What is Group Health Insurance Policy

Group Health Insurance is a risk cover issued by an insurance company to an organisation for covering its members against financial expenses resulting from hospitalisation.

This cover entitles the policyholders to be paid for the cost of treatment at a hospital for any injury or disease. The terms of the policy can be configured as per the requirements of the group and can be changed each year before renewal of the policy.

The claims under this policy can be taken either as cashless or as a reimbursement

Typically taken by employer employee groups but can as well be taken by other groups who want to cover their customers, trade organisations members, students, distributors or anyone else having a formal association with the registered group.

What is the purpose of group health insurance

Group Insurance facilitates spreading of risk by charging premium for all members covered and paying claims to some of them in any one policy year.

This ensures there is assurance of not having to dip into one’s savings to meet the high healthcare costs in the event of any hospitalization. Therefore this protects the savings of a family.

5 main purposes for providing group health insurance benefits are –

- Safeguarding members from unexpected costs due to hospitalisation

- Providing easy access to best-in-class healthcare

- Retention of members with the group

- Predictability of costs for the organisation and for each member covered – better financial planning

- Avoiding small and medium business owners to having pay for employee costs out of their own pockets

Advantage for the organisation

- D

- D

- D

Advantage for the members

- You dont get these terms often in the retail market. Often group health insurance policies cover pre existing diseases from day 1 and no other waiting periods apply.

- DThere are no medical tests needed to buy the policy. People with ‘substandard’ health conditions are able to get coverage without any hassles

- No lengthy proposal forms to be filled The coverage begins with just providing your ( and your family’s ) name, date of birth and sum insured

Who Can Take Group Health Insurance

A group health insurance policy can be taken by any formal entity. This means especially those entities which have been registered under law can take this cover.

Typical examples of such entities includes –

- Employees – Any organisation which has been registered under the relevant act in India viz The Companies Act, 1956, is eligible to take these for its employees

- Students of an educational institute

- Distributors – As a part of engagement to maintain a strong channel loyalty

- Member of a Religious / Spiritual organization – An example would be Jain International Organisation policy for its members

- Residents Welfare Association

- Gig Economy Workers – Much like Swiggy, Zomato and Urban Company have provided

- Any Association – Retired Employees Association, Trade Bodies to their members like Nasscom and The Indus Entrepreneurs has done in the past

The factors which influence providing a cover to any group is derived from the following –

- Size of the group

- How many people will enrol as a percentage of the overall group population

- Composition of the group

- Terms of the cover sought

- Who is paying the premiums

The underwriting team of each insurance company needs to get a comfort for issuance of such covers. The analysis of the risk profile is critical for them to quote appropriately.

Size of the group which wants to take group health insurance

Bigger size groups offer risk diversification for the insurer. The law of averages assures that the risk spread is large enough to avoid concentration of the claims. When a group is large, the distribution of low, medium and high risk profiles within the group ensures that the claims would be more in line with the expected frequency ( number of claims per 100 covered members ) and the average cost of claim will as well be in line with market standards

How many people will enrol as a percentage of the overall group population

In most employer-employee groups, though not all, the premium is often paid by the organisation. They cover all employees under the group health insurance plans. There are some organisations which facilitate group mediclaim covers for their employees but keep it voluntary. In such cases the entire premium may be borne totally by the employees or a part may be borne by them. In such cases not all employees take insurance.

Composition of the Group

Group health insurance may be for a single primary member ( for example only employees in an organisation ) or it could be additionally for spouse and children. In a few cases it may be for parents and parents in laws as well.

The possible configurations in this are as follows –

- Primary members Only ( viz Employees only )

- Primary member and Spouse Only

- Primary member, Spouse & Children

- Primary member & Parents ( especially in employer employee groups where the employe age is relatively much younger and hardly anyone who is married )

- Primary member, Spouse & Children and Parents ( or Parents in law )

In rare cases we have seen both – parents and parents in law getting covered in the policy. This can be either as an exception for the senior management or open for all employees.

Terms of the cover Sought

Who is Paying the Premiums

Can Group Health Insurance Be taken Selectively by Some Employees

Health insurance premiums follow certain data based predictions of the premium charged against anticipated risks. The group composition on the whole is often composed of low, medium and high risks.

