In the rapidly evolving business landscape of India, small businesses face unprecedented challenges in managing employee welfare and healthcare benefits. The COVID-19 pandemic has fundamentally transformed how organizations approach employee health, making comprehensive group health insurance not just a benefit, but a critical strategic necessity. PlanCover emerges as a pioneering insurance marketplace that understands the nuanced needs of small businesses, offering innovative solutions that go beyond traditional insurance models.

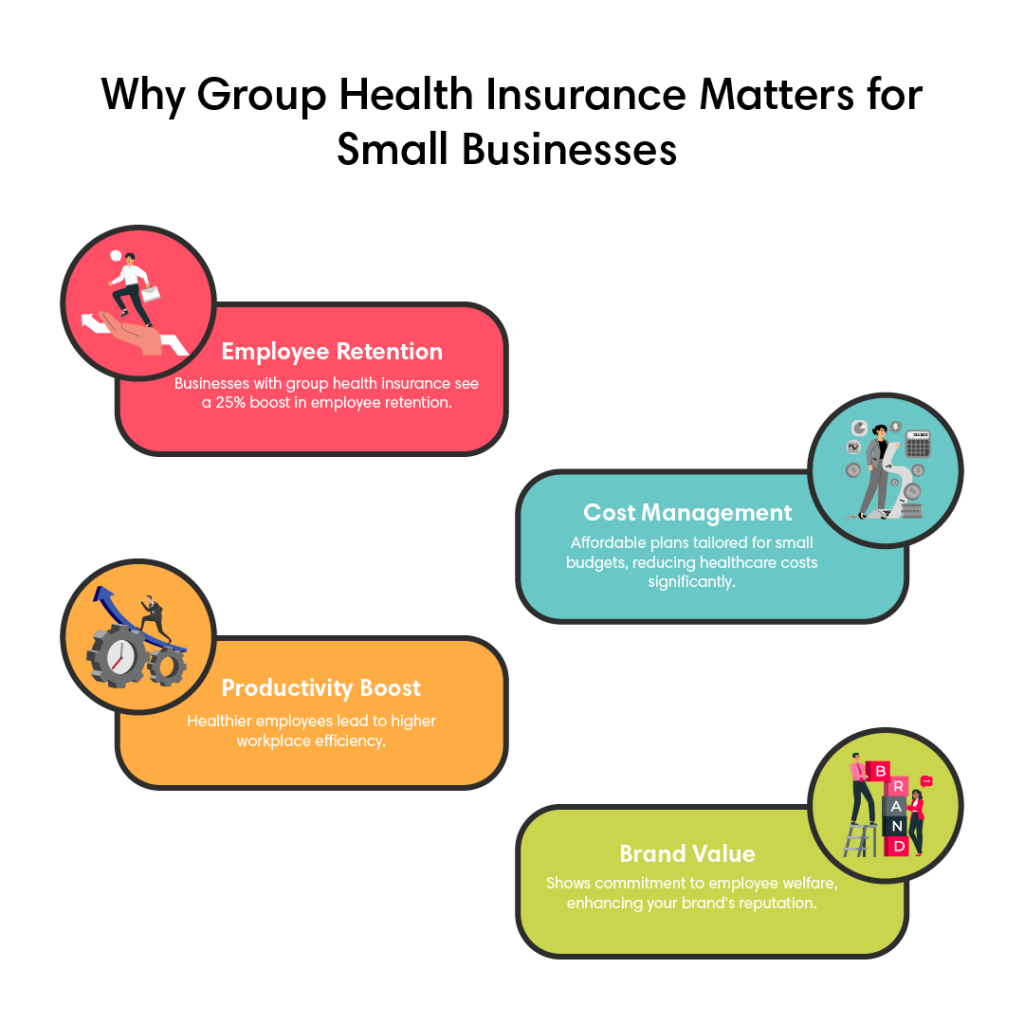

Small businesses represent the backbone of India’s economic ecosystem, and their ability to attract, retain, and care for talented employees depends significantly on the quality of benefits they can provide. Group health insurance has transformed from being a peripheral employee benefit to a core component of organizational strategy. It serves multiple purposes: protecting employee health, demonstrating organizational commitment, managing financial risks, and creating a supportive work environment.

