How does the hospital get money under cashless treatment?

After the cashless authorization is granted by the insurance company for a medical treatment to a hospital, the hospital also follow the reimbursement process as like an insured file reimbursement claim.

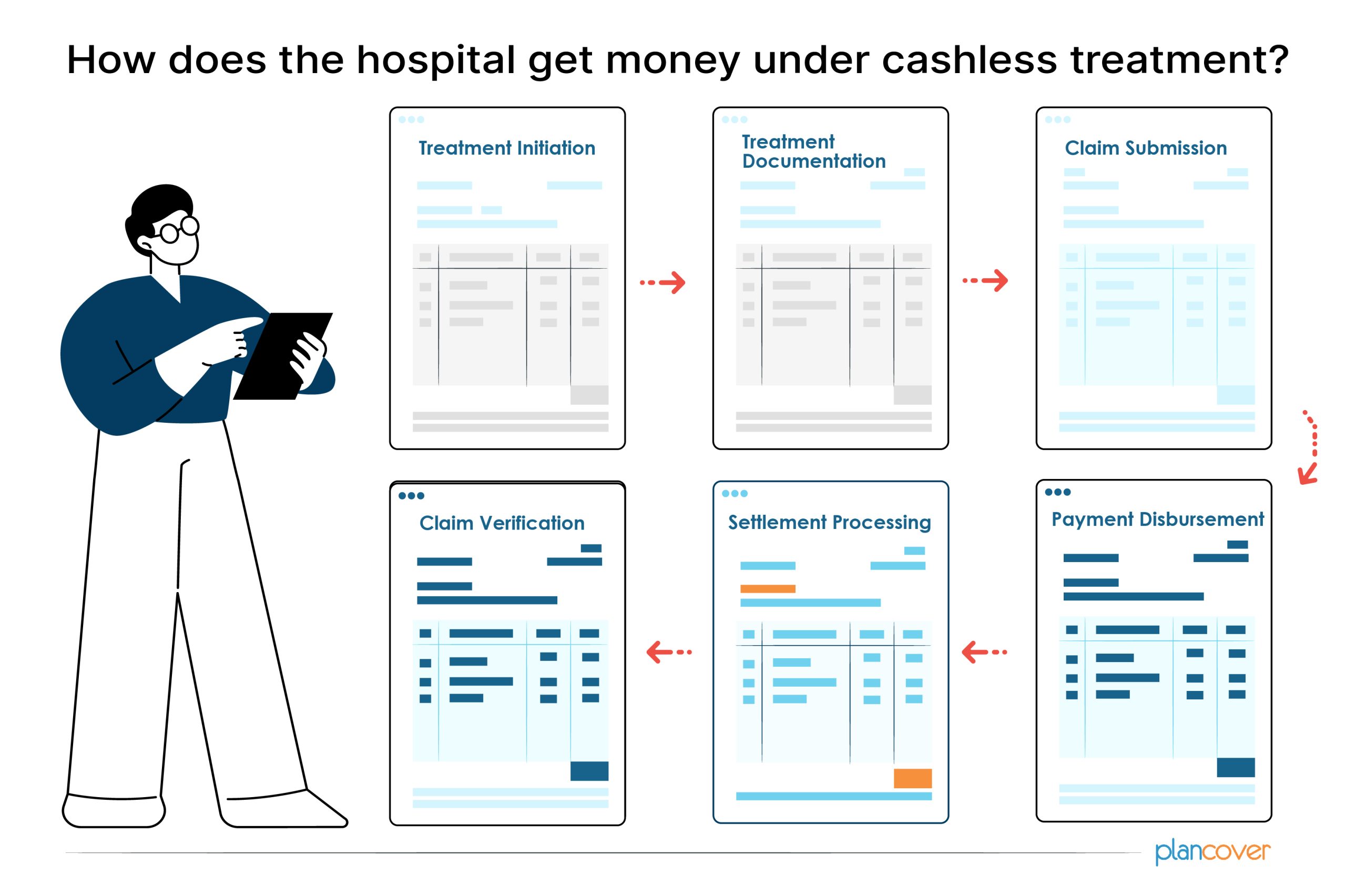

The settlement process typically involves the following steps:

1. Treatment Initiation: The insured individual undergoes the authorized medical treatment at the hospital.

2. Treatment Documentation: The hospital keeps track of all medical procedures, services rendered, and expenses incurred during the treatment process.

3. Claim Submission: Once the treatment is completed, the hospital submits a claim to the insurance company. This claim includes all relevant documents such as medical reports, bills, final authorization letter and any other required paper.

4. Claim Verification: The insurance company reviews the submitted claim to ensure that it complies with the terms and conditions of the policy and matches the pre-authorized treatment details.

5. Settlement Processing: Upon successful verification of the claim, the insurance company initiates the settlement process. This involves transferring the approved claim amount to the hospital’s designated bank account.

6. Payment Disbursement: The insurance company disburses the approved claim amount to the hospital as per the agreed-upon rates or package negotiated under the cashless facility agreement.

Overall, the settlement process ensures that the hospital receives timely payment for the provided medical services while ensuring compliance with the terms of the insurance policy.

How can I retrieve the security deposit amount from the hospital if the cashless claim has been settled with them?

If you have any security deposit with the hospital, you can request a refund once they receive the payment from the insurance company. The hospital may ask for payment transaction details, which you can obtain through the employee dashboard portal, mobile application, or by contacting your insurance company/TPA/intermediary. These details are also available on claim settlement letter, you can also share the same the hospital for refund.

Will the non-settlement of my cashless main hospitalization claim impact my pre and post-hospitalization claim?

Yes, it will impact your pre and post-hospitalization claims if the main hospitalization claim is not settled by the insurance company. The processing of your pre and post-hospitalization claims will be put on hold until the main hospitalization claim is settled. However, it’s important to note that this delay in settlement does not mean you should delay in submitting or filing the pre and post-hospitalization claim documents. You should still submit these documents promptly to ensure timely processing once the main hospitalization claim is settled.