The King Has No Clothes!

Why is your regular health insurance not enough?

In the fable, the King thought he had an elaborate and magnificent attire and no one had the courage to tell him he was naked. See if you feel vulnerable and unclothed after reading this piece.

This article brings out the hidden risk of having the traditional health insurance cover hoping that your savings will be protected in times of Corona. More than ever before, the evolving situation is throwing up challenges that you never expected. Read further to learn more about the surprises

The details below will show that Covid hospitalizations are resulting in lacs of rupees unpaid in the hospital bills, despite policyholders having ample sum insured. There are reasons for this which are explained and finally what are your options to cover for that risk.

The rate at which Covid-19 is rising, one expects that most of you reading this may come close to getting infected by the time the disease gets over. Worse of all, CDC in the US has now confirmed that the spread of the coronavirus is evidenced as airborne.

Many of us have a regular health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. At the time of making a health insurance claim, there are 4 areas where you will end up paying out of pocket –

- PPE kits – Personal Protective Equipment (PPE) kits and other consumables not getting covered under a health insurance claim – Almost 75% of the bill remains unpaid in some cases!

- The Government (General Insurance Council) restricts payment to the hospitals – GI Council says 10,000 INR per day to be paid, hospitals charge upto 50,000 INR. You end up bearing the difference.

- Your own policies terms and conditions – especially room rent restrictions if any – Double whammy

- Pre & post hospitalisation – the longer the better – complications are sometimes long term.

Although Coronavirus infection is covered under most of the regular health insurance policies, it may not be enough to cover the cost of Covid-19 treatment at a private hospital. People living in metros are spending, on an average, more than half of the amount of the treatment costs out of their own pockets.

A claim may not be settled fully in the following scenarios:

1. There is a capping on the room rent / ICU in the Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More:

For example, you have a standard health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More of Rs 10 lacs with 2% capping on Room rent and 5% on ICU, and a co-payment of 10% on the total claim amount. The hospitalisation bill comes for Rs 5 lacs – Rs 3 lacs room rent and medical expenses and Rs 2 lacs – Consumables and non medical items. The latter share will not be covered under your regular insurance. And out of the Rs 3 lacs Medical expenses, some more amount will be deducted towards the capping and co-payment. These factors would have a bearing on all associated medical costs. These cappings would result in the insured shelling out a lot of money off their pockets!

*Capping refers to the limit up to which the insurance will settle a claim.

2. Overhead Consumables – may not be covered under a regular health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

Overhead consumables such as PPE kits, gloves and other disposables. Rising cost of disposables and consumables has resulted in an exorbitant rise in the treatment costs in private hospitals.

PPE kits consist of 7 components i.e Goggles, FaceShield, Mask, Gloves, Coverall / Gowns (With or Without Aprons), Head Cover & Shoe Cover. Each component & its rationale use has been defined by Ministry of Health & Family Welfare

Usually the portion of consumables in a surgical case is almost 10% of the total bill value. When it comes to Covid-19 related hospitalisations, they constitute a much larger portion as much as 50% of the total bill amount! This is because the hospitals (small or large) have to invest heavily in keeping the infection in control. In addition, they have invested in logistical changes like increasing the health insurance cover for the doctors & nurses, spending more on disposable one-time use items, PPE kits, Overall cleanliness and dis-infection, more number of medical machines and equipment etc. Proportionally, with a rise in the operating costs, the treatment costs have gone up. And hospitals are levying higher charges on patients due to the increased operating costs.

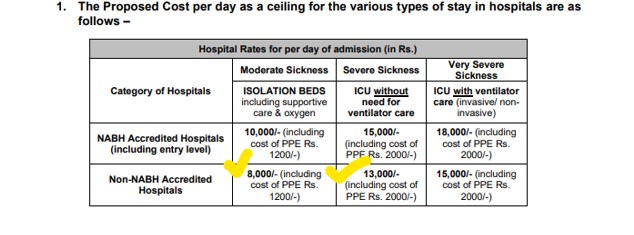

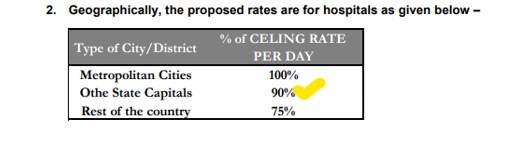

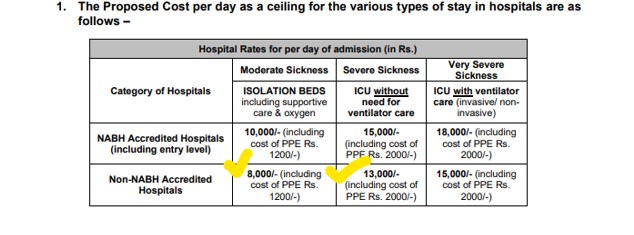

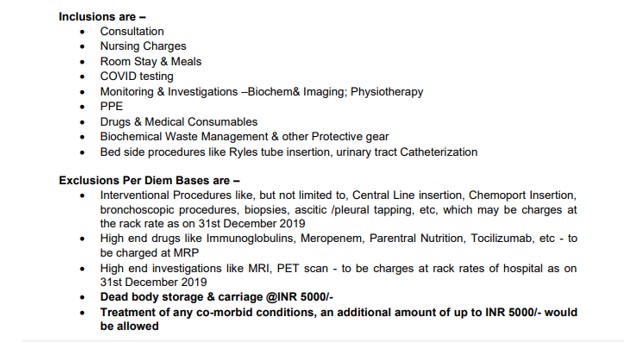

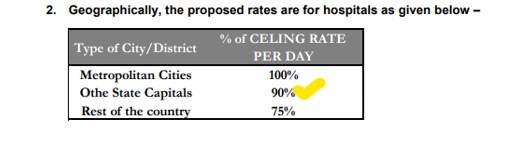

3. Ceiling on Covid-19 treatment rates by various State Governments and GI Council

In order to maintain a rational costing, GI Council issued a standard zone-wise rate chart to be followed by the hospitals and all the insurance companies. Most of the prominent private hospitals are not agreeing to the guidelines and charging as per their own tariffs. This is where comes the major dispute between insurers and hospitals over the expenses payable! Ultimately, the patient suffers the loss.

