In today’s competitive business landscape, providing comprehensive group health insurance has become more than just a benefit – it’s a necessity for attracting and retaining top talent. However, with healthcare costs continuously rising, businesses, especially small and medium enterprises, face the challenge of maintaining quality coverage while managing their bottom line. This comprehensive guide explores proven strategies to optimize your group health insurance costs without compromising the quality of coverage, drawing from the expertise of industry leaders like PlanCover, India’s premier insurance marketplace.

Table of Contents

The Current Healthcare Insurance Landscape

The healthcare insurance sector in India has undergone significant transformations, particularly in the wake of recent global health challenges. With medical inflation consistently outpacing general inflation, businesses must adopt strategic approaches to manage their insurance costs effectively. This becomes even more crucial considering that group health insurance often represents one of the largest expenses in a company’s benefits package.

The True Cost of Group Health Insurance

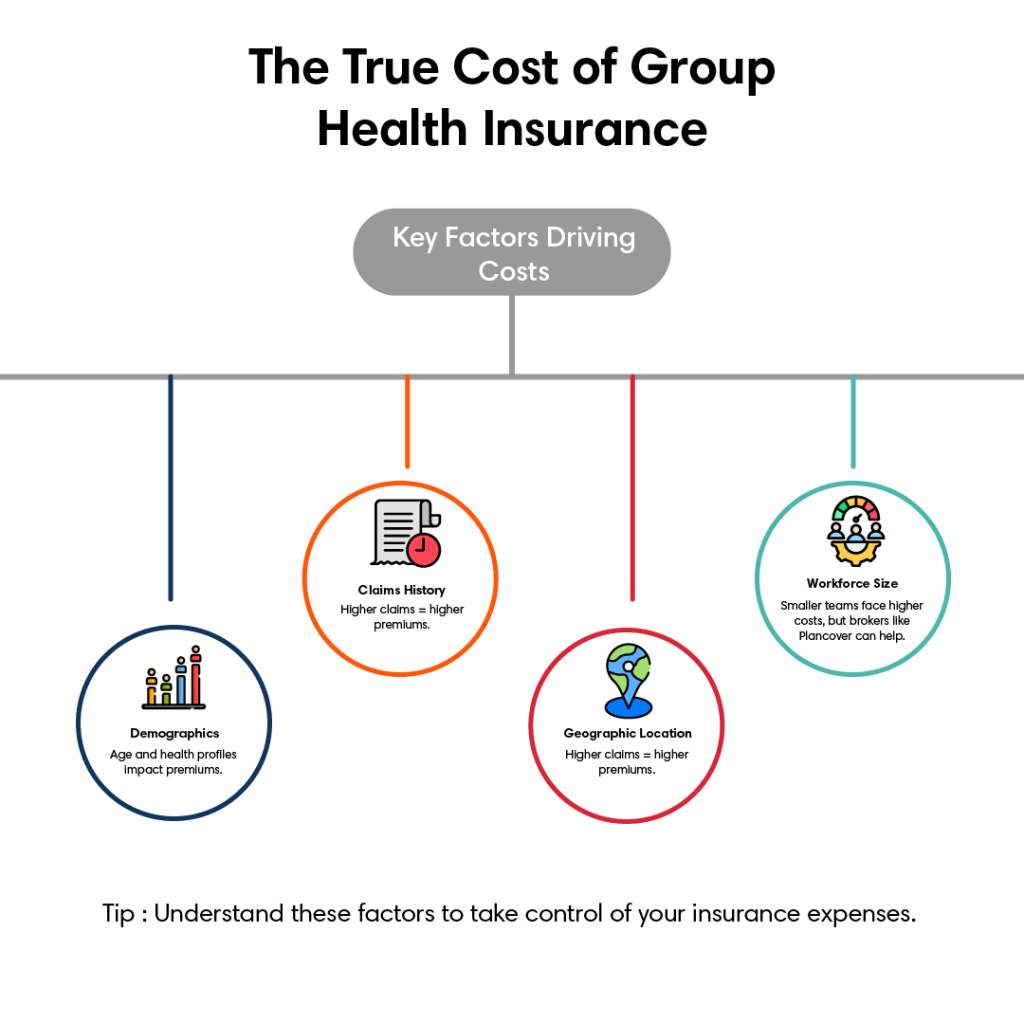

Before diving into cost-saving strategies, it’s essential to understand what drives the cost of group health insurance:

- Demographics play a crucial role in determining insurance premiums, as the age distribution and health profiles of your workforce directly impact the risk assessment performed by insurance providers.

