Decoding Insurance Policy Documents: A Guide for Indian Policyholders

Introduction

In the intricate world of insurance, policy documents are the compasses that guide policyholders through the maze of terms and conditions. In India, where insurance awareness is growing, understanding these documents is crucial for harnessing the full potential of insurance policies. This article aims to simplify the legal jargon and shed light on the key components of insurance policy documents.

The Significance of Insurance Policy Documents Insurance policies in India are not just contracts; they are the foundation of financial security for individuals and families. They serve as a testament to the insurer’s commitment to safeguard policyholders against unforeseen events. Comprehending these documents is essential for utilizing the coverage effectively.

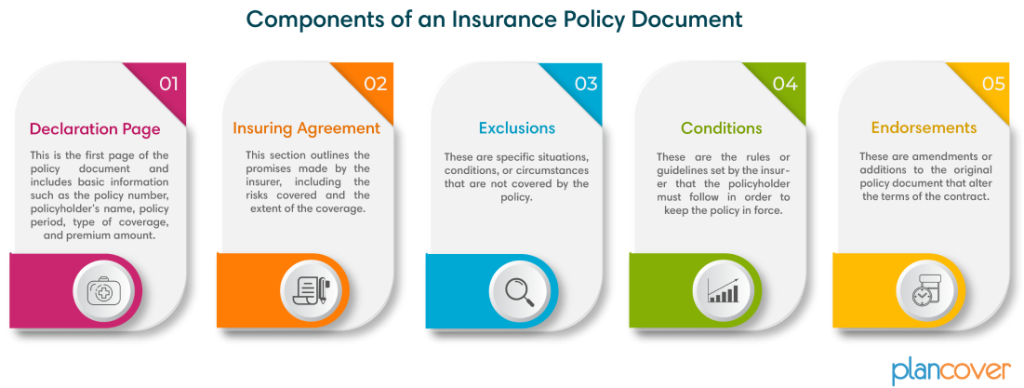

Components of an Insurance Policy Document An insurance policy document typically includes the following sections:

Declaration Page or Schedule: This is the first page of the policy document and includes basic information such as the policy number, policyholder’s name, policy period, type of coverage, and premium amount.

Example: Priya Sharma’s health insurance declaration page lists her family floater policy covering herself, her spouse, and two children. The listed coverage period is from April 1 to March 31, with an annual premium of ₹20,000.

Insuring Agreement: This section outlines the promises made by the insurer, including the risks covered and the extent of the coverage. Example: Rahul Verma’s accident insurance agreement ensures coverage for accidental injuries, disability, and hospitalization due to accidents. It’s his safety net against life’s unexpected twists.

Exclusions: These are specific situations, conditions, or circumstances that are not covered by the policy. Example: A health insurance policy might exclude coverage for pre-existing conditions during the waiting period. It’s important for policyholders to be aware of such exclusions.

Conditions: These are the rules or guidelines set by the insurer that the policyholder must follow in order to keep the policy in force. Example: To avail cashless hospitalization, policyholders must follow the insurer’s network hospital guidelines. Compliance ensures seamless claims processing.

Endorsements: These are amendments or additions to the original policy document that alter the terms of the contract.

Example: An IT professional adds an endorsement to his health insurance policy to cover his newly wedded spouse after marriage.

In addition to these, the IRDA also emphasizes the importance of a Customer Information Sheet (CIS). The CIS is designed to provide policyholders with all important information about their insurance policy in simple language. This includes the name and type of policy, coverage details, waiting periods, limits and sub-limits, and all exclusions.

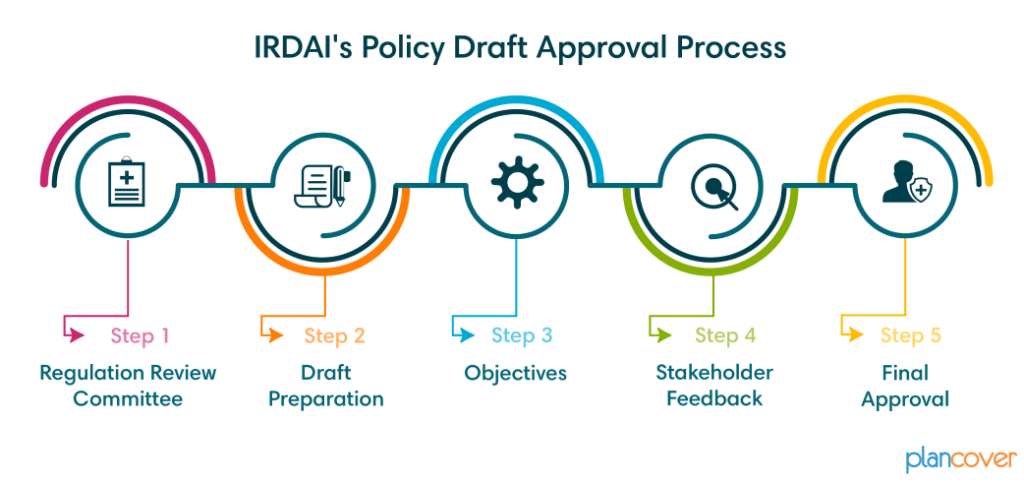

IRDAI and Insurance Policy Drafts

The Insurance Regulatory and Development Authority of India (IRDAI) has a specific process for approving insurance policy drafts. This process is outlined in the IRDAI (Insurance Products) Regulations

Regulation Review Committee (RRC): The IRDAI forms a Regulation Review Committee (RRC) with representatives from various stakeholder groups. This committee focuses on enhancing the ease of doing business and simplifying regulations.

Draft Preparation: After considering the RRC’s recommendations and prioritizing policyholders’ interests, a draft is prepared for the Insurance Regulatory and Development Authority of India (Insurance Products) Regulations.

Objectives: The primary goals of the proposed regulations are to help insurers swiftly respond to changing market needs, increase insurance penetration, safeguard policyholders, and ensure reliable management practices.

Stakeholder Feedback: Feedback and suggestions from stakeholders are invited, usually via email.

Final Approval: After reviewing feedback, the final draft is officially approved. These regulations are reviewed every three years unless an earlier review.

By understanding these components and the process of policy draft approval, policyholders can navigate the complex world of insurance with confidence and make the most of their coverage. Remember, when in doubt, don’t hesitate to reach out to PlanCover for clarification. They are there to help you understand your policy and ensure you are adequately protected.