There is a huge difference between how much an insurance company is willing to pay and what insureds are actually paying out of pocket!

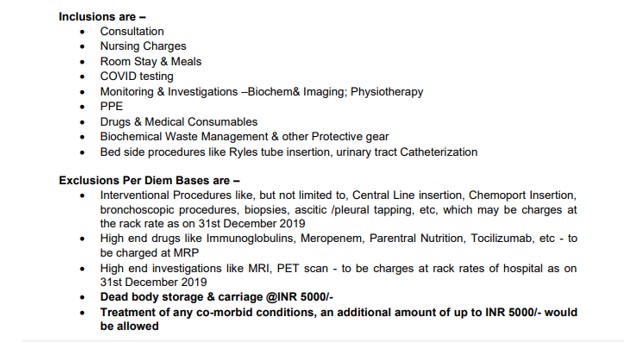

Read here on the guidelines issued by Oriental Insurance Company on charges that will be paid under health insurance.

The insurers are paying as per ‘Government Prescribed Package Rates’ or as per negotiated rates, whichever are lower.

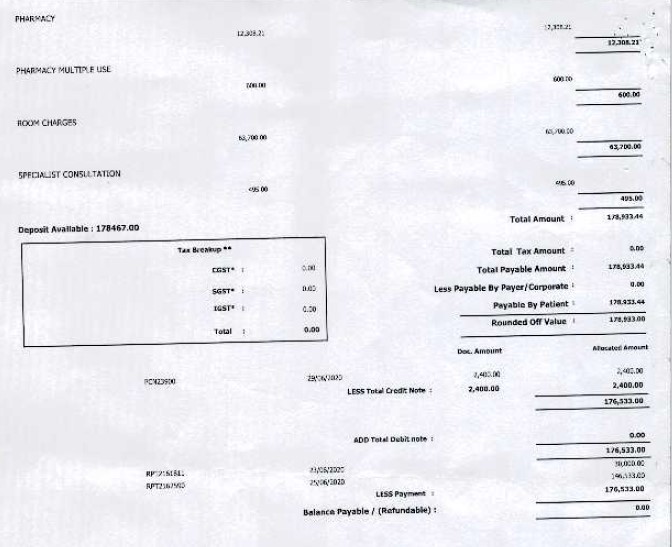

Some of the ceilings that have been provided are as follows.

Illustrations:

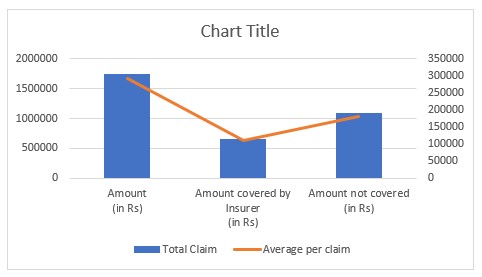

For the purpose of a study, we took a sample of 6 different Covid -19 bills.

