What does “authorization” signify in the context of a cashless claim ?

Authorization in a cashless claim context means that the insurance company agrees to cover the medical expenses directly to the hospital or healthcare provider. It serves as a guarantee of payment to the hospital, ensuring that the insured individual can avail of medical treatment without having to pay upfront.

However, it’s important to note that authorization does not necessarily mean a guarantee of payment in all cases. While the insurance company may pre-authorize the claim based on the information provided, the final payment is subject to verification of documents, compliance with policy terms, and completion of treatment as per the agreed-upon guidelines. If there are discrepancies or if the treatment does not meet the policy’s terms and conditions, the insurer may reject or partially approve the claim. Therefore, while authorization indicates the intention to cover the expenses, the final payment is contingent upon fulfilling all necessary requirements.

What is preauthorization?

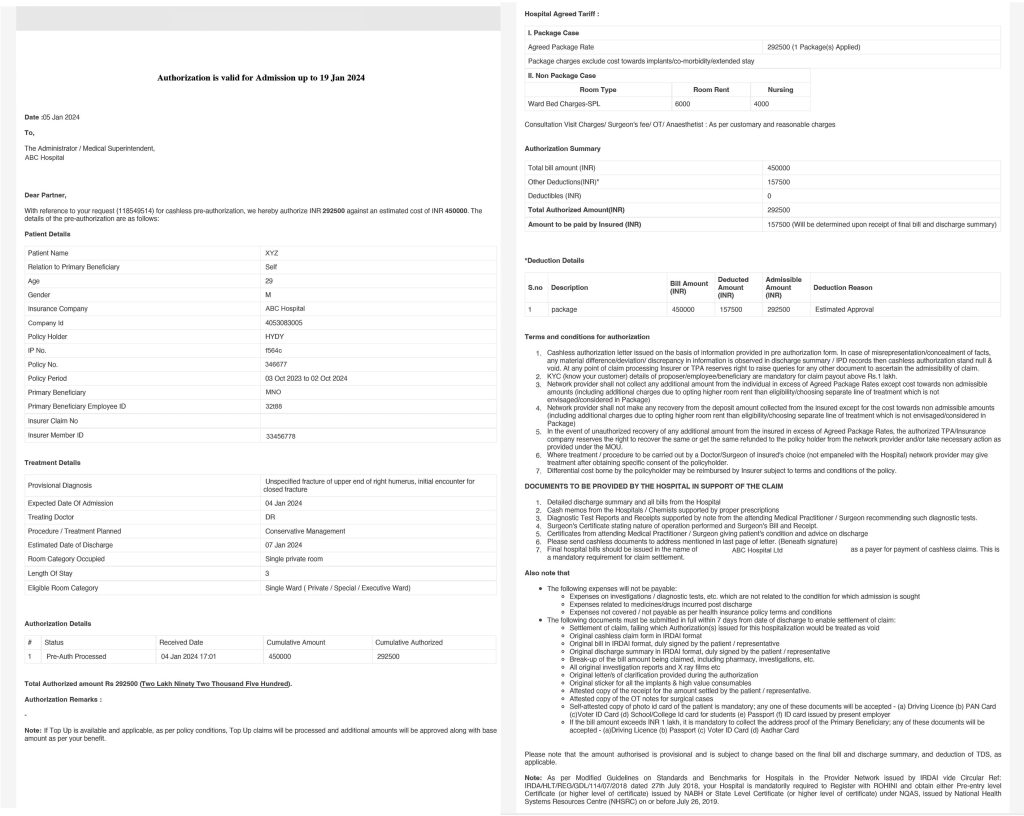

In the context of a cashless claim process, authorization refers to the approval granted by the insurance company in advance for the medical treatment or procedure that the insured individual is seeking. This approval, also known as pre-authorization, signifies that the insurance company agrees to accept the claim for the specified treatment or procedure.