Table of Contents

1. Comprehensive and Affordable Coverage: A Nuanced Approach to Employee Protection

Understanding the Financial Challenge

Small businesses operate with limited financial resources, making comprehensive health insurance seemingly challenging. Traditional insurance models often presented a false dichotomy: either provide expensive, comprehensive coverage or compromise on employee protection. PlanCover disrupts this paradigm by offering meticulously designed group health insurance plans that balance affordability with robust coverage.

Strategic Coverage Components

PlanCover’s group health insurance plans include comprehensive features designed specifically for small businesses:

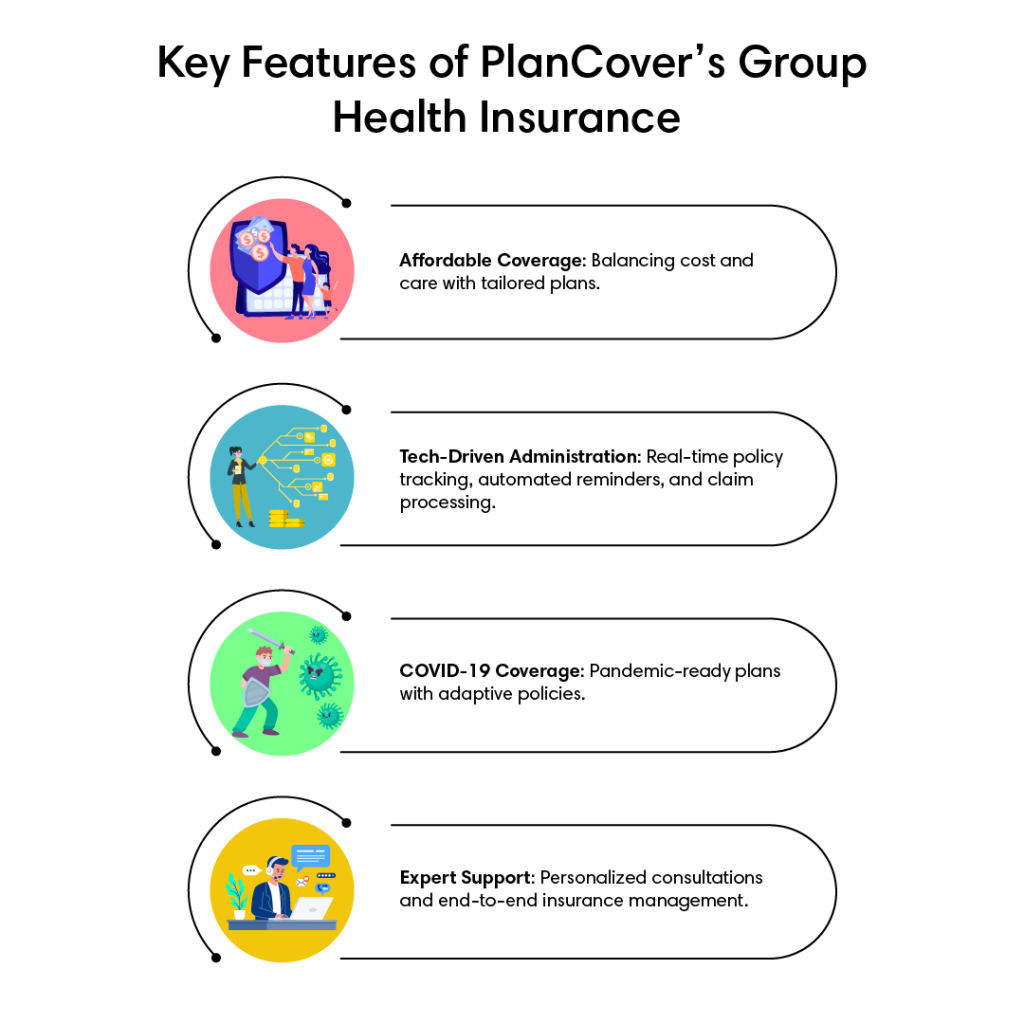

- PlanCover ensures that each insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More provides extensive medical coverage that includes hospitalization expenses, pre and post-hospitalization treatments, critical illness support, and preventive health check-ups. This holistic approach means employees receive comprehensive healthcare protection that goes beyond mere emergency medical support.