| Sample Size | Claim Amount

(in Rs) |

Amount covered by Insurer

(in Rs) |

Amount not covered

(in Rs) |

|

| Total Claim | 6 Claims | 1754085 | 664952 | 1089133 |

| Average per claim | 292348 | 110825 | 181522 |

Table of Contents

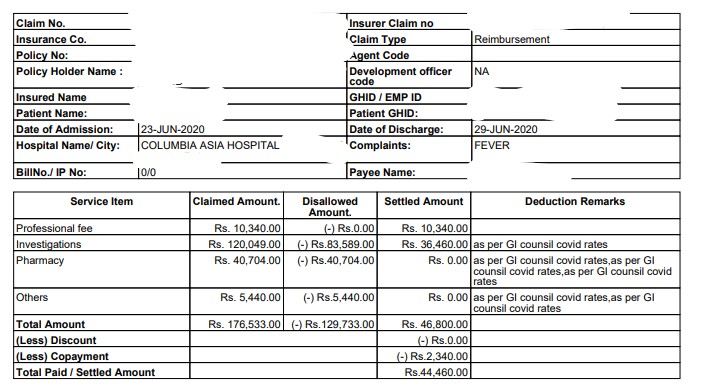

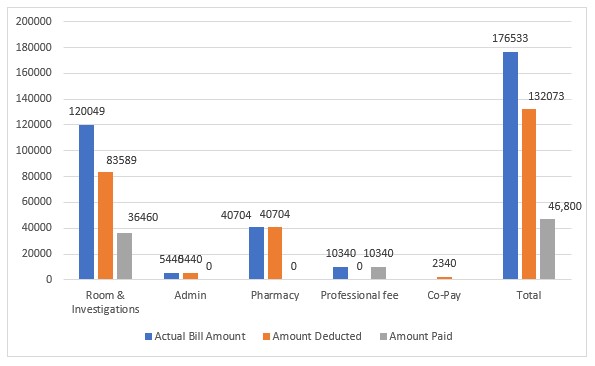

Case I

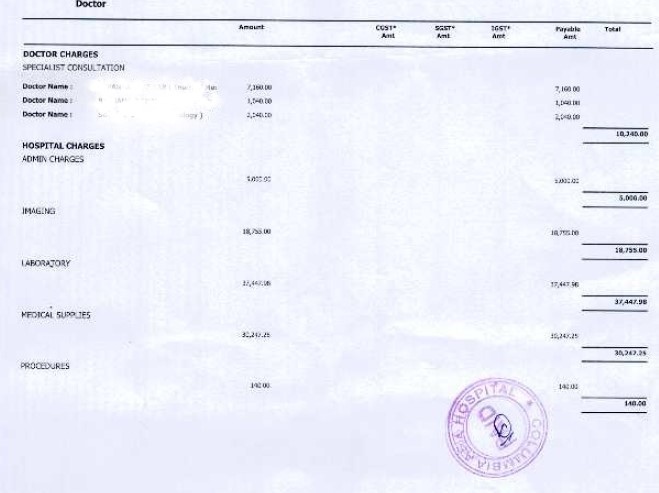

Here is a case of Mrs. Aparna (name changed), 29 years old was hospitalized for Covid-19 for 7 days in Columbia Asia Hospital in a metro city.

The total claim amount was Rs 1,76,533. The amount approved by the insurer was Rs 44,460 to be paid. Total deductions made under the claim was Rs 1,32,073, which is 75% of the claimed amount!

Copy of the bill –

Screenshot of GI Council guidelines:

Screenshot of the inclusions and exclusionsExclusions in insurance refer to specific conditions, treatments, or circumstances that are not covered under a policy. These exclusions define More under per day Hospital rates as per GI Counsil guidelines:

Bill Assessment

Claim Settlement Note:

| Header | Actual Bill Amount (in Rs) | Amount Deducted** (in Rs) | Amount Paid (in Rs) |

| Room & Investigations | 120049 | 83589 | 36460 |

| Admin | 5440 | 5440 | 0 |

| Pharmacy | 40704 | 40704 | 0 |

| Professional fee | 10340 | 0 | 10340 |

| Co-Pay | 2340 | ||

| Total | 176533 | 132073 | 46800 |

| Less 5% Co-pay | 44460 | ||

**The deductions are as per GI Council Covid Rates Guidelines / An assessment by the TPA

As per GI Council guidelines,

Rs 7800 Package per day (This includes room rent, consultation, Nursing Charges, Covid Test, Investigation, drugs, PPE kit and other protective gears, bedside procedures) – For a Non NABH Hospital in a metro city.

Rs 7800 X 6 days = Rs 46800

Amount settled – Rs 46800

5% Co-payment (for self) – Less Rs 2340

Final Amount paid = Rs 46800 – Rs 2340 = Rs 44,460 (25% of the total claimed amount!)

What if Mrs. Aparna had a Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More along with her Standard Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

Let us assume that Mrs Aparna had Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from Oriental Insurance Company Limited.

The premium for Rs 3 Lacs Sum Insured, 9.5 months tenure for a 29 year old person is Rs 1100 (with GST). This policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More would have covered all the charges under the heads – Room & investigations, Pharmacy, Professional fees and most of the charges under Admin (PPE Kit & other protective gear, Oximeter, disposables etc). And absolutely no co-payment is applicable!

Deductions (Admin charges)

Hospital Registration – Rs 250

Medical Records – Rs 500

Food and Beverages – Rs 175

Linen & Laundry Charges – Rs 600

Total = Rs 1525

Total Amount Payable by Insurer = Rs 176533 – Rs 1525

= Rs 175008 (99% of the claimed bill amount!)

