Table of Contents

The Best Ways To Reduce The Cost Of a Group Health Insurance Plan

Medical treatment costs have increased a lot due to inflation and updated medical procedures. The rate of renewal charges for healthcare insurance has also escalated to meet the coverage needs. However, you can never compare the prices between the actual treatment and the yearly premium expense. But, one can surely notice an elevation in the price charts over the last few years.

Individual Mediclaim or group healthcare plans; both have increased the premium charges, but the group insurances are lighter to the pocket. Small to mid-scale companies that purchase group medical policies for their employees struggle to bear the expenses with the wrong insurance plan. The trick is to make the initial decision carefully to reduce the cost.

Factors that determine the expense

An employer pays the premium for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More renewal on behalf of the employees working in the organization. The employees get the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More as a service benefit without paying anything extra for the premium charges. Unless there are add-on features, the employees do not have to bear the cost. They can enjoy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage till the last day of their service. As the expense gets managed by the employer, they need to have a clear idea about the cost factor. What makes the premium prices so high? Read along to know more –

- Overall employee strength

The elementary factor determining whether you have to pay more renewal charges lies in the employee strength. The more employees work in your company, the more you have to pay for the annual policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More renewal. For large-scale companies and established business firms, it is not a major factor. But for growing enterprises and startups, the number of employees can create a financial burden on the employer. Hence, choose the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features based on the affordability of the cumulative amount.

- The average age of employees

Almost every insurance company charges more for the group healthcare or individual Mediclaim by reviewing the policyholder’s age. If the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More is over forty-five, the premium is higher. For many insurance companies, the premium almost gets doubled if the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More is over fifty. Why? Because, with older age, the chances of claiming insurance coverage get higher. The insurance companies calculate the probability of claiming expense based on age and existing diseases of the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More.

In fact, most insurance companies keep a mandatory medical test for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval over the age of fifty. It helps the insurer to understand the chances of claiming, depending on which they quote a high premium rate for such policyholders.

- Comprehensive healthcare plans

The premium increases if an employer includes the employee’s family members into the group healthcare plan. Especially with dependent parents aged over 60, the renewal rates get too expensive. An employer can bear such costs if the overall employee strength is less. If the employee strength is ever-growing, then managing such expensive premium amounts can be troublesome. In fact, individual Mediclaim plans also have the same feature where you have to pay more for the floater family package.

