Employees are an integral part of an organisation. With growing awareness, companies are focusing on what they can provide to their employees, to improve their overall lifestyle, so that they start providing better results. Corporate health insurance plays a significant role to hold on to that valuable talent. The employee feels protected against any medical incidents/injuries that might occur.

Group Health Insurance is a medical cover provided to a group of individuals in an organisation. According to IRDAI, a group can be employer – employee or non employer – employee group.

Features of Group Health Insurance

- The group medical cover usually cover the spouse, dependent children and parents in the policy alongside the employees themselves.

- The employees can avail the benefits of the policy and get the treatment done all over India and the claim will be processed.

- The maximum age of entry for the policy is 65 years for adults and 18 years for dependent children. However dependents can be added from day 1 (i.e. from the time of birth) which varies to 90 days (from birth) depending on the policy terms and conditions.

- The employees can avail cashless hospitalisation in any of the empanelled hospitals which makes the payment process hassle free. Claims are processed in a jiffy just with the E – Card.

- Hospital expenses incurred as an in – patient due to an ailment and pre and post hospitalisation of 30 and 60 days respectively is covered.

- Covers ailments like chemotherapy, cataract surgery which require hospitalisation for less than 24 hours as day care procedures.

Who should buy?

A group health insurance can be bought by any legally formed group of people. It can be a group formed for commercial purposes or for non profit purposes. The groups can be profit making organisations, educational institutions and NGOs.

What’s in it for you?

- Waiver of Pre Existing Diseases – Any disease that existed before the inception of your health cover is waived. So if the patient is suffering from diabetes, he/she will not have to worry as it will be covered under the group health policy.

- No Medical Examinations – The best part about group health insurance is that no medical checkups are required which is not the case in retail health policies. One can claim for any ailment right from the date of inception of the policy.

- Maternity Benefit – Employees get maternity benefit for themselves or their spouse for normal delivery as well as C – Section without the waiting period of 9 months. This exclusive benefit is not provided in the individual health policies for such low premiums.

- Dependent Addition – The employees can add their dependents in their group mediclaim policy including spouse, dependent children, dependent parents and in – laws based on the policy terms and conditions.

- Waiver of the waiting periods – There is no waiting period for any pre existing disease. A new born baby is also covered from day 1 of birth.

However there are certain restrictions that the employees need to keep in mind.

- Employees cannot claim after their tenure from the organisation is complete.

- You cannot make changes to the policy benefits after the issuance of the policy till the date of the renewal of the policy.

- Companies decide the benefit in the medical cover at their own discretion which makes the policy inflexible and rigid for the employees.

- Many companies might not offer coverage for parents.

A healthy workforce, surely we can help!

Group Health Insurance helps the company to mollify the risks of the employees which keep the employees motivated at work. A health insurance makes sure that the employees are covered from the financial instability that they may face at the time of health risks. It also attracts talented resources to the organisation.

We at PlanCover are here to provide you get the best group health insurance for your company from the various insurance companies. We will do all the work of finding the right cover for you with the best benefits market has to offer at minimum premium costs by comparing the best health plans.

Making Claim

Now that the employees are insured and have a medical insurance cover, the question arises, how does one claim and what is the whole process? We will help to answer all those questions so that the claim is processed effortlessly.

How to claim?

You can make a health insurance claim in two ways :

1. Cashless Claims

2. Reimbursement Claims

On a Cashless Claim :

This is a facility extended by the insurance company and a part of your policy terms, whereby the policy holder can get admitted and undergo necessary treatment without paying the hospital directly for the medical expenses. The eligible medical expenditure which is incurred is settled by the insurance company directly with the hospital. You can avail cashless hospitalization only in the hospitals that are part of your TPA ( Third Party Administrator ) or Insurers network.