Regular Health Insurance v/s Carona Kavach Policy – 25 % v/s 99 %

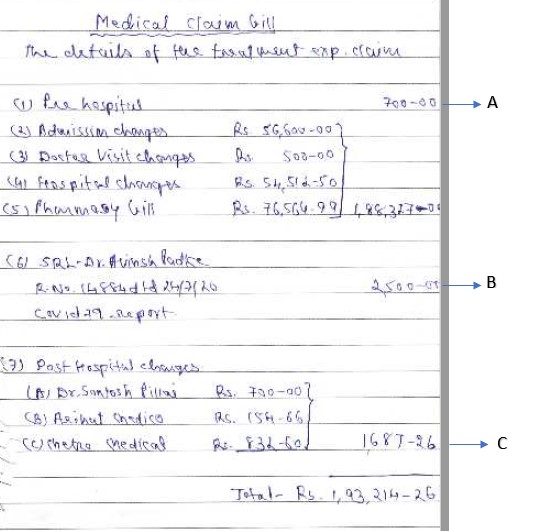

Case II

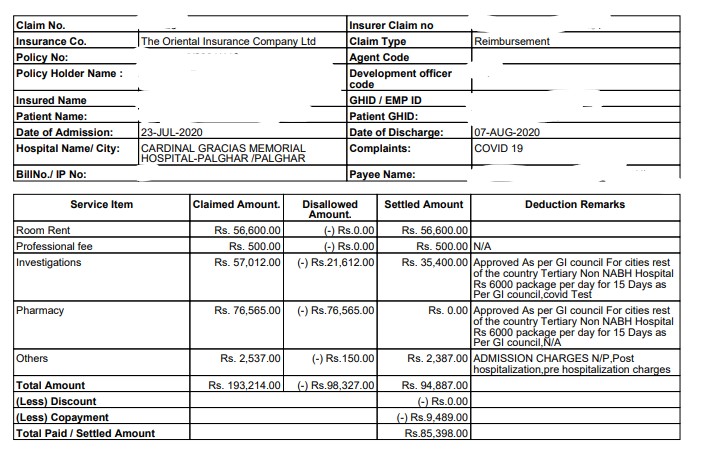

This is a Covid claim raised in Palghar, Maharashtra. Mr. Sudesh, 73 years, was admitted for 15 days in a tertiary-care Non-NABH accredited hospital because of Covid – 19 Pneumonia. He was pre-diabetic. The total bill amount came out to be Rs 193214 and the amount settled by the insurer was Rs 85398. The amount borne by the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More was Rs 107816 which is 56% of the total bill amount.

Summary of total hospital bill:

This is a handwritten summary of all the bills, in absence of a single consolidated bill from the hospital.

Bill Assessment

Bill Assessment

Claim settlement note:

As per GI Council guidelines,

Rs 6000 Package per day (This includes room rent, consultation, Nursing Charges, Covid Test, Investigation, drugs, PPE kit and other protective gears, bedside procedures) – For a Non-NABH Hospital in ‘Rest of India’

Rs 6000 X 15 days = Rs 90000 + A + B + C = Rs 94887.00

(A+B+C – Pre / Post hospitalisation and Covid Test)

10% Co-payment (for parent) – Less Rs 9489

Final Amount paid = Rs 94887 – Rs 9489 = Rs 85398 (44% of the total claimed amount!)

What if Mr. Sudesh had a Corona Kavach / Rakshak PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More along with his Standard Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

Mr Sudesh is 73 years old. A Corona Kavach / Rakshak policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can not be offered to anyone beyond the age of 65 years.