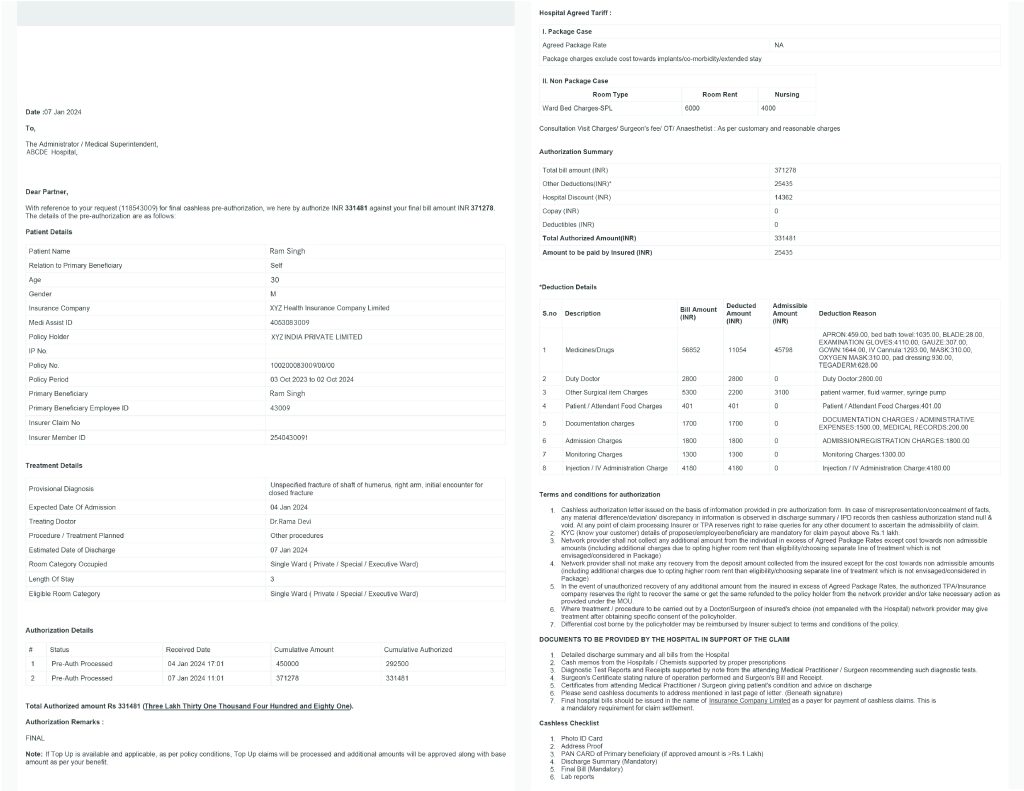

During the authorization process, the insurance company verifies several factors, including the validity of the policy, the coverage for the patient, and whether the prescribed treatment is included in the policy’s terms and conditions. Additionally, the insurer checks if the hospital where the treatment will be conducted is part of its cashless partner network.

The authorization process typically involves the insurer and the treating doctor filling out a pre-authorization form. This form, along with relevant documents and cost details, is then submitted to the insurer for review. The insurer evaluates these documents to determine whether to authorize the claim.

Initial authorization approval does not guarantee that the claim will not be rejected during the final authorization or approval stage. The initial authorization is just the first step in the process, where the insurance company or Third Party Administrator (TPA) agrees to consider the claim based on the information provided. However, during the final authorization, the insurer conducts a more thorough review, verifying all the necessary documents and ensuring that the treatment meets the policy’s terms and conditions. If there are any discrepancies or if the treatment is found to be not covered under the policy, the claim may still be rejected during the final authorization stage, even if it was initially approved.

What is final authorization/approval in cashless claim?

Final approval at the time of discharge in a cashless claim means that the insurance company or Third Party Administrator (TPA) has given the go-ahead to settle all medical bills directly with the hospital. At this point, the insured person’s liabilities typically include any expenses not covered by the insurance policy, such as deductibles or co-payments, charges for services not covered by the policy, or any extra costs incurred during the hospital stay. In simple terms, it’s the confirmation that the insurance will pay for the approved medical expenses, but the insured person may still have to cover certain costs depending on their policy.