What is PPN in cashless insurance?

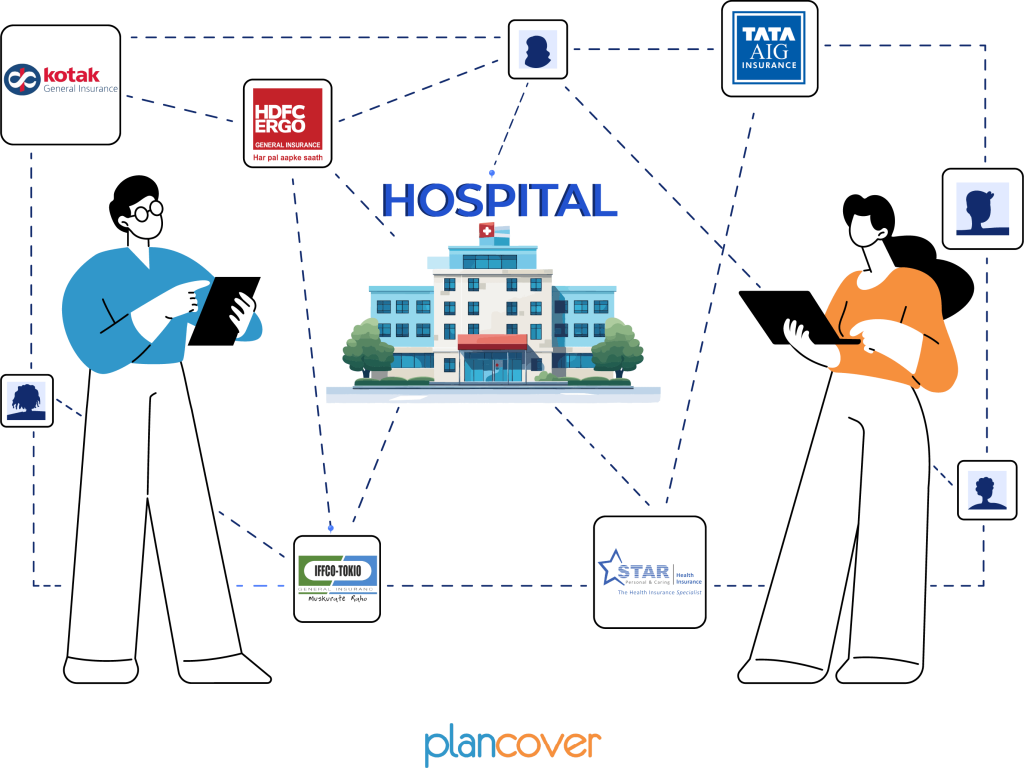

In the context of health insurance, PPN stands for “Preferred Provider Network.” PPN is a network of healthcare providers, including hospitals and clinics, that have an agreement with an insurance company to provide medical services to policyholders at pre-negotiated rates. The PPN is also commonly referred to as the “network hospital” or “network healthcare provider.”

When a health insurance policy offers a cashless facility, it often means that the policyholder can avail of medical treatment at the hospitals within the insurer’s Preferred Provider Network without having to pay the bills upfront. The insurance company directly settles the medical expenses with the network hospital.

Here’s how PPN works in the context of cashless insurance:

1. Network Hospitals: The insurance company has agreements with certain hospitals to form a Preferred Provider Network. These hospitals agree to provide medical services to the policyholders at negotiated rates.

2. Cashless Facility: If a policyholder needs medical treatment and chooses a hospital within the PPN, they can opt for cashless treatment. The hospital bills are directly settled between the insurance company and the hospital.

3. Pre-Negotiated Rates: The rates for various medical services are pre-negotiated between the insurance company and the network hospitals. These rates are often lower than the regular or non-network rates.

4. Co-payment or Deductibles: While the insurance company covers the pre-negotiated costs directly, the policyholder may still be responsible for any applicable co-payments or deductibles as per the terms of the insurance policy.

Using a Preferred Provider Network helps insurance companies manage costs and ensures that policyholders have access to quality healthcare services. It also simplifies the claims process for policyholders seeking cashless treatment within the network. Policyholders should be aware of the hospitals in the PPN and the terms and conditions associated with cashless treatments under their health insurance policy.