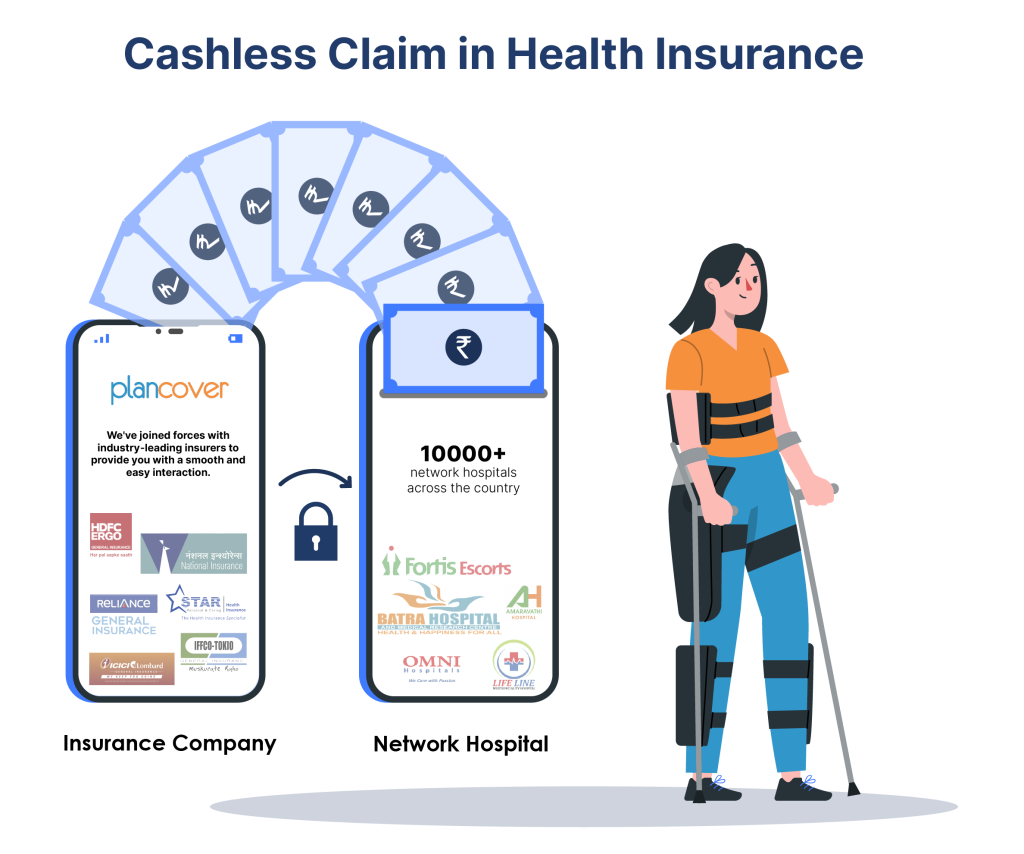

Medical emergencies can be overwhelming, but understanding how cashless claims work can significantly ease the financial burden. With a cashless claim, your health insurance provider may settle covered expenses directly with the hospital, allowing you to focus on your health. Let’s dive into how this process works in India.

What is a Cashless Claim?

A cashless claim is a feature of many health insurance policies that allows the insurer to settle hospital bills directly with the hospital. This eliminates the need for you to make upfront payments for covered medical expenses during hospitalization when immediate access to healthcare is crucial.

Understanding Cashless Claims: Smoothening Your Hospitalization

Hospitalization can be broadly classified into two types:

- Planned Hospitalization: For anticipated procedures, pre-approval is crucial. Here’s what you should do:

- Initiate Early: Contact your insurer or the hospital’s Third-Party Administrator (TPA) at least 48 hours prior to admission. You can even get approval earlier than that!

- Benefits: Pre-approval saves precious time during admission (up to 4-8 hours), eliminates financial worry, and offers flexibility within the approval’s validity period (often 15 days).

- Emergency Hospitalization: In unforeseen situations, focus on life-saving care. Here’s the process:

- Initial Deposit: Hospitals may request a deposit for immediate treatment. Don’t worry, this is often adjusted at discharge.

- Notify Insurer: Still apply for cashless treatment through the hospital’s TPA desk within 24 hours of hospitalization.