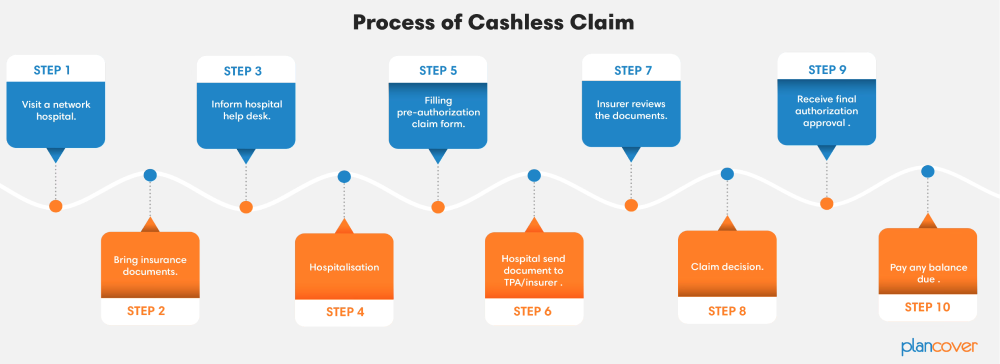

PROCESS OF CASHLESS CLAIM

- To avail the cashless facility, you can walk-in to any of the nearest network hospital.

- Carry your mediclaim cards along with any Government of India photo Identity proof.

- Please inform at the hospital reception ( or TPA / Insurer Helpdesk) that you are covered under Group Medical Insurance policy.

- Ask for pre-authorization form and get it filled by your treating doctor along with medical reports in support of diagnosed. Many Hospitals get this process done by themselves but you can check for particulars at the hospital you are going to.

- Mail the scanned copy of pre-authorization and medical reports to your respective TPA. This too is often handled by the hospital itself.

- Insurer / TPA will then evaluate the details mentioned in the form and process your claim within 4 hours – 6 hours ( this is typically a conservative estimate of time and can often happen much sooner) or intimate you further. This intimation could potentially be a request for more information or a denial of cashless. No denial can happen unless the treatment is not covered specifically under the policy terms. We will be happy to help in case that was to happen to re-validate the opinion of the insurance company and to challenge it on your behalf

- The cashless may be rejected if Insurer / TPA is of the view that the ailment/ hospitalization are not covered under this policy.

- At the time of discharge if the claim amount is more that your sanctioned amount, the Insurer / TPA will mention it in the approval note and you may have to bear that yourself. The common head’s under which this partial approval may happen are –

1. Your sum insured is exhausted

2. Non Medical Items that are not covered under the scope of any health insurance cover in India.

3. There is a provision of cost bearing on your part, as a policy feature under your policy, often called co-payment.

4. There is a capping for the particular treatment in your policy. - Few hospitals may ask for initial deposit at the time of admission. This is a subjective demand and varies from hospital to hospital. Any amount that you have paid, after adjustment for the details mentioned in the previous point above, will be refunded to you.

- At the time of discharge – The patient and family are obviously eager to get home at this point in time. We would like you to calibrate your expectations on this. While the treating doctor may advise discharge the previous day or the same day, the sequence of processes that a hospital needs to follow are many. THis process itself at the hospitals end, often can take a few hours. Finally once the hospital generates the final bill and discharge summary, they will send it to the Insurance company / TPA. This is then put into a detailed scrutiny by them and a doctor will also evaluate all the documents. Once they have validated all details and mapped it against the policy terms, they will approve the claim and also the amount that they will pay. THis will then result in the Final Authorization being sent to the hospital.

- On receipt of the Final Approval / Authorization, the hospital will let you know via the billing department if you need to pay any balance, assuming the approval is done. You can pay that balance or challenge it ( in which case seek us out and we will understand your point of view and represent it to the Insurer / TPA)

