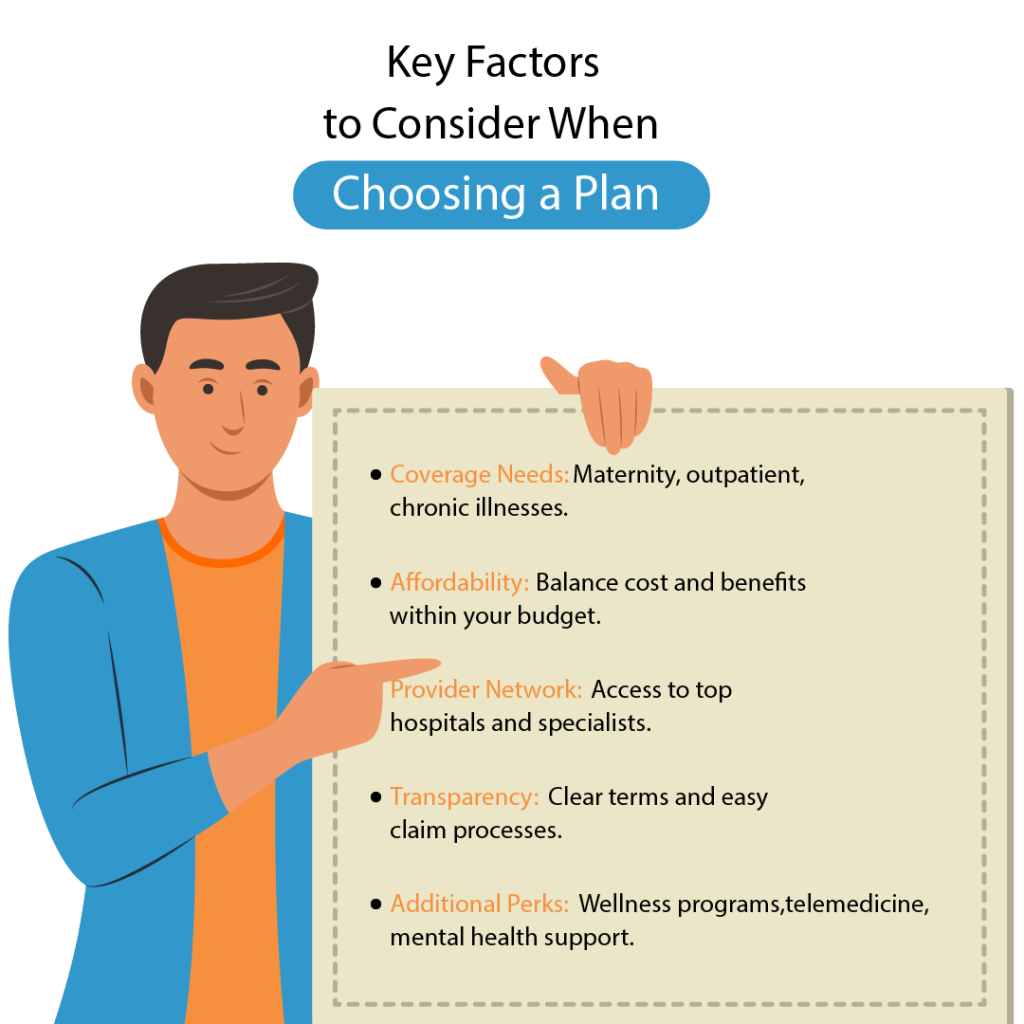

Key Considerations in Choosing a Group Health Insurance Plan

When selecting a group health insurance plan, there are several important factors that small business owners need to keep in mind:

- Coverage Requirements

Think about the type of coverage your employees need. Are they more interested in hospital coverage, maternity benefits, or outpatient consultations? A thorough understanding of their needs will guide you toward the right plan.

- Affordability and Budget

It’s crucial to balance the quality of coverage with what the business can afford. PlanCover provides various budget-friendly options, allowing you to manage your expenses while still offering substantial benefits to employees.

- Provider Network

Consider the network of hospitals and healthcare providers associated with the insurance plan. Employees will likely appreciate a plan that includes hospitals and clinics close to their homes or with renowned specialists in their network.

