A group health insurance plan is a medical expense coverage plan for employees working in an organization. Unlike the individual insurance policies where the policyholders pay the premiums, the employer bears the cost here. Under the scheme, any business or organization with an employee strength of more than 7 can offer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits. The organizations can buy the insurance directly from the company or approach an insurance seller to find the right one.

Table of Contents

Employers pay off the premiums

With the pandemic outbreak, it is currently mandatory for an organization to offer health insurance benefits to the employees. The group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More for employees could be availed free of cost by the employee. The employer of the organization pays the insurance premium on behalf of the employee. The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage bears the medical expenses incurred for treatment of any disease, sickness or injury that requires hospitalization depending on the features of the opted scheme and sum insured.

Employees getting compact insurance coverage

When an employee produces the health insurance card to get hospitalized for treatment, they can enjoy cashless facilities. The hospitals and policies that do not support cashless support offer a reimbursement of the expenses. The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage is valid till an employee works for the organization. On leaving the job, the benefits of the insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More are no longer applicable. Thus, the coverage that an employee or their family enjoys is valid till the service period in the company.

Know about the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits

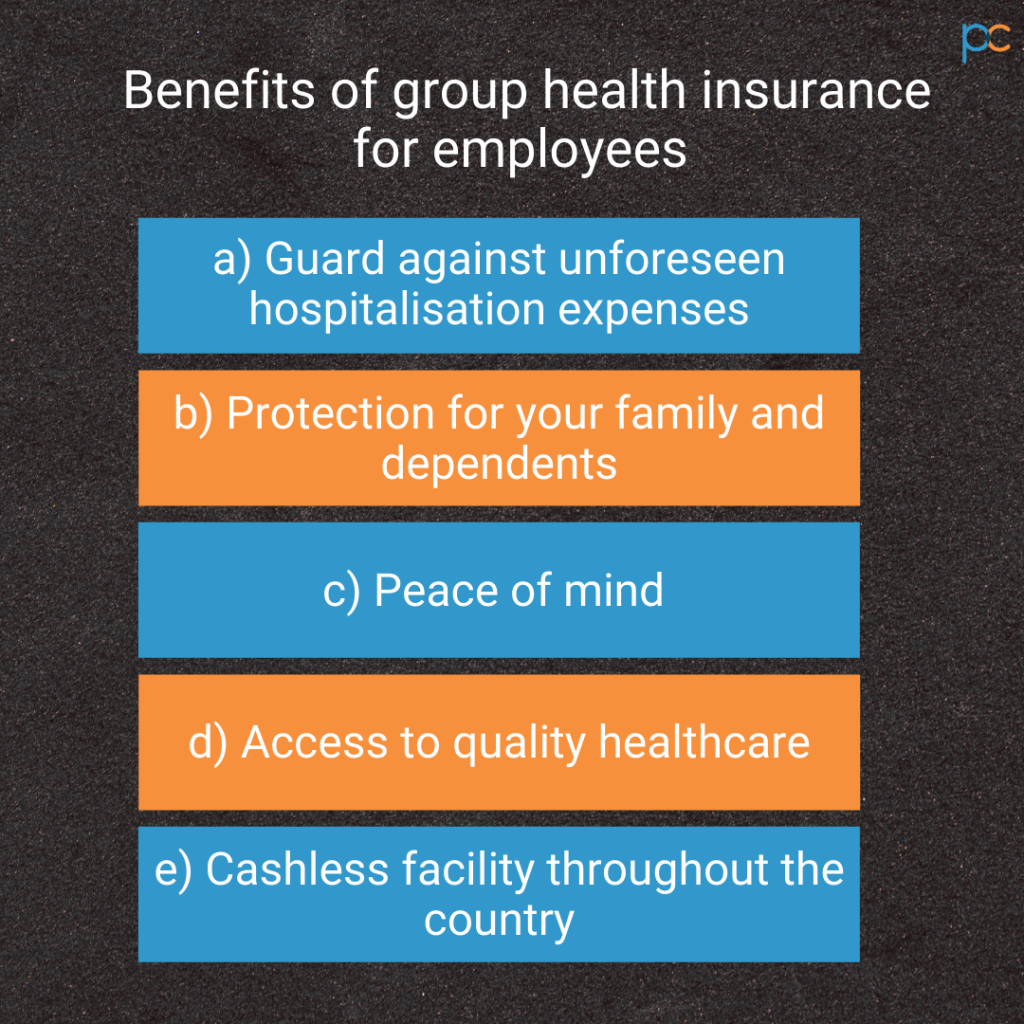

How is the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More beneficial for an employee? The benefits of the scheme are mutually advantageous for the employee and employer, but the employee gains more from it. The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage allows the treatment expense coverage for the employee and their dependable family members. Thus, without paying any extra premium charge, the employees can gain from the coverage. Read along to know how the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage works advantageously for the employees –

- Any pre-existing disease treatment: While many insurance policies do not bear the expenses for any pre-existing diseases, group health insurances work differently. As per the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More your employer picks, you can get coverage for the treatment of any pre-existing ailment. Unlike many insurance schemes, there is no waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More in the case of the group health insurance policies offered by certain insurance companies.

- Medical expenses for surgeries and accidents: The insurance company will also cover the cost for any surgery for the employee. The surgery may be due to any disease or accidental causes. You have to get admitted to a hospital that falls under the list of networks of hospitals to avail cashless services. Employees can take reimbursement facilities at the selected hospitals that fall under their list.

- Treatment expense coverage throughout India: A group health insurance is valid throughout India. You can get admitted to any hospital outside your native city and get cashless treatment if the hospital falls under the list of insurance-approved medical centers. If not cashless, you can always find the option for reimbursement on producing valid documents and medical bills.

