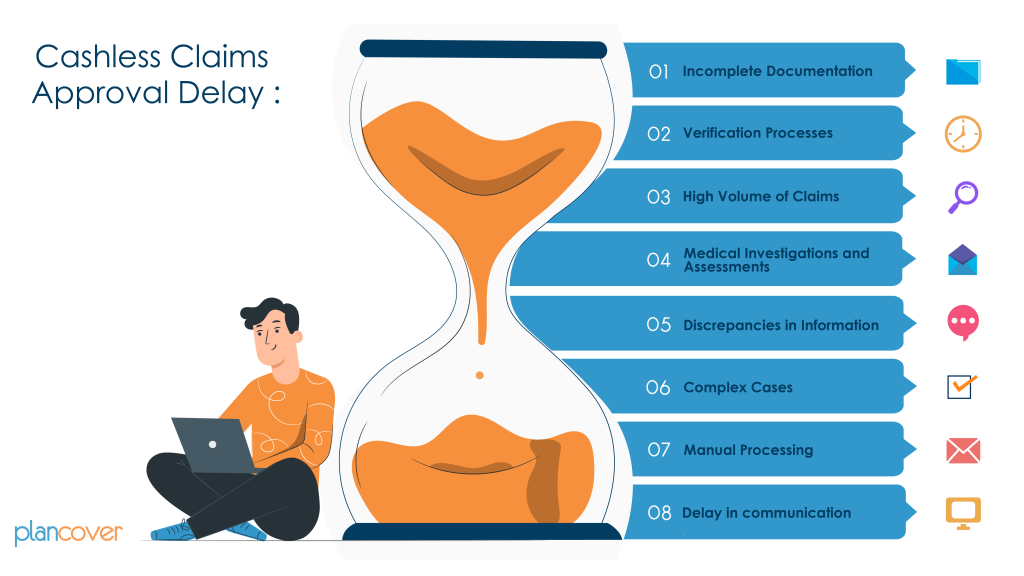

Delays in cashless claim approval

Delays in cashless claim approval can occur due to various reasons, including:

- Incomplete Documentation: One of the most common causes of delays is when the insured individual fails to provide all the necessary documents or submits incomplete information. Insurance companies require specific documentation to process claims, and any missing or incorrect information can lead to delays.

- Verification Process: The insurance provider may need to verify the authenticity of the claim and the eligibility of the insured for the coverage. This verification process can take time, especially if there is a high volume of claims to process.

- High Volume of Claims: During peak seasons or times of increased medical emergencies (e.g., natural disasters), insurance companies may receive a higher volume of claims. Processing this increased workload can lead to delays.

- Medical Investigations and Assessments: In certain cases, additional medical investigations or assessments may be required to verify the necessity and appropriateness of the treatment. These procedures can take time, leading to delays in claim approval.

- Discrepancies in Information: If there are discrepancies between the information provided by the insured, the hospital, the insurance company’s records and the insured statement. It can create confusion and prolong the approval process. In some instances, claims may be subjected to extra scrutiny, leading to delays, to ensure that they are genuine and valid.

- Complex Cases: Some claims involve complex medical conditions or treatments that require careful evaluation. These cases may take longer to assess and approve.

- Manual Processing: If the claim approval process involves manual intervention, it can be more time-consuming compared to automated processes. Generally, when the cashless claim process (Offline Cashless Claim- Insert Link) manually due to absence of the E-card, it’s taking more time.

- Delay in communication between hospital and insurance company: Even when you follow each step correctly, you may still experience delays in receiving your claim settlement. In such cases, the reason could be a delay in document submission by your hospital to your insurance company. Both your hospital and insurance company follow a stringent checking process before submitting and approving your claim, which can add to the time required for processing and result in a delayed settlement. Additionally, if documents are shared back and forth between the hospital and insurance company, it can further affect the time it takes to settle your claim.