Group health insurance plans are affordable and budget-friendly compared to the regular Mediclaim plans. But an employer needs to assess the prices to check the suitability of the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More. An employer does not pay the renewal premiums for one person or for themselves. Instead, the employer pays the cumulative premium charges for the insurance renewal every year. The employee does not need to pay any extra amount or deduct a portion of their salary to meet the expenses. They can enjoy the insurance benefits and plan coverages till the last day of their service. So, an employer has to do some serious calculations before taking up this responsibility on their shoulders.

Table of Contents

Is the plan coverage satisfactory?

For those not having a clear idea about the premium charges, it is better to research and find out the average rate. For example, if you choose a group healthcare package of Rs.1lac for an employee aged below thirty-five, the renewal cost would be around Rs. 1,400 to Rs.1,900. The exact price amount cannot be defined as the rates vary with the different insurance companies. Hopefully, this will help you figure out the average cost, but it is better to consult an expert to know the right prices.

The insurance premium charges you are paying need thorough evaluation in more than one way. The plan benefits, overall coverage, and much more makes the price worth it. So, check these pointers related to the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More to evaluate the price you pay for the insurance.

- Cashless facilities: Cashless facility in hospitals is a must and, most insurances offer the same. But the tricky part lies in the network of hospitals. If the premium charges are expensive, the service that the insurance company provides should match it. The network of cashless facilitated hospitals should cover pan-India and the number of names should be more than five to six thousand. So, check for parity between the hospital network and the price the insurance company charges for providing the plan coverage.

- Critical ailment support: Basic healthcare plans may not always offer exceptional coverage. The price you pay for the annual renewal may be light on the pockets. But, with little plan coverage, the insurance will be of no use. As an employer, you have to ensure the welfare of your employees. Thus, check if the group healthcare programs provide optimal treatment support during emergency illnesses and pre-existing medical conditions. Also, check the length of the waiting periodThe period of time that an individual must wait either to become eligible for insurance coverage or to become eligible More (the period during which the policyholderA person who pays a premium to an insurance company in exchange for the insurance protection provided by a policy More cannot avail of any treatment coverage for pre-existing ailments and critical diseases). The lesser the time, the better the insurance is for the policyholderA person who pays a premium to an insurance company in exchange for the insurance protection provided by a policy More. Thus, the premium charge should match the treatment coverage facilities and offerings.

- Pre-and post-hospitalization: The premium charges of the group healthcare insurances vary depending on the overall plan benefits. Not every insurance plan provides a similar treatment coverage and expenses for medical accessories. If you pay a moderate to a high amount for annual renewal the insurance plan should provide pre-and post-hospitalization charges. It helps the employees to reduce the financial burden and brings peace of mind to the policyholders. Check for the right balance between the offerings and prices to get a clear picture.

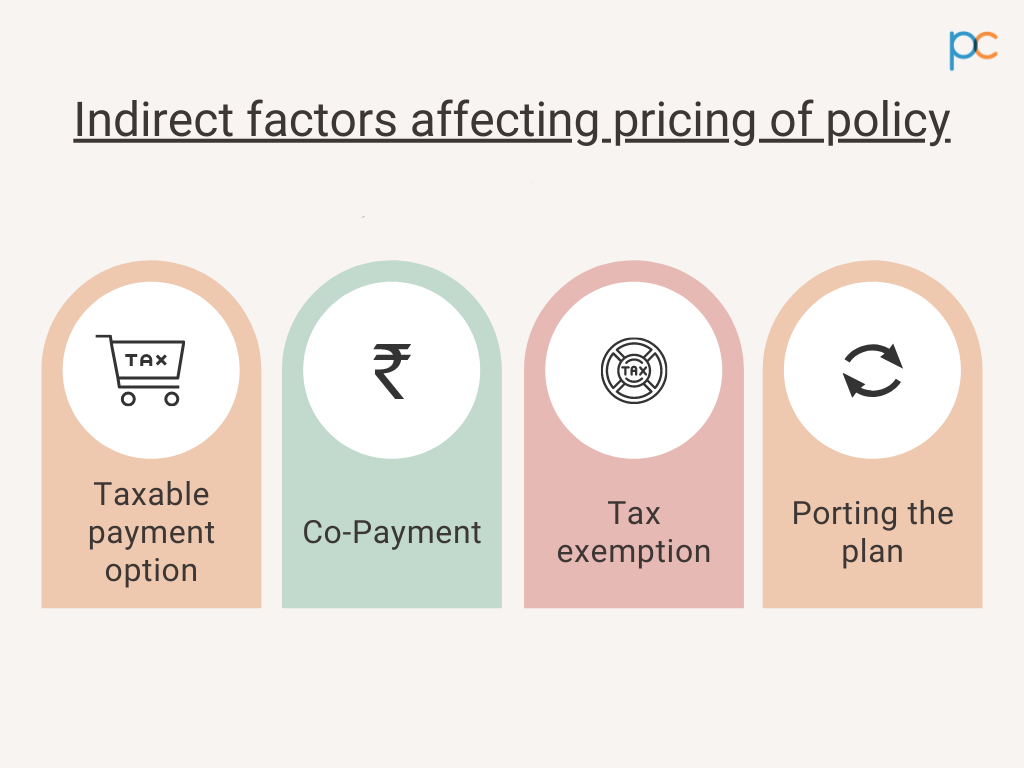

- Tax returns: You must be aware that paying premium charges for annual policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More renewal brings you tax relief. As an employer of a small to mid-sized enterprise, the tax cut is advantageous for multiple reasons. Even if you pay a high premium, you can stand a chance to redeem the money through the tax relief at year-end. So, first, talk with your accounts manager to get an idea of how much tax cut can you get for paying the premium amount. If there is a reasonable balance between the two, you are certainly on the gaining side. Why? Because higher premium charges indicate better plan coverage, and if you can get it in a lower price pack, is there a reason to worry?