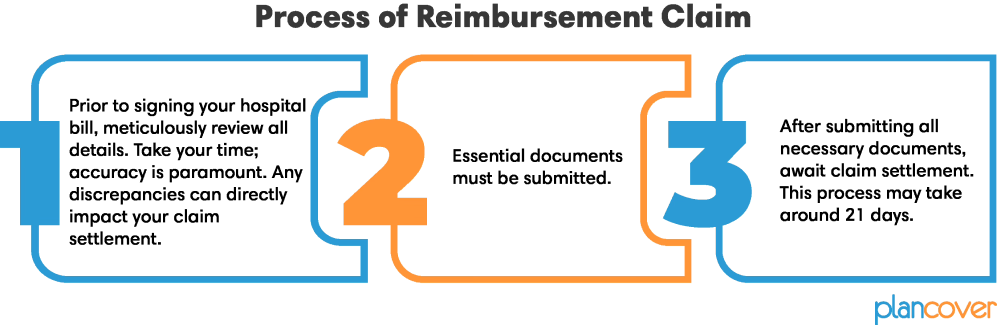

On a Reimbursement Claim :

This facility is opted by the claimant when he goes to a hospital as per his choice given that it is a non network hospital. Cashless process cannot be availed here. The claimant has to pay for all the medical expenses and other costs incurred during the hospitalisation. After discharge, the claimant has to provide all the original documents to the insurance provider. The provider will scrutinise all the document as per the policy terms and conditions and make the payment to the employees. In case the treatment is not covered, the claim is rejected and a reason is provided.

DOCUMENTS REQUIRED FOR REIMBURSEMENT :

-

- Copy of Hospital Registration Certificate with Registration number and number of beds certificate (This may not be required in case of larger hospital which are well known and in larger towns / cities )

- Claim Form duly signed. This is absolutely mandatory

- Copy of the Claim Intimation, if any ( If you are filing the main hospitalisation expenses for reimbursement, then you would have done the intimation of the claim in advance, as per your policy terms. Do attach a copy of that)

- Hospital Main Bill with proper breakup of the expenses. Often there is a summary bill and then there is a bill which mentions all line item wise expenses. The insurer will need the detailed latter bill

- Hospital Bill Payment Receipt for which the policyholder / claimant made the payment to the hospital. Do note that this receipt will need to be numbered.

- Original Hospital Discharge Summary (which should clearly mention :

1. Patient name

2. Date of Admission

3. Date of Discharge

4. Age of the Patient

5. Final Diagnosis - Case Summary / History (On Examination), Course in Hospital, Line of Treatment, Advice at Discharge with signatures and stamp of treating doctor. This will be on the hospitals letter head

- Others medical document that may be provided

- Doctor’s Prescriptions. Often in non-emergency cases, the patient is first shown to the doctor n OPD basis, In such cases all doctors prescriptions will be needed

- Copy of photo identity card of patient and employee

- Pharmacy bills.

- MLC Report & Police FIR, Alcoholic declaration in case of accidental cases particularly Road Traffic Accident (RTA)

- Also in RTA Cases, detailed circumstances of the trauma with date, place and time. This is mandatory for reimbursement claim in case of an accident case.

- All Investigation Films and Reports – ECG / CT / MR / USG / HPE or any other investigation reports. Obviously there will be no films in cases of blood investigations, urine / stool investigations or biopsy

- Original cancelled cheque, with printed name, for the transfer of payment to your bank account. If you providing cancel cheque without printed name please submit the copy of passbook with bank attestation. Bank E-statement (In case your name as an employee is NOT printed on the cancelled Cheque)

Points to keep in mind while filling the claim form for reimbursement process :

Kindly mention your Employee ID, Company Name and Contact details on top of the claim form (You can write this at the right top portion).

Please note that the following fields are mandatory in a claim form :

- Policy Number (in case of Corporate policies, even if you don’t have the policy number, that’s fine, you can omit it.

- Cashless Identity Card number ( would be mentioned on your hard copy or E Card in case you have that).

- Name of the Insured ( Primary Member) with addresses and contact details.

- Name of the Corporate & Employee code.

- Name of the Patient, date of birth and relationship with the employee.

- Tick on the type of claim, write, and date of admission and discharge, name, address and contact details of the hospital.

- Provide the details of illness / injury / disease.

- Provide the details of amount that is being claimed with breakup of bill numbers.

- All documents in original.

- Signature of the claimant along with place and date (this is mandatory).

Target audiences

- Those who already have a health insurance policy

- Those who are planning to buying a health insurance policy