How Does the Cashless Claim Process Work in India?

Here’s a step-by-step breakdown of the cashless claim process in India with an example

Imagine the Scenario:

Rani, a 32-year-old woman in, holds a cashless health insurance policy with ABC Insurance Company. One evening, she experienced a sudden appendicitis attack. Rushed to Lifeline Hospital, you’re relieved to learn it’s part of your health insurance provider’s network. But amidst the worry, a question pops up: how will the hospital bill be settled?

The answer lies in a convenient process called a cashless claim, where your insurer takes care of the expenses directly with the hospital. Here’s a breakdown of the process, using your situation at Lifeline Hospital as an example:

Steps to Avail Cashless Hospitalization Benefits under Health Insurance

- Visit a network facility: To avail of the cashless facility, She needs to walk into any of the nearest network hospitals. She can check her network list using the Click Here and select your insurance company or TPA for the network hospital list.

- Insurance Document: Carry your Mediclaim / health insurance card along with any Government of India photo Identity proof (Photo ID copy of both employee and patient). check what documents are required for a cashless claim.

- Intimation: The first step is to inform your health insurance provider or its Third-Party Administrator (TPA) about your hospitalization at Lifeline Hospital as soon as possible. Provide your policy details. This is crucial, especially for planned procedures.

- Example: In her case of emergency appendicitis, a family member should immediately call your health insurance provider or TPA to inform them about her hospitalization at Lifeline Hospital.

