Reimbursement is like getting a refund from your health insurance. When you go to the hospital , pay for your treatment, and keep all the receipts, you can ask your insurance company to give you back the money you spent. You send them the bills, they check if it’s covered by your policy, and if it is, they repay you for what you paid at the hospital. It’s like the insurance company repaying you for your medical expenses.

Picture this:

Mike, recently experienced heart troubles and needed treatment. He decided to go to a specialized heart hospital, even though it wasn’t in the network covered by his health insurance. After the necessary procedures, Mike received a bill that outlined the expenses, including fees for the cardiologist, the operation room, and medications.

Mike paid the bills directly, and then he decided to file a reimbursement claim with his health insurance company. He collected all the essential documents like medical bills, and prescriptions. Mike filled out a reimbursement claim form, providing details about himself, his insurance policy, and a clear breakdown of the incurred costs.

The insurance company carefully reviewed Mike’s claim, making sure it met all the required conditions. They verified his policy coverage and checked the legitimacy of the expenses related to his heart treatment. Once everything was in order, they processed the claim. Mike then received a reimbursement check that covered the eligible expenses

How to Raise a Reimbursement of Medical Expenses:

The process to raise a reimbursement claim is easy and pretty straight forward:

Step 1:

Prior to signing your hospital bill, meticulously review all details. Take your time; accuracy is paramount. Any discrepancies can directly impact your claim settlement.

Step 2:

Essential documents that must be submitted:

- Completed claim settlement form

- Copy of your health insurance plan or insurance card

- Doctor-signed medical certificate

- Pathological report.

- Hospital discharge card

- Original medical bills and receipts

- Pharmacy original bills

- Investigation report (if applicable)

- MLC/FIR copy for accident claims

- Bank details for claim disbursement

- Completed CKYC form if the medical bill exceeds ₹1 lakh

- If all the documents are not available immediately, then you can collect them later and submit them to the insurer.

Step 3:

After submitting all necessary documents, await claim settlement. This process may take around 21 days.

The insurer may contact you if there are any queries or if the claim isrejected.

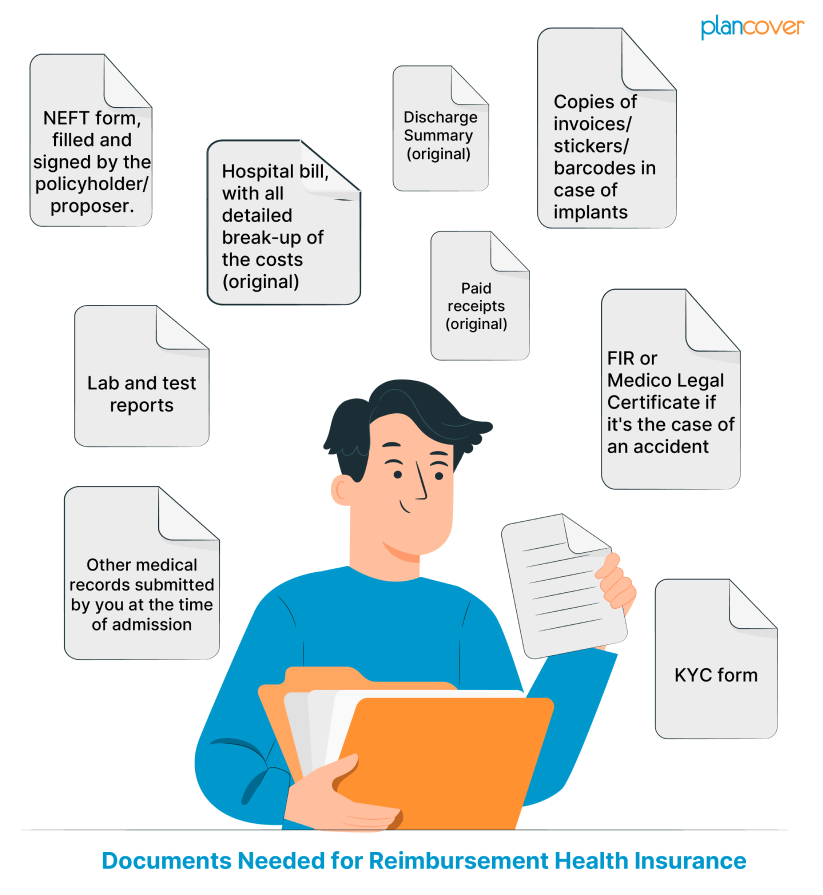

Documents Needed for Reimbursement Health Insurance Claim

Along with the claim form, the documents required for Mediclaim reimbursement process are as follows:

1. Discharge summary of the patient (original)

2. Hospital bill, with all detailed break-up of the costs (original)

3. Paid receipts(original)

4. Lab and test reports

5. Copies of invoices/stickers/ barcodes in case of implants

6. First consultation letter from a doctor

7. KYC form

8. NEFT form, filled and signed by the policyholder/ proposer.

9. FIR or Medico Legal Certificate if it’s the case of an accident

Things You Should Consider Before Opting for Health Insurance Reimbursement Claims

- Know What Your Insurance Covers

Read through your insurance policy carefully to understand what it covers. Match your expenses with the categories listed to make it clear when you file a claim. - Don’t Miss Deadlines

Pay attention to the deadlines for submitting reimbursement claims. Missing these deadlines could cause problems. Use reminders on your phone to help you remember to submit on time. - Keep Your Records Safe

Keep all your receipts, invoices, and bills safe. These documents are crucial proof of your expenses, especially in emergencies. - Watch Out for What’s Not Covered

Check your policy for things that may not be covered for reimbursement. Knowing these exclusions helps you have realistic expectations. - Add Up Your Costs

Calculate all your expenses and make sure they fit within the maximum limit set by your policy. If you go over this limit, you might have to pay the extra amount yourself, so stick to your budget. - Consider Waiting Periods

Some policies have waiting periods where certain expenses may not be eligible for reimbursement. Be patient and plan for this, understanding that you might need to manage these costs differently. - Learn the Claim Process

Understand how your claim will be processed step by step. This usually involves submitting documents, having them reviewed, and waiting for approval. Knowing this process will help you navigate it more easily. - Know About Taxes

Understand how getting reimbursed might affect your taxes. Some reimbursements may be taxable, and others may not be. Being aware of this will help you make smarter financial decisions. - Handle Your Money Wisely

Think about the financial impact of your expenses. Make sure you can cover them temporarily until you get your reimbursement. Being smart with your money ensures you’re financially prepared throughout the process.

In case of any assistance/ Quarries/Escalation,

kindly reach out us at: assist@plancover.com

Call our dedicated Helpline Number (During office hours only)

In case of any medical emergency (You may reach out us after office hours as well): 9971730455.