- Expenses for medical accessories: Many group health insurance policies cover room and nursing charges, ambulance fees, etc. However, the rules may vary depending on the norms of the selected insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. But in most cases, an employee enjoys such coverage benefits.

- Coverage for diagnostic tests: Diagnostic tests under the prescription of a doctor are eligible for insurance coverage. Here also, the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More feature may bring a difference in the amount insured for the purpose. But in most group health policies, the employees get a reimbursement of the pathological testing charges on producing valid bills and prescriptions.

- Family health coverage: Alongside the employee, the dependent family members are eligible for the benefits. The group health insurance works as a comprehensive solution to the employees as they get overall medical support in times of emergencies. The family policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage is valid for directly dependent family members like the spouse, children, and parents. It does not apply to other relatives or in-laws.

- Maternity coverage benefits: Female employees and spouses of male employees can avail of maternity medical support. Many insurance policies offer expenses for normal and C-section delivery along with post-maternity costs. Depending on the norms of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, there can also be coverage benefits for the newborn for a span of ninety days.

- Cashless treatment at registered hospitals: Employees can conveniently pick the cashless treatment in the selected hospitals and ease their needs. The process is simple, where they only have to produce valid ID proofs and insurance cards for getting admitted. The rest of the settlement will be taken care of by the hospital representatives and TPAs of the insurance company.

Attain peace of mind with better insurance coverage

With a group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, an employee can lead a peaceful life and stay motivated. The benefits of policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage save a lot of financial distress and bring a sense of dependability in times of need. The way insurance policies work is also highly convenient on their part. They can produce the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More cards and get admitted without any hassles. No lengthy paperwork or lumpsum deposits, the policies act as an instant savior in emergencies.

Get an overall idea about insurance coverage

From easy cashless treatment to efficient reimbursement, the group health insurance policies are always the best choice for the employees. As an employer, improve employee retention in your organization by picking the best insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from a reliable company. If you do not know how it works or how to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, you can directly approach the insurance providers or find an insurance seller. They will help you out with all the details and pick the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers maximum benefit for the employees and employers.

Top-rated insurance brokers at your service

PlanCover a trusted name among the leading insurance brokers in the country, brings you the best policies for employees. You can select the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More by comparing several group health insurances offered by reputed and IRDAI-registered insurance companies. Get in touch with the team of PlanCover, and they will address all the doubts that you have regarding the policies and their benefits.