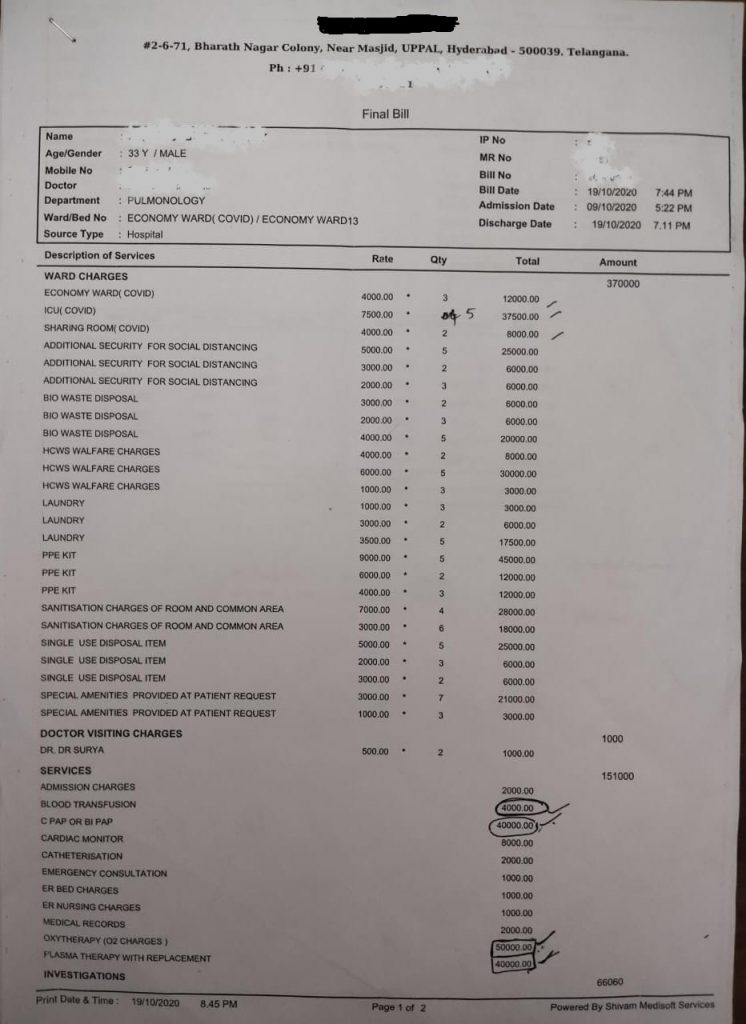

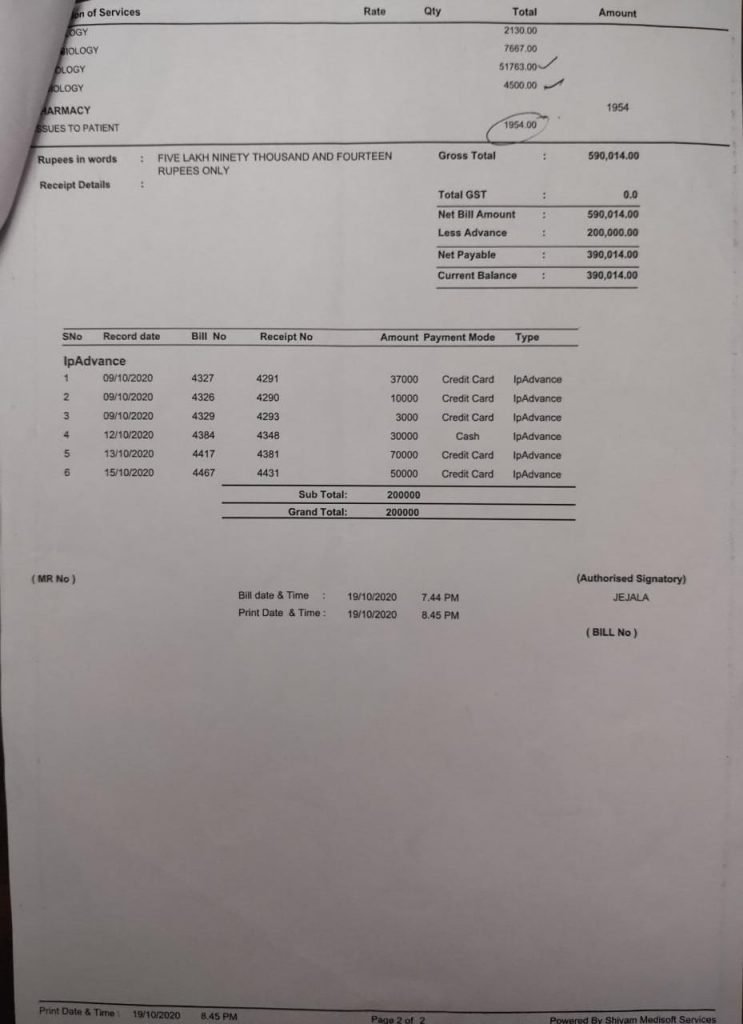

Case III

Mr. Subhash, 33 years old was admitted for 10 days in a super-specialty hospital in Hyderabad for health complications due to Coronavirus Infection. He incurred a bill of Rs 813571 at the time of discharge. He is covered under a group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More (Group Medical PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More) offer by his employer for Sum Insured of Rs 500000.

Copy of the bill –

Complete Bill Break-Up

| HOSPITAL BILLS | |||||

| Bill Head | Days | Amount (in Rs) | Amount Break-Up / Detail | Department | |

| Economy Ward – 9th Oct 11th Oct | 3 | 12000 | Rs 4000*3 days | Ward Charges | |

| ICU Ward – 12th oct to 16th Oct | 5 | 37500 | Rs 7500*5 days | ||

| Sharing Covid Ward – 17th Oct to 19th oct – | 2 | 8000 | Rs 4000*2 days | ||

| Room Sanitisation Charges | 10 | 46000 | (Rs 3000*6 days) + (Rs 7000*4 days) | ||

| PPE Kit | 10 | 69000 | (Rs 4000 * 3 days)+ (Rs 9000 * 5 days) + (Rs 6000 * 2 days) | ||

| Additional Security | 10 | 37000 | (Rs 2000 * 3 days) + (Rs 5000 * 5 days) + (Rs 3000 * 2 days) | ||

| BIO Waste Disposal | 10 | 32000 | (Rs 2000 * 3 days) + (Rs 4000 * 5 days) + (Rs 3000 * 2 days) | ||

| HCW Welfare Charges | 10 | 41000 | (Rs 1000 * 3 days) + (Rs 6000 * 5 days) + (Rs 4000 * 2 days) | ||

| Laundry | 10 | 26500 | (Rs 1000 * 3 days) + (Rs 3500 * 5 days) + (Rs 3000 * 2 days) | ||

| Single Use Disposable items | 10 | 37000 | (Rs 2000 * 3 days + (Rs 5000 * 5 days) + (Rs 3000 * 2 days) | ||

| Special Amenities as per patient request | 10 | 24000 | (Rs 3000 * 7 days) + (Rs 1000 * 3 days) | ||

| Oxytherapy | 50000 | Rs 5000 * 10 days | Services | ||

| Plasma Therapy | 1 | 40000 | |||

| C PAP | 4 | 40000 | Rs 10000 * 4 days | ||

| Blood Transfusion | 2 | 4000 | Rs 2000 * 2 days | ||

| Admission Charges | 1 | 2000 | |||

| Cardiac Monitor | 8 | 8000 | Rs 1000 * 8 days | ||

| Catheterisation | 1 | 2000 | |||

| Emergency consultation | 1 | 1000 | |||

| ER Bed Charges | 1 | 1000 | |||

| ER Nursing Charges | 1 | 1000 | |||

| Medical Records | 1 | 2000 | |||

| Investigation Cardiology | 1 | 2130 | ECG and ECHO | Investigation | |

| Investigation Microbiology | 1 | 7667 | D Dimer Test*2, Hbsag, Hcv HIV, Troponine, | ||

| Investigation Pathology | 1 | 51763 | Blood Test | ||

| Radiology | 1 | 4500 | CT Scan | ||

| Issued to Patient | 1 | 1954 | Some items issued to patient like Water Bottle *3 + 2 medicine | Others | |

| Dr. Visit Charges | 2 | 1000 | 2 times | ||

| Hospital Total Final Bill | 590014 | ||||

| Other Bill (Outside Hospital) | |||||

| Meditech Sleep Solution Medicine Shop | 19th oct to 18th Nov | 8500 | Oxygen Glucometer | Outside Medical bills | |