- Transparency and Convenience

An ideal insurance plan should be easy to understand and manage. PlanCover’s insurance broking services ensure that small business owners get transparent, detailed information about each plan, along with expert support for managing claims.

- Additional Services

Besides basic health coverage, some plans come with wellness programs, mental health support, or telemedicine services. These can add significant value to your benefits package and show employees that you care about their holistic well-being.

Why Choose PlanCover for Your Group Health Insurance Needs?

PlanCover is a leading insurance marketplace in India, specializing in finding the best group health insurance plans for small businesses. Here’s what sets PlanCover apart:

1. Commitment to Helping Small Businesses

PlanCover is dedicated to helping small businesses succeed by providing affordable and comprehensive health insurance options. The company understands the unique challenges of small businesses and works to simplify the insurance process so owners can focus on running their businesses.

2. Convenience and Transparency

With PlanCover, business owners get a transparent view of each insurance plan, including details about premiums, coverage, and terms. They can rely on PlanCover to provide easy-to-understand options that eliminate confusion and guesswork.

3. Extensive Network and Relationships with Insurers

PlanCover partners with all top-ranked insurance companies in India, giving you access to a variety of plans at the best possible prices. This partnership ensures that PlanCover customers have access to the most comprehensive and competitive options.

4. 24/7 Customer Support and Claims Assistance

One of PlanCover’s key strengths is its world-class customer support. With 24/7 assistance, the PlanCover team ensures that policyholders can get help with everything from policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More issuance to claims processing, making it easier to manage the administrative aspects of insurance.

5. Expert Team of Certified Brokers

With a team of highly qualified brokers, PlanCover offers professional guidance every step of the way. They’re committed to understanding your business’s unique requirements and helping you select the best insurance plan that meets those needs.

6. COVID-19 Coverage

Given the impact of COVID-19, PlanCover has adapted its services to include comprehensive coverage options that protect against coronavirus-related expenses. Employees and their families can access treatments for COVID-19 under several of the plans offered, providing peace of mind in these uncertain times.

Types of Group Health Insurance Plans Available Through PlanCover

PlanCover offers a range of plans designed to suit different business needs:

- Basic Group Health Insurance: Provides essential coverage, including hospitalization and emergency care.

- Comprehensive Group Health Insurance: Covers a wider range of healthcare needs, including preventive care, outpatient consultations, and sometimes even dental and vision.

- COVID-19 Specific Plans: Include coverage specifically for COVID-19 testing and treatment, allowing businesses to safeguard their employees’ health during the pandemic.

- Add-on Benefits: Many plans offer add-on options, such as critical illness riders, maternity benefits, and telehealth services.

