What are the basic deductions in a cashless claim?

In the context of health insurance, a basic deduction, often referred to as a deductible, is an amount that the policyholder is required to pay out of their own pocket before the insurance coverage kicks in. It represents the initial portion of the covered expenses that the insured individual is responsible for before the insurance company starts reimbursing or directly settling the remaining medical costs.

Here’s how the basic deduction works in a cashless claim scenario:

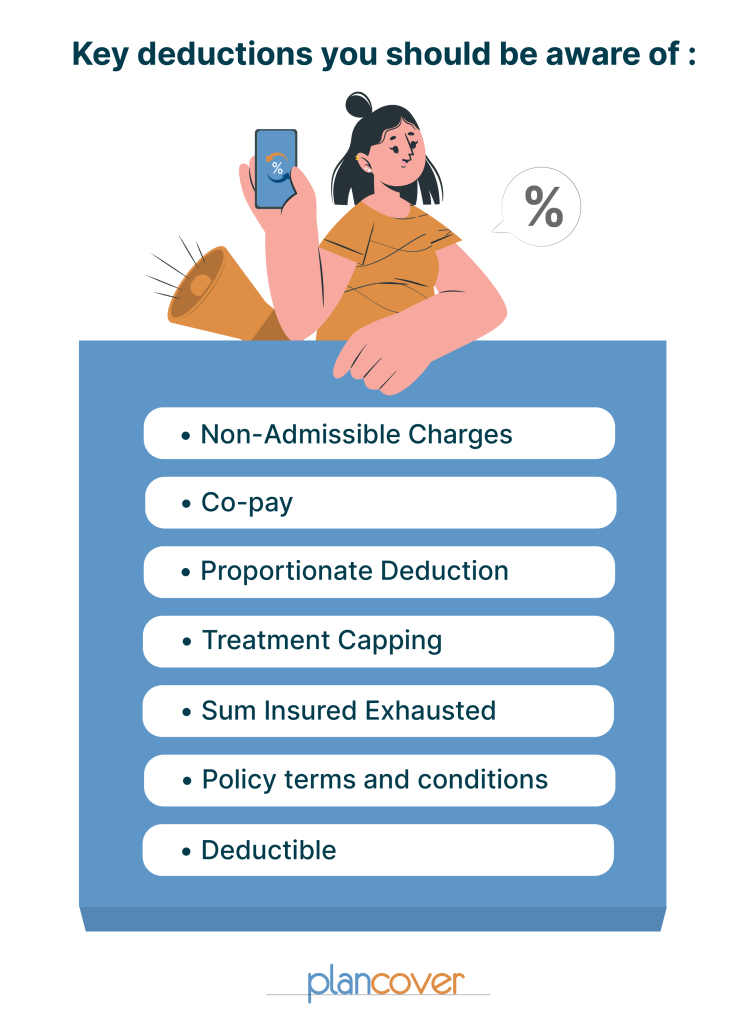

Understanding Deductions in a Approved Cashless Claim: Congratulations on the approval of your cashless claim. However, it’s important to note that there might still be some amount due from your end. Here are potential deductions you should be aware of:

- Non-Admissible Charges: Charges not covered in insurance policies, including service fees like admission fees, medical record charges, and the cost of consumables (gloves, swabs, thermometer, hand sanitizer, etc.).

- Co-pay: Varied across policies, co-pay requires the insured to pay a percentage of the bill value, typically ranging from 5-50%. Check your policy for specific co-pay details.

- Proportionate Deduction: Failure to check room rent eligibility may result in a proportionate deduction on the entire bill value if the chosen room category exceeds the policy’s specified limit.

- Treatment Capping: Certain treatments, such as cataract surgery, hernia treatment, or maternity cover, may have sub-limits defined by the insurance. The insurer’s liability might be capped at an amount lower than the sum insured.

- Sum Insured Exhausted: Your policy might not have enough balance to cover the entire treatment cost. If the sum insured is exhausted, the remaining amount needs to be borne by the patient.

- Reviewing policy terms and conditions: It’s crucial to review your policy terms and conditions to understand the specific details of deductions applicable to your cashless claim. Be proactive in clarifying any queries with your insurer or TPA to ensure transparency and avoid surprises during settlement.

- Deductible

a. Understanding Health Insurance Deductibles:

A health insurance deductible is the amount a policyholder must pay before the insurance company starts covering the claim. This implies that the insurer will only pay the claim amount after the policyholder has cleared the deductible. If the claim amount is less than the deductible, the insurer will not contribute, and the claim will be denied.

Example:

Let’s illustrate the concept of a deductible with an example:

– Health Insurance Policy Details:

Sum Insured: Rs 3 lakh

Deductible: Rs 30,000

Scenario 1:

Surgery Costing Rs 50,000:

1. You need surgery with a cost of Rs 50,000.

2. Before raising a claim, you must pay Rs 30,000 out of pocket.

3. The insurer will cover the remaining Rs 20,000.

Result: You pay Rs 30,000, and the insurer pays Rs 20,000.

Scenario 2:

Hospitalization Bill of Rs 20,000:

1. You are hospitalized for an illness, and the bill is Rs 20,000.

2. Since this amount is less than the deductible (Rs 30,000), you have to bear the entire cost.

3. You cannot raise a claim because it is below the deductible.

In summary, the deductible acts as a threshold, and the insurer’s responsibility kicks in only when the claim amount exceeds this predetermined amount. Understanding your policy’s deductible is crucial for managing out-of-pocket expenses and making informed decisions about when to raise a claim.

It’s important to note that the deductible is typically an annual requirement, meaning it applies per policy year. Once the policyholder has met the deductible for that year, the insurance coverage takes effect for subsequent medical expenses during that policy year.

The purpose of the deductible is to share the financial responsibility between the insured individual and the insurance company, and it helps in controlling premium costs. Policyholders should carefully review their health insurance policy documents to understand the terms and conditions associated with deductibles, as they can vary between policies and insurance providers.