| M/S TX Pharmacy Bill No-208638 | 44123 | 377 | Medicine Post Discharge | ||

| M/S TX Pharmacy Bill No-208478 | 44120 | 15004 | During admission | ||

| M/S TX Pharmacy Bill No-208219 | 44114 | 21478 | During admission | ||

| M/S TX Pharmacy Bill No-208194 | 44113 | 18568 | During admission | ||

| M/S TX Pharmacy Bill No-208271 | 44115 | 23162 | During admission | ||

| M/S TX Pharmacy Bill No-208319 | 44116 | 6409 | During admission | ||

| M/S TX Pharmacy Bill No-208315 | 44116 | 919 | During admission | ||

| M/S TX Pharmacy Bill No-208226 | 44114 | 3139 | During admission | ||

| M/S TX Pharmacy Bill No-208310 | 44116 | 19394 | During admission | ||

| M/S TX Pharmacy Bill No-208285 | 44115 | 713 | During admission | ||

| M/S TX Pharmacy Bill No-208571 | 44121 | 3998 | During admission | ||

| M/S TX Pharmacy Bill No-208187 | 44113 | 7058 | During admission | ||

| M/S TX Pharmacy Bill No-208537 | 44121 | 4379 | During admission | ||

| M/S TX Pharmacy Bill No-208559 | 44121 | 571 | During admission | ||

| M/S TX Pharmacy Bill No-208487 | 44119 | 877 | During admission | ||

| M/S TX Pharmacy Bill No-208593 | 44122 | 18498 | During admission | ||

| M/S TX Pharmacy Bill No-208536 | 44121 | 11003 | During admission | ||

| M/S TX Pharmacy Bill No-208368 | 44117 | 20505 | During admission | ||

| M/S TX Pharmacy Bill No-208444 | 44122 | 16051 | During admission | ||

| M/S TX Pharmacy Bill No-208586 | 44123 | 2204 | During admission | ||

| Srikara Hospital blood bank | 44118 | 15000 | During admission | ||

| Yashoda Hospital ORE158240/20 | 44110 | 8750 | CT Scan (Pre Hospitalisation) | ||

| Covid Plasma Therapy Not Found | 15000 | ||||

| Total | Rs 831571 | ||||

The Total Hospital bill – Rs 590014

Total pharmacy bills + Other bills (Outside the Hospital) – Rs 226557

The final claim amount is worked out to be Rs 813571

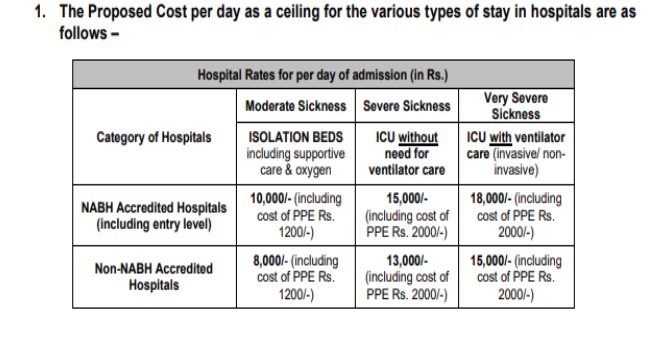

Screenshot of GI Council guidelines:

Bill Assessment

As per GI Council guidelines (Rest of India),

Rs 7200 Package per day for Ward and Rs 11700 per day for ICU

So, the total amount covered under insurance is Rs 242506 (Room & ICU packages, High-end Drugs & Investigations, CT Scan etc)

Less 5% of Co-pay: Rs 242506 – Rs 12125 = Rs 230381, which is just 28% of a total bill! And the rest is paid by the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More.

What if Mr. Subhash had a Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More along with his Standard Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

Let us assume that Mr Subhash had Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from Oriental Insurance Company Limited.

The premium for Rs 5 Lacs Sum Insured, 9.5 months tenure for a 33 year old person is Rs 1517 (with GST). This policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More would cover all the charges under the heads – Room & investigations, Pharmacy, Professional fees, pre-hospitalisation & post hospitalisation bill expenses and most of the charges under Admin (PPE Kit & other protective gear, Oximeter, disposables etc) upto a maximum limit of Rs 500000.

Total Covered amount = Rs 500000 ——–> A

Deductions

Total Bill amount = Rs 831571

Total deducted amount = Rs 331571 (this includes all the non-medical expenses that can not be covered under the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, like Admission, Medical Records, Food and Beverages etc along with a few other expenses) – 27% of the total claimed amount.

Regular Health Insurance v/s Carona Kavach Policy – 28 % v/s 60 %

Furthermore, the total deducted amount of Rs 331571 under the Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be claimed through the regular health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More (Group Mediclaim PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More). Except the expenses for non medical items and a 5% co-payment on the amount payable, rest all charges would get covered by the insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More (as per the terms and conditions of the existing health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More).

Total non-medical items – Rs 110454 (Like Additional Security, Admission, Medical Records, HCW Welfare Charges, Laundry, Water bottle etc).

Less 5% Co-Payment (under existing policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More) = Rs 11055

Payable Amount – Rs 210061 ———> B

Final Amount Paid = A + B = Rs 500000 + Rs 210061 = Rs 710061

This entire exercise shows that the total covered amount under both the insurance policies (Regular Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and a Standard Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More) rises up to 85% of the total claimed amount!