The pricing of insurance has a direct bearing on this

Insurance companies use historical data sets to predict the number of claims in any group and the average cost of treatment of those claims. This gives them an indicative premium they need to charge to cover the losses. This determines the final premium a customer pays

The classical assumption in insurance around risk is based on age. Lower the age, lesser is the probability of claims. Even if there are claims, the average cost of treatment in this group is lower as compared to higher age and therefore higher risk categories.

Therefore, linked to age, the following are higher –

- Incident Rate – the number of people getting hospitalized per 100 members covered. For a younger group, this may be 3%-5% of the total members covered. As the age profile increases, particularly when parents are considered, this incident rate may increase to 7 %- 12 %

- Average Cost of Treatment – This increases with age. For a younger person getting hospitalised, the nature of ailments they may need treatment for ( viz Stone removal, hernia, Gastroenteritis and other water borne diseases ) are relatively priced lesser ( average claim size in various age categories confirms this ). This when compared to alderly population, you will observe that the nature of ailments often seen in this age group ( viz Cancer treatment, cardiac treatment, other treatments of kidneys, neurology etc) are priced much higher.

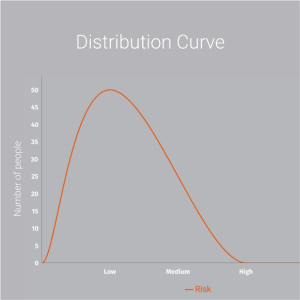

Age distribution in a company with younger employees and the risks classification

This risk distribution is often found in startups looking for group health insurance, technology and related industries where the average age of the employees is lower. This becomes all the more true for group mediclaim policies which cover only employees of an organisation. The moment parents start getting covered, the risk distribution starts shifting towards the high risk category

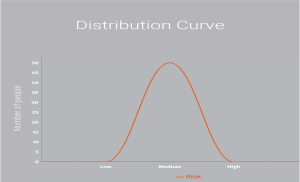

Normal Risk Distribution curve expected in most policies

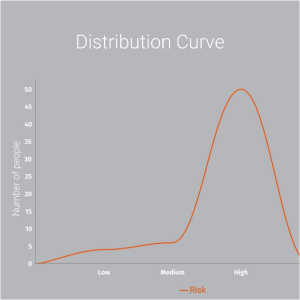

Risk Distribution expected when Selection of insured members is allowed

When there is a selective enrollment in insurance, the risk distribution shifts as clear from the charts above.

In group health insurance, this is called Adverse Selection

While insurers and their underwriters deliberately allow for adverse selection in many groups, there are certain inputs they consider

- Size of the group – how many members are there. This includes primary members as well as family members

- Composition of the family – Are parents ( in laws ) being covered under this plan

- Average age of the members – Higher the average age, the more chances of hospitalisation.

- Percentage of enrollment – out of the total members of the group, how many will eventually get enrolled into a policy

- Past Claims Experience of the Group– This is relevant in those policies where their is historical evidence of claims and the program has been running either as a fully enrolled group or selective enrollment of insured members exists

- Industry – This factor becomes relevant in certain cases to deciding whether an insurance company will offer selective enrollment. Healthcare related businesses are often a declined risk category. If the risk perception of the insurance company is that the nature of the group and its members may have a lower barrier to claiming insurance benefits, they may decline such risks

What Type of Employees Can be Covered Under Company Group Health Insurance Policies

The Group Health Insurance policy ( or Group Mediclaim ) is extended to all formal members associated with it.This includes employees of any organisation or members associated in chase of other type of groups The group policy covers the following

- Employer Employee Groups –

- This allows eligible full time employees to be covered. Many companies offer coverage as well to family members. This coverage can be for spouses and children. Significant number of companies extend the group health insurance benefits to parents and parents-in-law as well

- Consultants – Especially in Healthcare industry and Technology driven sectors the market practice of hiring Consultants In common. These are well accomplished people who for a variety of reasons may want to offer their services to the organisation. They can be covered under Group Health Insurance

- Part Time Directors – These cases are often seen in senior resources who have been with the organisation for long and now contribute on part time basis. This profile can be covered under the group health insurance policy

- Board Members – These also include independent Board Members on the Board of any organisation.