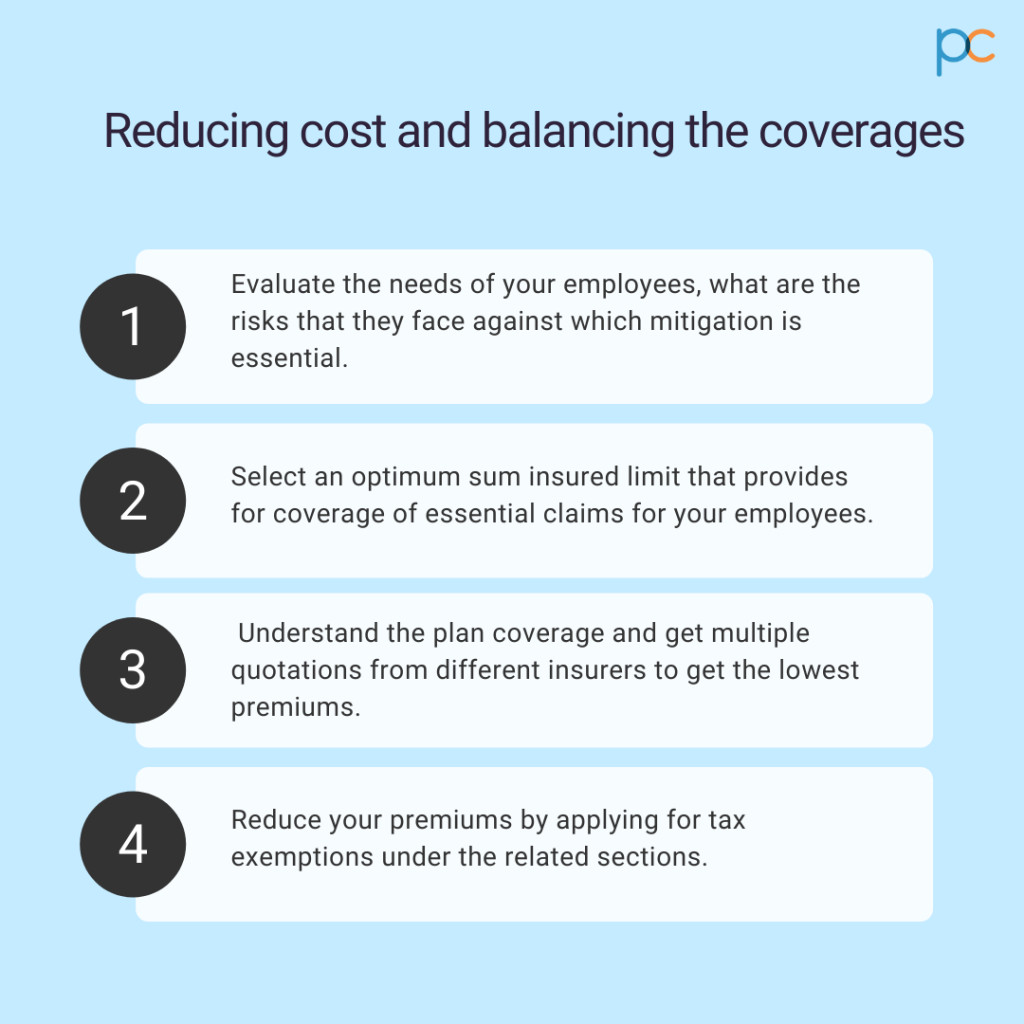

7 Smart ways to save money on health insurance

Employers of small to mid-capacity organizations need to find an effective solution to cut the expenditure. The easiest way is to go for the most basic plan with simple Mediclaim features. It has a lower premium cost compared to tailor-made insurance plans. But will that be helpful for the employees? If you reduce the insured sum to Rs.1lac, will it cover the necessities? Maybe not. You have to strike the right balance of plan features and premium charges to make the best deal. Following are some of the best ways to reduce the financial burden when it comes to maintaining a group healthcare insurance plan for the employees:

Evaluate plan coverage and premium charges

Understanding the plan coverage is the first step. You have to get a clear idea about the group healthcare benefits that other companies (competitors in the market) are providing to their employees. One of the targets of presenting the group Mediclaim is to ensure employee retention. If the employees get more service benefits and better pay packages in other companies, they will switch without a second thought. Hence, keep parity in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More offerings and determine the premium that suits your estimates. Browse through many insurance plans to decide the right one.

Hire younger employees in the team

As discussed earlier, the age band impacts the overall expense of the employer. So, it is a wise step on your part to hire young employees between the age band of 25 to 35. For growing companies and startups, it acts as a boon. Why? Because a younger workforce yields better and more efficient performance. It will help your company to grow more in the coming years.

- No-claim bonus: Not only will you have to pay a reduced amount but, you can also enjoy discounts for a no-claim year. Many insurance companies offer a no-claim bonus at the year-end by deducting a certain amount from the renewal charges. You can enjoy the discount by picking a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More offering this feature and getting younger employees on board.

Consider the comprehensive plan

A comprehensive plan is always a better attraction for retaining the employees or recruiting new talents. It helps the employees attain peace of mind and more advantages compared to the basic group healthcare plan coverages. But it can become a financial liability to the employer! How do you find a balance? One effective way is to offer a comprehensive package but by altering it wisely. Include the employee’s spouse and children in the healthcare plan. Exclude the parents as your premium rises for the aged policyholders. This way, you can meet both the needs with a calculated step.

Know the needs first

One of the best ways to find a way to cut cost is by consulting with your employees. Currently, most employees already own a personal medical plan for better health coverage. Even if you offer a corporate Mediclaim, most of them prefer to keep an individual policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More also. Hence, you can discuss and find if they need the extensive facilities of the group healthcare policies. If the majority of the employees already own insurance, you can select a basic group healthcare plan to meet your responsibility and at the same time ease the cost.

Reduce with the tax exemption

Buying an IRDAI-approved group healthcare insurance can be helpful while you pay the taxes. It indirectly reduces the financial burden of meeting the premium charges for annual policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More renewal. You can produce the premium-payment documents and earn a lucrative discount on the annual income tax amount. Enjoy tax relief with the group healthcare insurance and reduce the overall financial liability.

Who can help you out?

Now that you know which factors are responsible for increasing the premium rate and the right ways to manage the rates, why wait? It is high time you bought the best group medical insurance plan for your employees. Your employees are the asset to the company for which, offering such service benefits are a must. Offer them a useful policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that will relieve their financial stress during a medical emergency, without making it a burden on you!

Find a reliable insurance broker

A trustworthy insurance broker is your ultimate go-to option. They will find you the most appropriate group healthcare plan without exceeding the budget. Find a company that deals with the leading insurance companies in India and serves the best deal in every way.

PlanCover – Bringing the best deals.

PlanCover, the most trusted insurance broker, always brings the best group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policies for employers without exceeding their budget. There is no better option for small to mid-sized companies than PlanCover when it comes to buying the policies. They offer you the trending deals on group healthcare policies from the leading insurance companies (IRDAI-approved). With them, you only have to mention the budget and plan coverage requirements; they will manage the rest with ease. Connect to them for an efficient and effective consultation before buying the most cost-effective group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.