As per the guidelines issued by the General Insurance Council (GIC), the following is the reference rate chart for Covid – 19 treatment with respect to rates published by various state governments.

| HOSPITAL RATES FOR PER DAY OF ADMISSION | |||||||

| No | State / City | Normal Ward | ICU (without Ventilator) | ICU (with Ventilator) | |||

| NABH | Non-NABH | NABH | Non-NABH | NABH | Non-NABH | ||

| 1 | Delhi | 10000 | 8000 | 15000 | 13000 | 18000 | 15000 |

| 2 | Uttar Pradesh | 10000 | 8000 | 15000 | 13000 | 18000 | 15000 |

| 3 | Gujarat | 9000 | 18050 | 21850 | |||

| 4 | Telangana# | 4000 | 7500 | 9000 | |||

| 5 | Rajasthan | 5500 | 5000 | 8250 | 7500 | 9900 | 9000 |

| 6 | Maharashtra# | 4000 | 7500 | 9000 | |||

| 7 | Vadodara## | 6000 | 12000 | 8500 | 21500 | 18000 | |

| 8 | Jharkhand | 8000 | 7500 | 10000 | 9000 | 12000 | 11500 |

| 9 | Punjab | 10000 | 15000 | 18000 | |||

| 10 | Haryana | 10000 | 8000 | 15000 | 13000 | 18000 | 15000 |

| 11 | Ahmedabad | 10000 / 14000 | 19000 | 23000 | |||

| 12 | Karnataka### | 10000 / 12000 | 15000 | 25000 | |||

Source: Guidelines issued by various State Governments toward standard charges (packages) for Coronavirus treatment. The above rates are on a per-diem basis. The per day package rates include doctor’s consultation, nursing charges, room stay, meals, Covid testing, investigation expenses, PPE and other necessary consumable items, biochemical waste management, bedside procedures etc. It doesn’t include some high-end drugs and investigations, and some interventional procedures (like bronchoscopic procedures, biopsies etc).

# Does not include PPE Kits, Covid tests, High end investigations including Imaging viz CT, MRI – all to be billed as per MRP or Hospital rack rates. Covid – 19 test to be billed as per the agreed rates.

## Doesn’t include Dialysis – RS 1500 per dialysis, cost of inj. Tocilizumad, high end antibiotics for secondary infection

### Rates as per Covid – 19 Patients privately admitted by Hospitals (Cash payment – non-insurance)

Role of Covid-specific Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

This is exactly where the IRDAI mandated Covid-specific health insurance products provide the much-needed support! The following are some points worth considering as to why we need to have a Coronavirus Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More in addition to the regular health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More:

- Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More covers the cost of essential consumables: It aptly, addresses the high cost of consumables that forms a significant part of a hospital bill

- The out of pocket payment due to the capping on the room rent / ICU in a regular policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is taken care of in this policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. A Corona Kavach policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More doesn’t impose a cap on the room charges or any other treatment cost.

- This policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More covers a ‘home care treatment’ or a ‘home-quarantine’ with a continuous active line of treatment for a specified number of days.

- It provides Coverage for Road ambulance, Ayush benefit upto the SI, Pre and Post hospitalisation.

- There is an option to go for an add on – Hospital Daily Cash with a very little extra price. This will ensure a payment of 0.5 % of the Sum Insured for every 24 hours of hospitalisation for a maximum of 15 days, by the insurer to the insured (benefit based). This could take care of the loss of pay due to hospitalisation.

- A Corona Rakshak PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More (Benefit Based) pays a lump sum amount on occurrence of the infection with specific conditions. A 100% of the Sum Insured is paid to the insured when he tests positive for covid – 19 and requires hospitalisation for a minimum of 72 hours.

Overview of some Covid – 19 Specific Policies:

Corona Kavach

It is an indemnity-based health insurance cover which is offered as an individual as well as a family floater policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Recently this product has been offered as a group cover by many insurance companies.

- Range of Sum Insured: ₹ 50000 to ₹ 500000 (In multiples of ₹ 50000)

- Corona Kavach policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be taken for self, spouse, dependent children, parents and parent-in-laws.

- The cover eligibility extends from day 1 of birth till 65 years of age.

- This policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More covers hospitalisation costs that include room / ICU rent, Doctors’ fee, anaesthesia, blood, oxygen charges, medicines, diagnostic costs etc. A minimum period of 24 consecutive hours of hospitalisation is required.

- A Corona Kavach policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More typically covers a pre-hospitalisation of 15 days prior to the hospitalisation or home care treatment and a post hospitalisation of 30 days after the discharge or completion of the home care treatment.

- Ayush treatment covered.

- Ambulance cover offered with a maximum limit of ₹ 2000 / hospitalisation

Some highlights of Corona Kavach Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More are:

- No room rent sub-limit

- No co-payment

- No zone-based pricing

- No pre-policy check-up required

- These will cover pre-existing illnesses (comorbidities) along with the treatment of Coronavirus (after an underwritingUnderwriting is the process through which an insurance company evaluates the risk of insuring an applicant and determines the terms, More assessment is done). Other health insurance policies usually cover some Pre-Existing Diseases after a WP of 2 to 4 years

- 15 days waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More

- Children covered from day 1 of their birth

- Home Care Expenses covered – Up to 14 days per incident. It is covered only in case there is a positive diagnosis of Covid from a Government authorised diagnostic centre. Most importantly, home care is advised by a Medical Practitioner along with an active line of treatment with monitoring of the health status every day. For the claim, a daily monitoring chart including records of treatment by the treating doctor is required.

- Coverage for essential consumable – PPE Kit, Gloves, Masks etc (these may not otherwise be covered under any other standard health insurance)

Hospital Daily Cash: Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More gives an option of an add on cover of Hospital Daily Cash (this optional cover is benefit based). As per the guidelines the insured person will get 0.5% of the sum insured per day for up to a maximum of 15 days during hospitalisation.