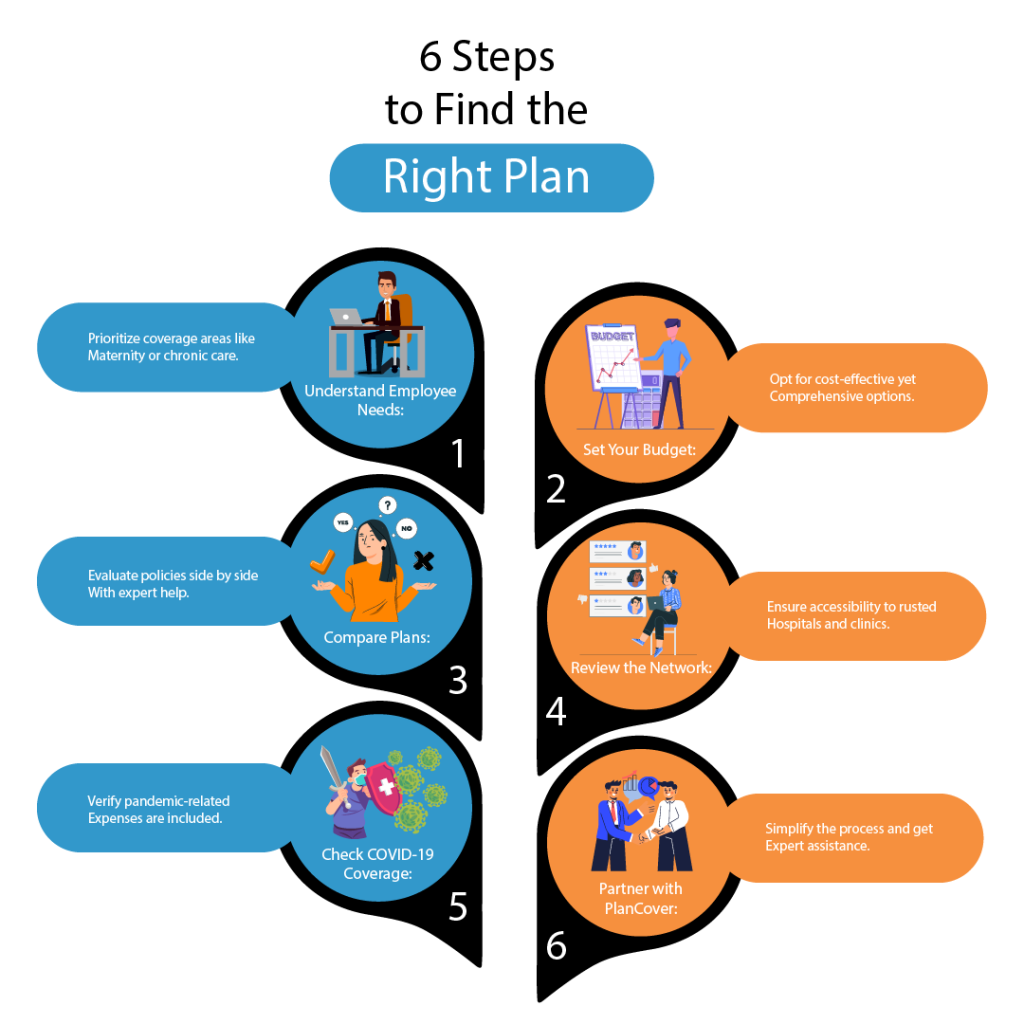

Steps to Choose the Right Group Health Insurance Plan

Here’s a step-by-step approach to choosing the right group health insurance plan for your small business:

Step 1: Assess Your Employees’ Needs

Consider the age range, family responsibilities, and health needs of your employees. Employees with young families may value maternity coverage, while those who are older may prioritize chronic disease management.

Step 2: Set a Budget

Determine what your business can realistically afford to spend on health insurance. PlanCover offers a range of budget-friendly options that allow you to offer competitive benefits without overextending financially.

Step 3: Compare Different Plans

Leverage PlanCover’s expert assistance to compare multiple insurance options. This ensures you’re getting the most coverage for your money and not missing out on important benefits or features.

Step 4: Evaluate Network and Facilities

A good insurance plan should have an extensive network of hospitals and healthcare providers. This gives employees greater flexibility in choosing their care providers.

Step 5: Check for COVID-19 Coverage

With COVID-19 still a concern, it’s essential to confirm that the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More includes COVID-related treatments. PlanCover’s plans offer protection against the costs of coronavirus treatment and hospitalization.

Step 6: Get Expert Help with PlanCover

Working with an insurance broking service like PlanCover can take the pressure off small business owners. PlanCover provides a seamless experience with expert brokers who help you compare policies, understand your options, and manage the purchasing process from start to finish.

FAQs About Group Health Insurance for Small Businesses

Why should I provide health insurance for my employees?

Offering health insurance is a valuable way to attract and retain employees, boost morale, and reduce absenteeism. It’s also often tax-deductible, which can offset costs.

What should I look for in a group health insurance plan?

Consider factors like coverage scope, affordability, network of healthcare providers, transparency, and customer support.

How can PlanCover help me find the right insurance plan?

PlanCover provides expert broking services, helping you compare policies from top insurers, manage the buying process, and handle claims efficiently.

Are there COVID-19 specific health insurance options?

Yes, PlanCover offers health plans with COVID-19 coverage to protect employees and their families from coronavirus-related medical expenses.

Final Thoughts

Choosing the right group health insurance plan is a significant step in safeguarding your employees’ health and well-being. With a partner like PlanCover, you get access to comprehensive, affordable, and convenient health insurance solutions tailored to the needs of small businesses. Let PlanCover’s expert team of brokers guide you through the insurance landscape and ensure that you find a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers both peace of mind and value.

For more details on group health insurance plans and a free quote, visit PlanCover and take the first step in protecting your team’s health and your business’s future.