Disease-Specific Waiting Periods in Health Insurance: A Detailed Look

Disease-Specific Waiting Periods in Health Insurance: A Detailed Look

When you sign up for a health insurance policy, you may notice that certain diseases have a designated waiting period before coverage kicks in. This is known as the disease-specific waiting period. It’s a crucial aspect to consider when choosing a policy, as it affects when you can start claiming benefits for specific conditions.

What is a Disease-Specific Waiting Period?

A disease-specific waiting period is the time frame during which claims for treatment of certain specified diseases are not covered by your health insurance policy. This period can vary from one insurer to another but typically ranges from 2 to 4 years.

Why Do Insurers Implement Disease-Specific Waiting Periods?

Insurers use disease-specific waiting periods to mitigate the risk of covering conditions that may require treatment soon after the policy begins. It’s a way to prevent individuals from purchasing insurance solely to cover imminent medical expenses.

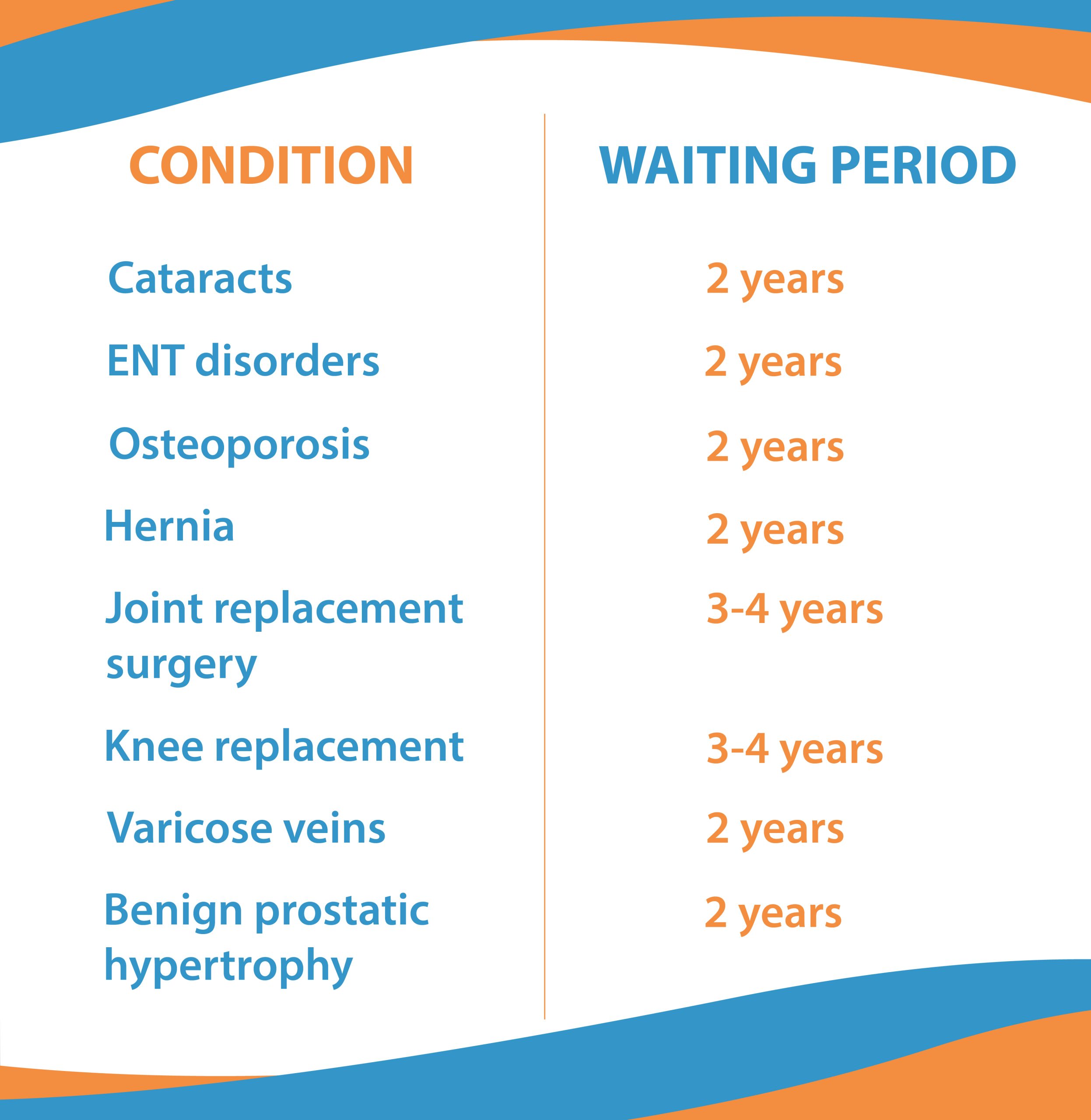

Table of Waiting Periods for Common Conditions:

Note: The above table is a general guide. The actual waiting period for these conditions may vary depending on the terms and conditions of your specific policy.

Disease-specific waiting periods are an important factor to consider when purchasing health insurance. By understanding these periods and planning accordingly, you can ensure that you have the coverage you need when you need it.