- Your company’s claims history significantly influences future premium rates, making it essential to implement strategies that encourage responsible healthcare utilization while ensuring adequate coverage.

- Geographic location affects insurance costs due to variations in healthcare prices and availability across different regions, which insurance providers factor into their pricing models.

- The size of your workforce impacts your negotiating power with insurance providers, though working with experienced brokers like PlanCover can help level the playing field for smaller organizations.

Strategic Approaches to Cost Optimization

1. Leveraging Professional Insurance Broker Expertise

Working with an experienced insurance broker like PlanCover offers multiple advantages in cost optimization:

- Professional brokers maintain strong relationships with multiple insurance providers, which enables them to negotiate better rates and terms than companies might secure on their own, particularly given PlanCover’s track record of managing over 300,000 claims successfully.

- Insurance experts can conduct thorough market analyses to identify the most cost-effective plans that meet your specific needs, leveraging their comprehensive understanding of available options and industry trends.

- Experienced brokers provide valuable insights into plan design optimization, helping you structure benefits in ways that maximize value while minimizing unnecessary expenses.

2. Implementing Comprehensive Wellness Programs

A well-designed wellness program can significantly impact healthcare costs:

- Organizations that implement comprehensive wellness initiatives often see reduced claims frequency and severity, as preventive care and healthy lifestyle choices help minimize serious health issues among employees.

- Employee wellness programs that focus on preventive care and early intervention can help identify health issues before they become more serious and expensive to treat, resulting in long-term cost savings for both the employer and employees.

- Mental health support programs have become increasingly important and can help reduce overall healthcare costs by addressing issues before they lead to more serious physical health problems or extended absences.

3. Optimizing Plan Design for Cost Efficiency

Strategic plan design can significantly impact costs while maintaining quality coverage:

- Implementing a tiered network structure encourages employees to use more cost-effective healthcare providers while still maintaining access to a broad network of medical professionals.

- Adding telemedicine options can reduce unnecessary emergency room visits and provide convenient, cost-effective care for minor health issues, which has become increasingly important in today’s digital age.

- Structuring prescription drug benefits to encourage generic medication use when appropriate can lead to substantial savings without compromising medical effectiveness.

Advanced Cost-Saving Strategies

1. Data-Driven Decision Making

Utilizing data analytics can reveal opportunities for cost optimization:

- Regular analysis of claims data helps identify patterns and trends that can inform plan adjustments and reveal areas where additional cost controls might be beneficial without impacting quality of care.

- Monitoring utilization patterns allows organizations to adjust their coverage options based on actual employee needs rather than assumptions, ensuring resources are allocated effectively.

- Tracking wellness program participation and outcomes helps quantify the return on investment and identify the most effective initiatives for your specific workforce.

2. Technology Integration for Enhanced Efficiency

Modern insurance technology solutions offer multiple pathways to cost reduction:

- Digital platforms for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration and claims processing can significantly reduce administrative overhead while improving the employee experience with faster, more efficient service delivery.

- Online portals that provide employees with easy access to their benefits information and claims status can reduce the burden on HR staff while empowering employees to make more informed healthcare decisions.

- Mobile applications that facilitate easy access to telemedicine services and health resources can help reduce unnecessary medical visits while ensuring employees get the care they need.

3. Employee Education and Engagement

Informed employees make better healthcare consumers:

- Comprehensive education programs about benefits utilization help employees make more cost-effective healthcare decisions while still receiving appropriate care for their needs.

- Regular communication about available resources and best practices for healthcare utilization can lead to more responsible use of benefits and reduced overall costs.

- Engagement initiatives that encourage preventive care and early intervention can help reduce the incidence of more serious and costly health issues.

Specialized Solutions for Small Businesses

Small businesses face unique challenges in providing competitive health benefits:

1. Alternative Funding Arrangements

- Level-funded plans can offer the benefits of self-funding with less risk, potentially resulting in significant savings for companies with healthy employee populations.

