After the lockdown in 2020, it has become compulsory for all the professional organizations in India to provide medical insurance to the employees. Whether it is a small-scale enterprise or a startup, the employer has to ensure the Mediclaim benefit to the employees. For those not having an idea about group health insurance, here is a brief introduction of the Mediclaim plan –

A group healthcare plan is a Mediclaim insurance bought by the employer of the organization or business owner for the employees working over there (and their dependent family members, if included). Individual health insurance and group health insurance or more or less similar with an elementary difference. In personal healthcare policies, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More pays the yearly renewal charges. In the case of group healthcare plans, the employer pays the premium to renew the insurance. The employees can enjoy the healthcare plan coverage based on the sum insured as long as they are a part of the organization. They need not pay a penny for availing of the insurance benefit unless there are added benefits to the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Why should you evaluate the cost?

As an employer purchasing the healthcare plan for your employees, you must have noticed the varied premium charges. There are two primary reasons why the premium rates differ at large. One – the insurance companies have diverse plan features and, thus, they charge you with higher or lower premium charges for annual renewal. The second reason is for the multiple factors that determine how much plan coverage you can enjoy.

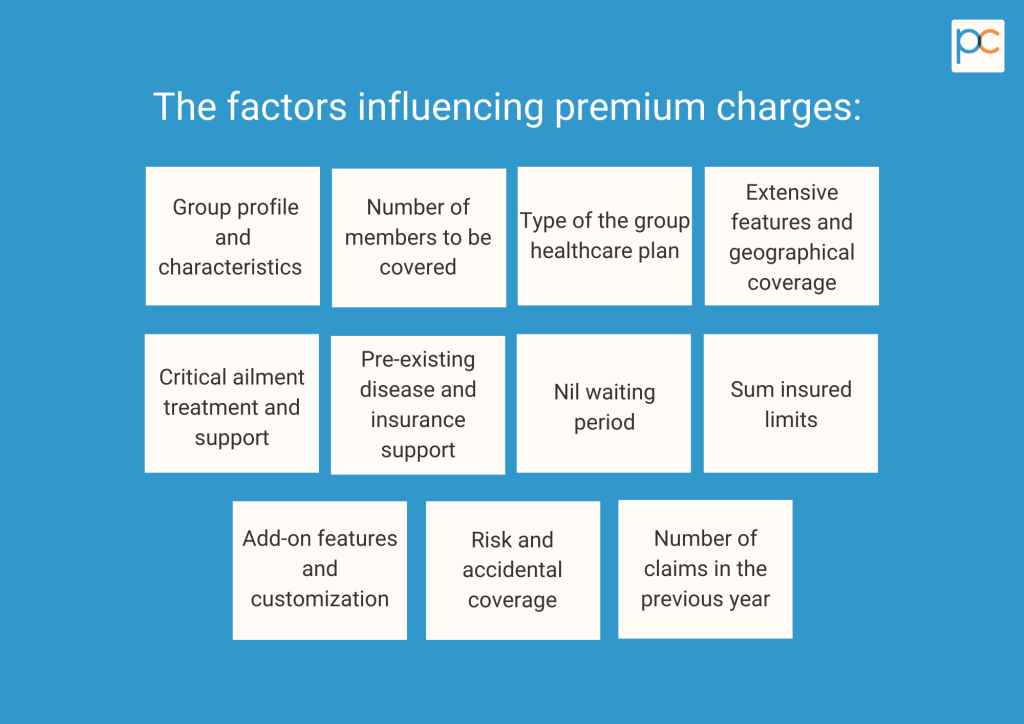

The factors influencing the premium amount, are more or less similar for healthcare plans all across the leading insurance companies in India. Following are the most common reasons that influence the overall premium charges –

- Group dynamics and medical history

Informal and formal groups can buy the healthcare plans. If an organization has more than seven employees, the employer can offer the Mediclaim benefits. But the overall premium depends on a few aspects related to the group members. The average age of the members in the group (employees in this case) and, the medical history of the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More, make a significant difference in the overall expenditure. If most of the employees in the organization are above the age of thirty-five, then the premium will be more. As the chances of insurance claims are more for people in the higher age band, the insurance companies charge you more for the annual renewal.

