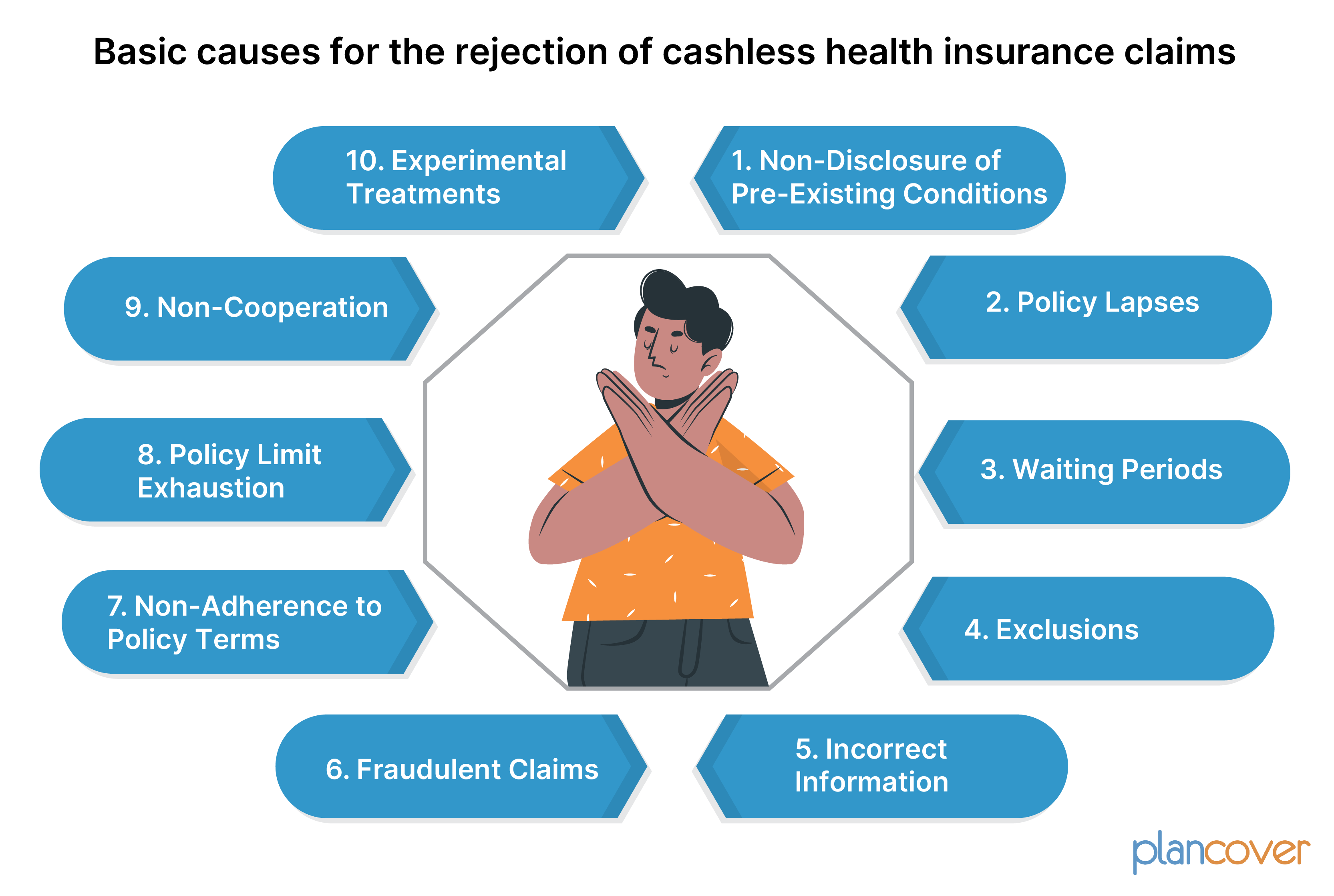

What are the basic causes for the rejection of cashless health insurance claims ?

Cashless health insurance claims may be rejected for various reasons. Common causes for rejection include:

1. Non-Disclosure of Pre-Existing Conditions:

Failure to disclose pre-existing medical conditions during policy application can lead to claim rejection.

2. Policy Lapses:

If the policyholder fails to renew the policy on time, claims may be rejected during the lapse period.

3. Waiting Periods:

Claims related to conditions covered after a waiting period may be rejected if the waiting period is not completed.

4. Exclusions:

Claims for treatments or conditions explicitly excluded in the policy may be rejected. Here, we have mentioned some examples which are permanently excluded in the policy:

- Alcohol and any intoxicating related diseases or injury.

- Cosmetic and Aesthetic related treatment.

- External Congenital Disease.

- Infertility.

- Intentional injury.

- STD.

- Mental illness/psychiatric.

- Dental treatments.

- Sterility.

- Modern Treatments

- Domiciliary Hospitalization

5. Incorrect Information:

Providing inaccurate or incomplete information in the claim form can lead to rejection.

6. Fraudulent Claims:

Submitting false or exaggerated information or documents can result in claim rejection.

7. Non-Adherence to Policy Terms:

Claims that do not comply with policy terms, such as using a non-network hospital without authorization, may be rejected.

8. Policy Limit Exhaustion:

If the sum insured/sublimit is exhausted, further claims may be rejected.

9. Non-Cooperation:

Lack of cooperation during the claim investigation process may result in rejection.

10. Experimental Treatments:

Claims for treatments not recognized as standard or proven may be rejected.

Policyholders should thoroughly understand their policy terms, provide accurate information, and adhere to the specified procedures to minimize the risk of claim rejection. If a claim is rejected, understanding the reason and addressing it appropriately can help in the reconsideration process.