- The insurance plans are dynamically structured to accommodate the diverse healthcare needs of different workforce demographics, recognizing that a young tech startup might have different health requirements compared to a traditional manufacturing unit. This customization ensures that each business receives a tailored insurance solution.

- By leveraging technology and maintaining strong relationships with top-ranked insurance providers, PlanCover can negotiate competitive rates that make high-quality health insurance accessible to small businesses with constrained budgets.

Cost-Effectiveness Mechanism

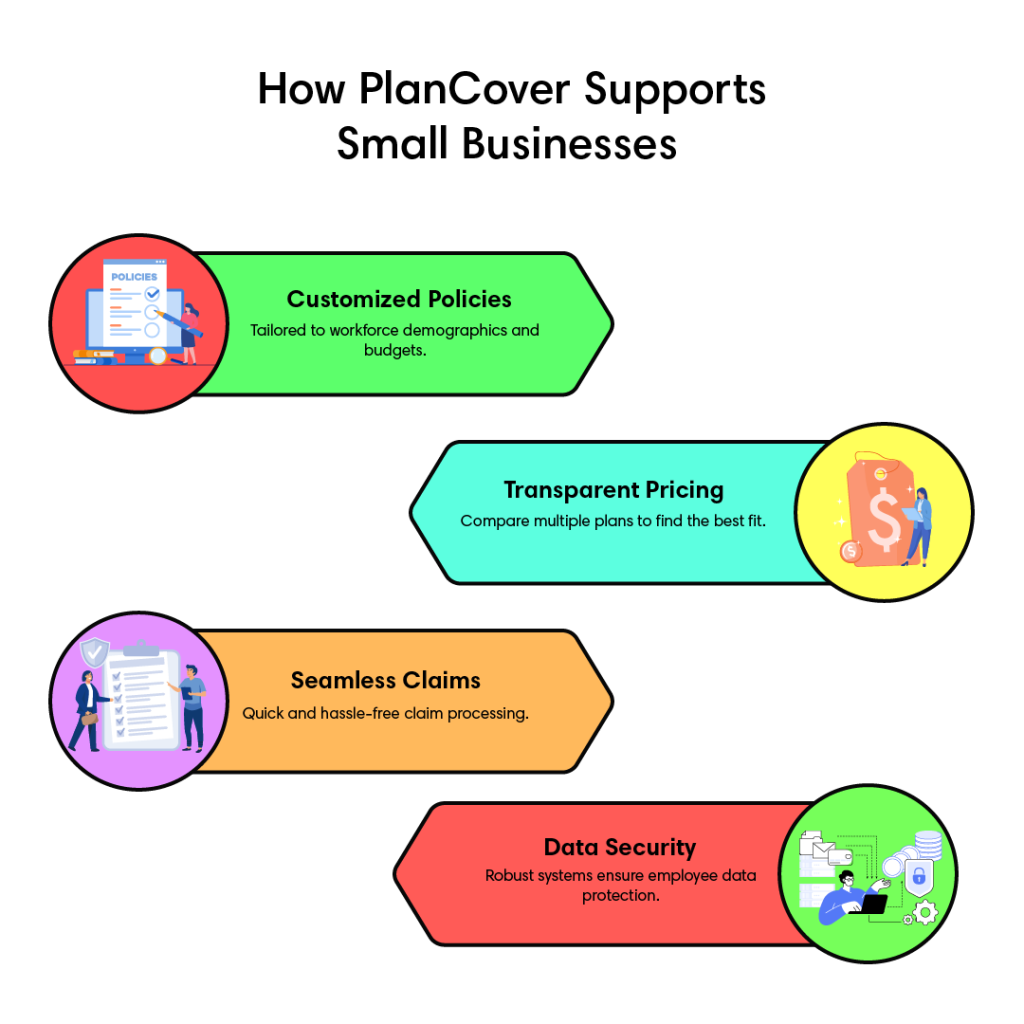

The marketplace model employed by PlanCover allows for unprecedented transparency and competitive pricing. Small businesses can:

- Compare multiple insurance plans side-by-side

- Understand the nuanced differences in coverage

- Select plans that offer optimal value for their specific workforce demographics

- Access professional guidance in making informed decisions

2. Technology-Driven Administration: Revolutionizing Insurance Management

Digital Transformation in Insurance

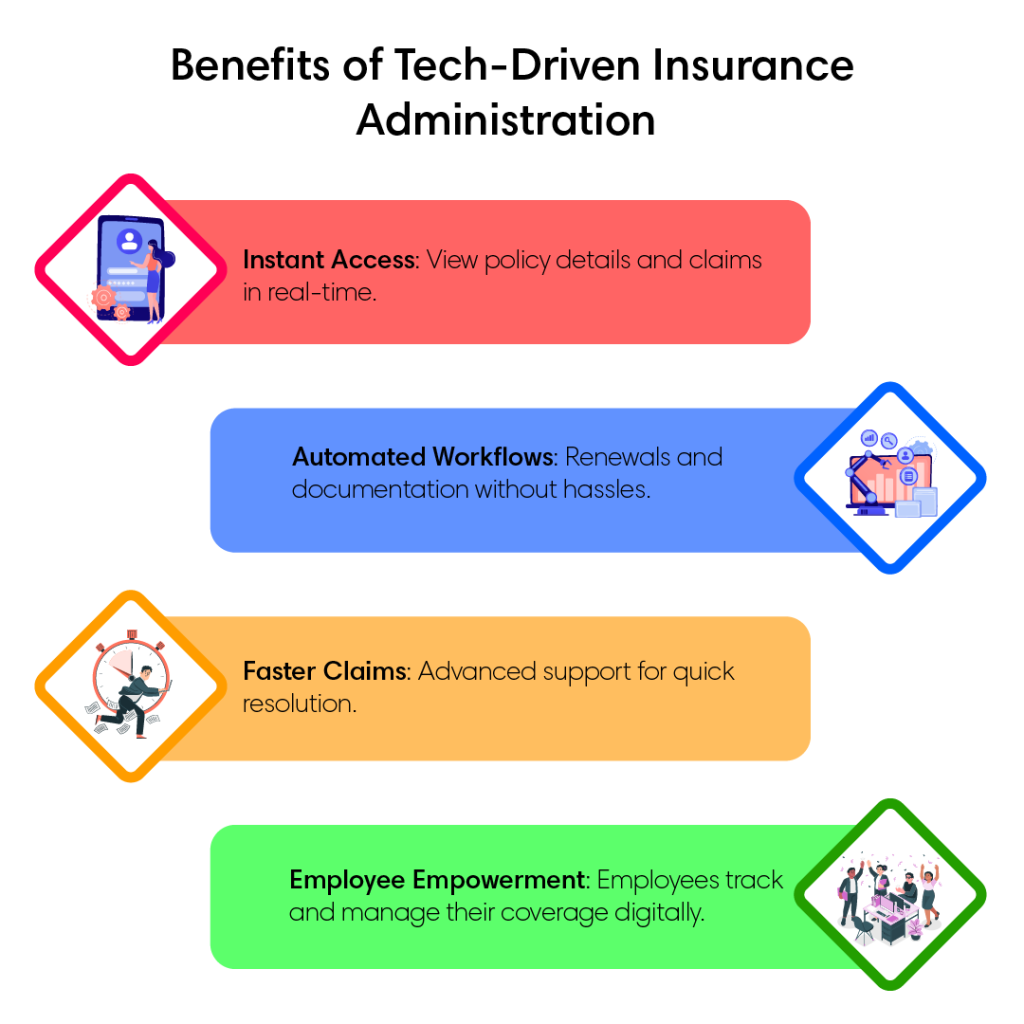

PlanCover recognizes that modern small businesses require modern solutions. Their technology-driven approach transforms insurance from a complex, paper-heavy process to a streamlined, user-friendly experience.