Many insurers offer a range of discounts under Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More:

- Discount for health care workers

- Family discount – Non floater

- Family Floater discount

- Female insured discount

- Loyalty discount

- Employee discount

Who should buy a Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

- People who do not have a Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for their family and themselves

- People who have a Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More of a lower Sum Insured or with a Room Rent sub-limit (Sub-limits result in a proportionate deduction whereas Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More doesn’t have a limit on room rent). Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be bought as a supplementary cover.

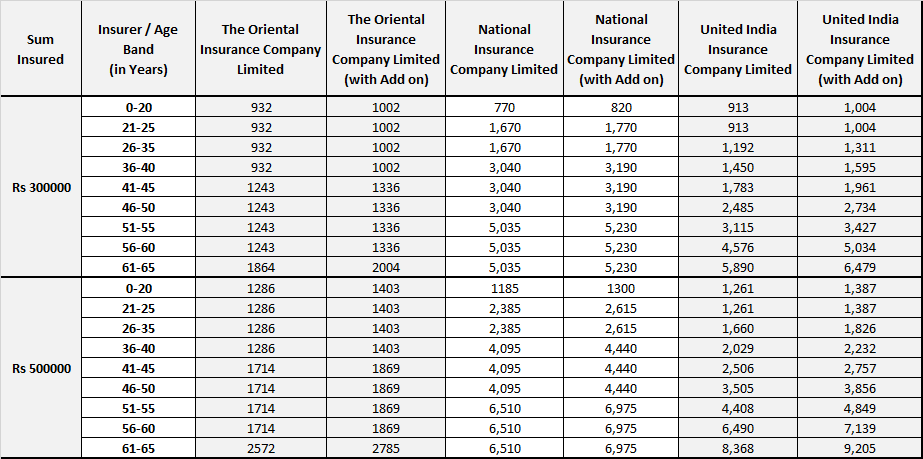

Premium Comparison – Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

Corona Rakshak

It is a benefit based Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More where Lump sum benefit equal to 100% of the Sum Insured would be payable on positive diagnosis of Covid-19. This is offered as an Individual policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More only.

- Range of Sum Insured: ₹ 50000 to ₹ 250000 (In multiples of ₹ 50000)

- Corona Rakshak policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be taken for self, spouse, dependent children, parents and parent-in-laws.

- The minimum requirement is a hospitalisation for a continuous period of 72 hours.

- The positive diagnosis of Covid-19 should be from a government authorized diagnostic centre.

- The cover eligibility starts from 18 years to 65 years of age.

- There is a 15 days waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More from the start of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, to avail the benefits.

- The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More will terminate when 100% of the Sum Insured is paid.

Who should buy a Corona Rakshak PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

People who already have a Health Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. But a hospitalisation may impact the financial position of the person. In such a case, Corona Rakshak PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More acts as a replacement of his/her income.

Premium Comparison

| Sum Insured | Insurer / Age Band (in Years) | The Oriental Insurance Company Limited | Cholamandalam MS General Insurance Company Limited | Star Health & Allied Insurance Company Limited |

| Rs 200000 | 18-40 | 1748 | 1728 | 4154 |

| 41-60 | 2331 | 1728 | 4154 | |

| 61-65 | 3497 | 1728 | 4154 | |

| Rs 250000 | 18-40 | 2186 | 2160 | 5192 |

| 41-60 | 2914 | 2160 | 5192 | |

| 61-65 | 4371 | 2160 | 5192 |

What is not covered in both Corona Kavach and Corona Rakshak Policies:

- Non – authorised diagnostic centres: A claim can be rejected if the Covid test is carried out in a non-authorised diagnostic centre. The test has to be carried out from a Government authorised diagnostic centre.

- Home quarantine cases without an active line of treatment for Corona Kavach PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Home quarantine is not covered under the Corona Rakshak Plan.

- Claim within waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More: There is a stipulated 15 days waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More within which no claim is entertained.

Frequently Asked Questions–

Yes. There is a waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More of 15 days from the commencement date of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. After this period only a claim can be made. Yes. Ayush treatment is covered (without a sub limit) upto the chosen Sum Insured. The Insurance companies will cover the cost of a treatment incurred by the insured person for availing treatment at home for up to 14 days per incident. This cover is only extended in case there is a positive diagnosis of Covid-19 from a Government authorised diagnostic centre. Most importantly, home care is advised by a Medical Practitioner along with an active line of treatment with monitoring of the health status every day. For the claim, a daily monitoring chart including records of treatment by the treating doctor is required. Under Corona Kavach Plan any comorbid condition (including pre-existing comorbidities) will be covered along with the treatment of Covid-19 up to the Sum Insured. Some of the insurance companies have given a list of pre-existing conditions or diseases that are not covered. Corona Kavach is an indemnity based short-term health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More specifically for Coronavirus treatment. It covers the cost of hospitalisation, pre-hospitalisation, post hospitalisation, treatment of co-morbidities and home care treatment. Corona Rakshak is a short term benefits based plan where a lump sum 100% payout is made to the insured person on a positive diagnosis of Covid-19 followed by a 72 hours continuous hospitalisation. We come to believe now that a Covid-19 specific health insurance plan can take care of the part of the claim which is not covered under your regular health insurance plan. While the hospitalisation and treatment charges would be covered under your regular plan, you may claim the rest of the bill amount under a Covid-19 health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Is there a waiting period for Corona Kavach?

Is Ayush treatment covered under the Corona Kavach Policy?

What is Home Care Treatment in Corona Kavach Policy?

Does Corona Kavach cover pre-existing diseases?

How is the Corona Kavach Plan different from the Corona Rakshak Plan?