- Professional Employer Organization (PEO) arrangements can help small businesses access better rates through group purchasing power while maintaining control over their benefits strategy.

- Association health plans, when available, can provide small businesses with access to better rates and more comprehensive coverage options through collective bargaining power.

2. Tax-Advantaged Options

- Understanding and maximizing available tax credits and deductions can help offset the cost of providing health insurance while ensuring compliance with regulatory requirements.

- Implementing Section 125 cafeteria plans allows employees to pay their portion of premiums with pre-tax dollars, effectively reducing costs for both the employer and employees.

- Health Savings Account (HSA) programs can help reduce premium costs while providing employees with tax advantages and greater control over their healthcare spending.

Maintaining Quality While Controlling Costs

1. Quality Metrics and Monitoring

- Regular assessment of provider networks ensures employees have access to high-quality healthcare providers who deliver cost-effective care.

- Monitoring patient satisfaction and outcomes helps identify areas where coverage might need adjustment to maintain quality standards.

- Tracking key performance indicators related to both cost and quality helps maintain the right balance between expense control and care delivery.

2. Strategic Vendor Relationships

- Building strong relationships with insurance providers through brokers like PlanCover can lead to better service levels and more favorable terms during contract negotiations.

- Regular vendor performance reviews help ensure service quality remains high and costs remain competitive over time.

- Exploring partnerships with local healthcare providers can sometimes lead to preferential pricing arrangements without compromising care quality.

Looking to the Future: Emerging Trends and Opportunities

1. Digital Health Integration

- The continued evolution of telemedicine and virtual care options presents new opportunities for cost-effective healthcare delivery while maintaining or improving access to care.

- Artificial intelligence and machine learning applications in healthcare management can help predict and prevent health issues before they become more serious and expensive to treat.

- Digital health platforms that integrate with existing benefits systems can provide more personalized healthcare experiences while helping control costs.

2. Personalized Benefits Approaches

- Data-driven personalization of benefits packages can help ensure resources are allocated where they’ll have the most impact for your specific workforce.

- Flexible spending arrangements that allow employees to choose the benefits most important to them can help optimize benefit spending while maintaining employee satisfaction.

- Innovation in plan design continues to create new opportunities for cost control while maintaining or improving coverage quality.

The Role of Professional Insurance Partners

Working with experienced insurance brokers like PlanCover provides several distinct advantages:

1. Comprehensive Support Services

- PlanCover’s 24/7 call center support ensures that employees have access to assistance whenever they need it, reducing the burden on internal HR resources while improving the employee experience.

- Dedicated claims servicing helps ensure that claims are processed efficiently and effectively, minimizing delays and maximizing the value of your insurance investment.

- Regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reviews and optimization recommendations help ensure your coverage remains both cost-effective and comprehensive over time.

2. Technology-Enabled Solutions

- PlanCover’s digital platforms streamline policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More administration and claims processing, reducing overhead costs while improving service delivery.

- Online portals provide easy access to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More information and support resources, empowering employees while reducing administrative burden.

- Data analytics capabilities help identify opportunities for cost optimization while maintaining coverage quality.

Conclusion

Successfully managing group health insurance costs while maintaining quality coverage requires a multi-faceted approach combining strategic planning, professional expertise, and ongoing optimization. By working with experienced partners like PlanCover, businesses can access the resources and expertise needed to implement effective cost-control strategies while ensuring their employees receive the coverage they need.

The key to success lies in finding the right balance between cost control and coverage quality, and this balance will be different for every organization. However, by following the strategies outlined in this guide and working with experienced insurance partners, businesses can develop and maintain health insurance programs that meet both their budgetary constraints and their employees’ needs.

For more information about optimizing your group health insurance program while maintaining quality coverage, contact PlanCover’s expert team at +91 9711059159 or email assist@plancover.com. With their comprehensive support services and proven track record of managing over 300,000 claims, PlanCover can help you navigate the complex world of group health insurance while ensuring the best value for your investment.

Remember that investing in employee health through quality insurance coverage, while managing costs effectively, is not just about meeting immediate needs – it’s about building a sustainable foundation for your organization’s long-term success and your employees’ well-being.