Technological Features

The digital platform offers comprehensive administrative capabilities:

- The online portal provides real-time access to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More details, allowing business owners and HR professionals to manage insurance coverage with unprecedented ease and transparency. Employees can access their insurance information, track claims, and understand their coverage instantly.

- Advanced claim support mechanisms enable quick processing and resolution, reducing the administrative burden on businesses and providing employees with rapid healthcare access during critical times.

- Automated renewal reminders and digital documentation eliminate traditional administrative challenges, allowing businesses to focus on their core operational objectives while ensuring continuous healthcare coverage.

Security and Compliance

PlanCover’s technological infrastructure adheres to stringent data protection standards, ensuring that sensitive employee information remains secure and confidential.

3. Unparalleled Support and Expertise: Beyond Traditional Brokerage

The Human Touch in Digital Age

While technology drives efficiency, PlanCover understands that personalized expert guidance remains crucial in navigating complex insurance landscapes.

Expert Broker Capabilities

The certified insurance brokers at PlanCover provide comprehensive support through:

- Personalized consultation sessions that delve deep into understanding each business’s unique workforce composition, healthcare requirements, and financial constraints. These consultations go beyond surface-level discussions to create truly customized insurance strategies.

- Detailed, data-driven plan comparisons that help businesses make informed decisions, considering factors like coverage extent, premium costs, claim settlement ratios, and additional benefits.

- Continuous support throughout the insurance lifecycle, from initial policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More selection to claim processing and renewal, ensuring businesses have a reliable partner at every stage.

Professional Credentials

PlanCover’s team comprises certified insurance professionals with extensive industry experience, bringing a blend of technical knowledge and practical insights to each client interaction.

4. Pandemic-Responsive Coverage: Adapting to Emerging Healthcare Challenges

COVID-19: A Transformative Healthcare Moment

The global pandemic has fundamentally reshaped perceptions about health insurance, elevating it from a optional benefit to an essential protection mechanism.

Innovative Coronavirus Coverage

PlanCover’s approach to pandemic-related insurance demonstrates remarkable adaptability:

- Specialized COVID-19 insurance plans that provide comprehensive coverage for pandemic-related medical expenses, including testing, treatment, and potential complications. These plans are continuously updated to reflect the evolving understanding of the virus.

- Educational initiatives that increase awareness about health insurance benefits, helping businesses and employees understand the critical importance of comprehensive coverage in uncertain times.

- Flexible policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More structures that can be quickly modified to address emerging health challenges, ensuring businesses remain protected against evolving medical risks.

Proactive Risk Management

By offering pandemic-responsive insurance solutions, PlanCover helps small businesses manage potential financial risks associated with widespread health emergencies.

5. End-to-End Solutions and Commitment to Excellence

Holistic Insurance Ecosystem

PlanCover transcends the traditional role of an insurance broker, positioning itself as a strategic partner in employee health management.

Comprehensive Service Model

The end-to-end solution encompasses:

- A seamless insurance purchase process that guides businesses through complex policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More selection with transparency and expertise.

- Continuous policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More management that includes regular reviews, renewal support, and adaptive coverage recommendations based on changing business and workforce needs.

- Robust claim support system that ensures quick, hassle-free claim processing, reducing stress for both employers and employees during medical emergencies.

Satisfaction Guarantee

The 100% satisfaction guarantee is not a marketing slogan but a fundamental operational philosophy. Each interaction is designed to exceed client expectations through personalized, results-oriented service.

Conclusion: Transforming Employee Health Protection

PlanCover represents a paradigm shift in how small businesses approach group health insurance. By combining technological innovation, expert guidance, comprehensive coverage, and unwavering commitment to client success, they offer more than an insurance policy—they provide a strategic health management solution.

For small businesses navigating complex healthcare landscapes, PlanCover emerges as a trusted partner dedicated to protecting their most valuable asset: their employees.

Secure your business’s future by investing in comprehensive, intelligent employee health protection.