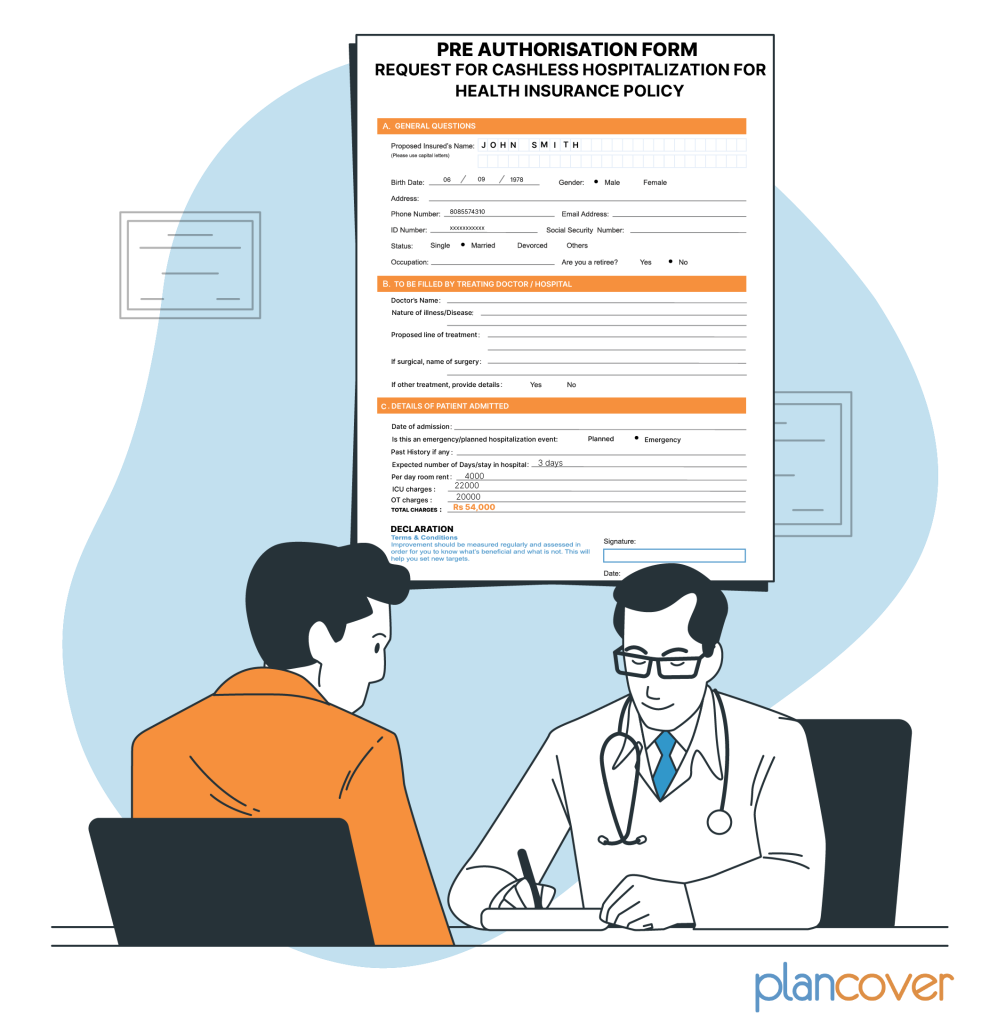

4. Pre-Authorization Form: Lifeline Hospital’s insurance desk will provide her or her family member with a pre-authorization form. Fill it out carefully and submit it, along with any required medical documents (like diagnostic reports), to the hospital’s insurance desk

Example: The staff at Lifeline Hospital’s insurance desk will guide her through completing the pre-authorization form, which includes details about her condition, treatment plan, and estimated costs. she need to attach any relevant medical reports to support your claim.

5. Approval: The hospital will send the form and documents to her health insurance provider/TPA. They assess the claim’s validity and eligibility as perher policy terms. If approved, they issue an authorization letter to Lifeline Hospital.

Example: Once Lifeline Hospital submits her pre-authorization form, her insurer will review it to ensure the treatment for appendicitis is covered by her policy. If everything is in order, they will send an authorization letter to Lifeline Hospital, allowing them to proceed with her treatment.

There might be a fast-track process for emergencies like yours

6. Treatment: Once the claim is approved, you can receive the necessary treatment for your appendicitis at Lifeline Hospital without worry about immediate payment

Example: After receiving claim approval, she can undergo the appendectomy (appendix removal surgery) at Lifeline Hospital, focusing on her recovery without the stress of upfront medical bills