- Part time employees – Much as in Consultants, this profile is similar and can be given cover

- Contractual employees – With the amendment of the Labour Laws in India effective 1st April 2021, the nature of relationship with part time employees in an organisation has shifted significantly. The group insurance benefits can be extended to this profile as well

- Gig Workers – Zomato, Swiggy

Can an Organisation give Group Health Insurance Benefits as a Voluntary Option

Group Health Insurance benefits or Group Mediclaim is given to members of an organisation ( hyperlink to Who can Take Group Health Insurance ). Within any organisation it can be given to many categories of members ( hyperlink to What Type of Employees Can be Covered Under Company Group Health Insurance Policies )

When any organisation is looking at starting a group health insurance benefits, they need to provide the data of covered members to the insurer and obtain a quote. At this time, the organisation needs to declare to the insurer whether this cover is being given to all the members or only selective members

Selection of members sometimes may happen due to clear reasons which are acceptable to the insurer. And then sometimes it happens due to the policy being optional or voluntary. Such instances often require the members to bear a part or whole of the premiums.

Instances where selection is not a problem

- ESI Covered members being excluded from the scope of private commercial health insurance

- Group health Insurance Benefits being given only to a select level of employees – lets say grade wise, tenure wise or above a certain salary range

Can Different Sum Insured Be Offered to Employees / Members under Group Health Insurance

Can the group health insurance policy be different for different members in an organisation

The simple answer is yes, it can be different.

These differences can be on the basis of –

- Varying Benefits – coverages can vary from one level to another level

- Family members covered can vary – you can have only employees / primary members covered up to a certain level and beyond that you can have other family members covered

Do note that offering different sum insured is actually a market practice followed in many organisations

How can I get a Quote for Group Health Insurance

In most emerging organisations there comes a time when you feel the need to offer group health insurance benefits to your members. Particularly in startups and fast growing companies, this need is acutely felt as soon as you feel the need to attract and retain employees.

The discovery of terms and premiums for your group health insurance cover can often be an overwhelming task. Some of the challenges that you will need to overcome are elaborately mentioned in this article on how to set up a group health insurance policy for a startup

Here we will explain the steps you need to follow to ensure you quickly set up a group health insurance benefits program for your company

Step 1

Choose the benefits you want in the group health insurance policy.

This includes the terms of the policy ( explained here ), when should you choose a certain set of terms and change those terms at what point

Step 2

Collect the covered members data

As you come to this step, you have identified the terms of the policy you have done, benchmarked them against competition and have what you consider as the right fit for yourself. Now you need to have the data ready of the covered members. Please note this article on what all data sets are required for the members to be covered under your group health insurance plan.

Step 3

Share with your broker. Read here why use a broker for your health insurance plan and what PlanCover.com can do for you

Step 4

Step 5

Step 6

Step 7

Step 8

Step 9

Why You need to use a broker for your running your group health insurance plan

What are the data sets we need to share with an insurance company to get quotes for group health insurance policy

Let us classify the request for quote processes for two kinds of policies

- Fresh Policy – When you are taking the cover for the first time

- Renewal Policy – When you have already been running the policy and it has come up for renewal

For group health insurance policies coming up for renewal, please read this article on how to negotiate for best premium rates during renewal of your group health insurance policy

Data points required for sharing with the insurance company to get quotes for group health insurance

- Policy Terms –

- First Time Purchase – You need to fix which policy terms are needed for the policy. Visit PlanCover.com ( insert link to rater )

- Renewal Policies – These may be the same as the previous year or may be different for the upcoming policy renewal

- Member Data – This includes the name, employee code ( or any other identifier in case of non-employer-employee policies ), date of birth and sum insured. If your policy also is extended to family members then additionally you want to provide their name, date of birth and relationship to the primary member ( spouse, child, parents, in laws ) (Link to excel for providing member data )

- Only In case of renewal policies – You need to provide the previous years policy copy and the claims MIS. The claims MIS comes in 2 forms and it is advisable you provide both – one is the excel sheet with the details of the claims and the other is the pdf of the claims analysis from your insurance company or the TPA.