Check for overall support.

The best insurance companies in India offer a dedicated service alongside offering extensive plan coverage. The insurance premium you pay is justified only when the service is up to the mark and meets your expectations. If you pay a high premium charge then the service from the insurance team should also be convenient and effective.

Compare the prices to check

Comparing the prices of the leading insurance companies is the best way to assess. If you find the price you pay for annual renewal too high, you can always port the insurance. An insurance broker like PlanCover can be of help in finding the best market rate based on your plan coverage expectations. You can connect to them and consult to assess the premium charges at nil service charges.

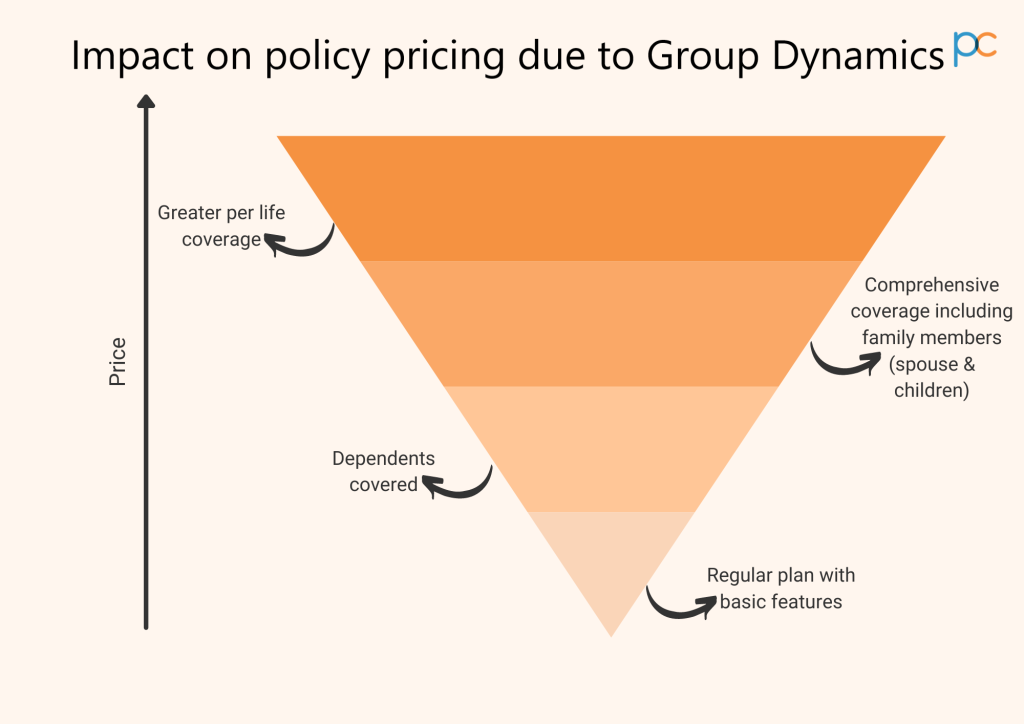

Check the group dynamics.

One reason why the renewal premiums may appear high on the budget is for the existing group dynamics. Multiple factors influence the premium prices to increase. Assess the amount by evaluating the employee group and see if it exhibits the following attributes –

- Most employees belonging to the upper age-bad (more than 45) – With age, the premium value rises and you have to pay more for them.

- The total number of employees in the organization – With more people in the company, the cumulative premium charges will increase.

- Type of the group healthcare policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More – If you include the dependent family members of the employees into the insurance plan, the premium will be more. Especially with the addition of dependent senior citizen parents in the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More, the amount is certain to rise.

Is it too expensive for your budget?

Lastly, check your overall estimate to understand if the premium price is right for you. There is no better assessing point than your specific budget and capacity to afford. The affordability factor is varied with the different companies and businesses. So, the employer has to understand how much they can afford and then proceed with the plan features. If you select tailor-made group healthcare plans, you can offer partial payment where the employee also bears a certain portion.

- Experts at your rescue: For finding a plan that meets the needs without exceeding the budget it is always good to seek expert assistance. The brokers in the insurance market are the best guides. Go for an experienced broker to identify the best price and plan coverage features among the many options.

Suit your budget with PlanCover

PlanCover, the highly reputed insurance broker company has been assisting employers for a long period in finding the right policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More. They assist you in identifying the best policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More with the correct premium charges without making it heavy on the pockets. Any small to mid-scale company owner can approach their team to get the best group healthcare policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy More. They present to you the group healthcare plans from the leading insurance companies in India. Connect to them to crack the best deal and meet the needs of the employees working under you.