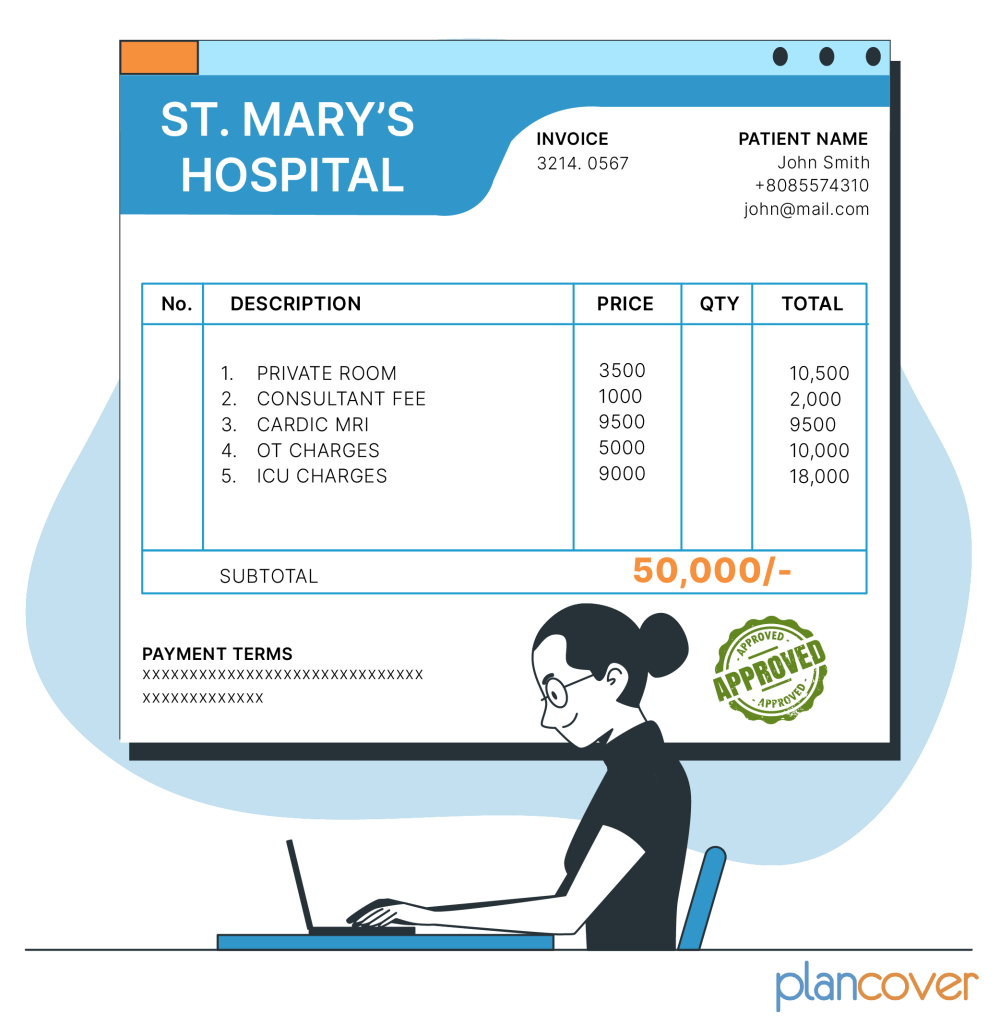

7. Billing and Settlement: Upon completion of treatment and discharge from Lifeline Hospital, they prepare the final bill. detailing the services rendered, medications administered, and other relevant charges. The billing department submits the bill to the TPA for final authorization. After the verification process, the TPA discovers that certain services provided during Ritu’s hospitalization are not covered under his insurance policy. As a result, ABC Insurance Company approved a total payment of Rs. 51,000 for the approved medical expenses, which is in line with Ritu policy coverage. However, since the total bill amounted to Rs. 54,000, there is a remaining balance of Rs. 3,000 that Ritu responsible for covering. The hospital informs Ritu about this deductible amount and requests payment before he can be discharged.

8. Discharge:

With the deductible amount paid, Ritu completes the discharge process. The hospital provides him with all necessary discharge documents, including his medical reports, discharge summary, and prescriptions for any post-discharge medications.

In this elaborate example, Ritu’s experience demonstrates the seamless process of availing cashless health insurance benefits during a medical emergency. By receiving timely treatment at a network hospital and utilizing the cashless facility, Ritu is able to focus on his recovery without the added stress of managing hospital bills and expenses.

2. Pre-Authorization Request:

The attending physician at St. Mary’s Hospital initiates the pre-authorization process with ABC Insurance Company. They gather John’s medical history, conduct necessary diagnostic tests such as an electrocardiogram (ECG) and blood work, and formulate a treatment plan, which includes cardiac catheterization and possible angioplasty.

3. Pre-Authorization Approval:

The hospital’s billing department submits all relevant documents, including John’s medical records, treatment plan, and estimated costs, to the TPA appointed by ABC Insurance Company. The TPA carefully reviews the submitted information to ensure it aligns with the terms and conditions of John’s insurance policy.

After reviewing the documents, the TPA approves the pre-authorization request, confirming that ABC Insurance Company will cover the approved medical expenses up to the sum insured for John’s policy.

4. Treatment:

John undergoes cardiac catheterization and angioplasty as per the treatment plan approved by ABC Insurance Company. The medical procedures are performed by the hospital’s experienced cardiologist, and John receives the necessary care and attention throughout his hospital stay.

5. Billing and Settlement:

Following the completion of the medical procedures, St. Mary’s Hospital prepares the final bill, detailing the services rendered, medications administered, and other relevant charges. The billing department submits the bill to the TPA for the final authorization.

After the verification process, the TPA discovers that certain services provided during John’s hospitalization are not covered under his insurance policy. As a result, ABC Insurance Company approves a total payment of Rs. 51,000 for the approved medical expenses, which is in line with John’s policy coverage. However, since the total bill amounted to Rs. 54,000, there is a remaining balance of Rs. 3,000 that John is responsible for covering. The hospital informs John about this deductible amount and requests payment before he can be discharged.

6. Discharge:

With the deductible amount paid, John completes the discharge process. The hospital provides him with all necessary discharge documents, including his medical reports, discharge summary, and prescriptions for any post-discharge medications.

In this elaborate example, John’s experience demonstrates the seamless process of availing cashless health insurance benefits during a medical emergency. By receiving timely treatment at a network hospital and utilizing the cashless facility, John is able to focus on his recovery without the added stress of managing hospital bills and expenses.

Please click here to see our explainer video on Cashless Claims Process

Please click here to see our explainer video on Delays in Cashless Claims

| Name | Type | Size | Download |

|---|