- Number of policyholders

The more employees you have in your organization, the more premium you have to pay for annual renewal. The premium charges increase further if the majority of the employees have a pre-existing medical record and belong to the upper age band. Thus, as an employer, you have to consider the plan features as per the total number of employees in the organization and your affordability.

- Type of the group healthcare plan

Group healthcare insurances can be for the employee or a comprehensive plan. A comprehensive plan is where the dependent family members of the employee are also included in the insurance coverage. The family members who can be included in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage beneficiary list are – spouse, children, dependent parents. Including the family members in the group, insurance increases the premium for the increased number of heads. Also, including the names of the dependent parents (senior citizens) in the list increases the premium charge as per the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More norms.

- Extensive features and geographical coverage

The more features in the insurance plans, the more premium charge you have to bear. If the group healthcare plan is custom-planned and, offers added benefits for daycare treatment, OPD expenses, and others; then the premium will be more. Also, with a greater plan coverage outside India, there will be an increase in the overall charges. A regular healthcare plan covering Pan-India is cheaper than a globally accepted insurance plan with extra medical benefits.

- Critical ailment treatment and support

If the insurance plan provides extensive treatment coverage for critical illnesses, then the premium will be expensive. For example – if the group healthcare plan you have bought offers covid care treatment benefits, the premium will be more. Similarly, for specialized treatment benefits for other critical ailments related to the heart or kidney, you have to pay a higher amount. To reduce the overall premium, most employers offer a regular healthcare plan for the employees. If the employee (policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More) needs added policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage for a specific disease, they can buy add-onsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More to extend the insurance coverage and treatment support.

- Pre-existing diseases and insurance support

Almost every insurance company charges you extra to offer unconditional coverage for pre-existing ailments. For example, if the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More has a chronic disease like diabetes, then the chances of claiming medical expenses for the disease increases. The insurance companies increase the rate to meet the needs for frequent claims, and greater medical coverage.

- Low waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More

In every healthcare plan, there is a waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More during which the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More cannot claim any medical expense for a few ailments. The ailments needing a waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More may be pre-existing or other critical ones. Different insurance companies have a different span for the waiting term. Usually, the average waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for most insurances is around 24months. If the insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you have bought offers a lesser waiting span, the premium will be higher. So, if your insurance company is charging you more, maybe it is for the lesser waiting term to make the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage convenient for you.

- The sum insured

The premium amount increases at par with the total sum insured for the healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Most organizations in India (small to mid-scale) offer a total sum of Rs.1lac to Rs.3lac per employee. The average cost for annual premium for an employee aged below 35 with Rs.1lac insurance coverage will be between Rs.1,400 to Rs.1,900. If the sum increases, the insurance premium will automatically level up.

- Add-on features and customization

If the employer provides a custom-made healthcare plan for the employee, that includes specific disease coverage and comprehensive benefits, the premium gets high. In such cases, the employee may pay the extra part for the add-on benefits while the employer takes care of the basic premium charges essential for regular plan coverage.

- Risk and accidental coverage

Healthcare insurances that offer special benefits and coverage for accidental treatment will charge you more. Usually, organization owners opt for this beneficial healthcare program if the employees need to indulge in life-risking activities for the organizational services. Regular healthcare plans for employees offer basic treatment coverage for accidental medical emergencies. But with the added coverage benefits, the expense support from the insurance company gets more. Hence, they charge you more for annual renewal.

- Number of claims in the previous year

Just like a no-claim bonus, most insurance companies charge you more for a frequent policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More claim. If the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More has claimed insurance multiple times in a year, the renewal charges increase in the following year. In contrast, if the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More does not raise a claim for any expense in a year, they can avail of premium discounts.

Choose the right insurance company.

An employer can buy the group healthcare plan from the insurance company or approach an insurance broker. The best way to manage the expenditure and reduce the premium charges is by going for a regular healthcare plan. Insurance consultants always advise the employers to pick basic coverage for the employees to ensure a lesser load on the budget. For expanding the coverage benefits, the employees can buy the add-onsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More or use the insurance top-ups and pay the extra charges. (if needed)

PlanCover – Bringing the best deals

PlanCover brings the most suitable group healthcare plans for employers having a small or mid-scale organization. You can browse through the different insurance options available at their end from the leading insurance companies in India. PlanCover is your trusted insurance broker when it comes to group healthcare policies. Connect to them now to find the best deal with affordable premium.