Understanding Pre-Hospitalization and Post-Hospitalization Expenses in Health Insurance

Navigating the world of health insurance can be complex, especially when it comes to understanding the coverage for medical expenses incurred before and after a hospital stay. This article delves into the intricacies of pre-hospitalization and post-hospitalization expenses, providing clarity on what they entail and how they are covered by health insurance policies.

Pre-Hospitalization Expenses

Pre-hospitalization expenses are the medical costs that an insured individual incurs before being admitted to a hospital. These expenses are typically related to the diagnosis and initial treatment of the condition that eventually leads to hospitalization.

Key Components of Pre-Hospitalization Expenses:

Health Insurance Coverage: Most health insurance plans provide coverage for pre-hospitalization expenses, usually for a period ranging from 30 to 60 days before hospital admission.

Important Considerations: Coverage is typically linked to the same illness or medical condition that necessitates hospitalization. Policyholders should review their insurance terms for any specific exclusions.

Post-Hospitalization Expenses

Post-hospitalization expenses are the costs incurred after an individual is discharged from the hospital. These expenses are associated with the continued treatment and recovery from the condition that required hospitalization.

Key Components of Post-Hospitalization Expenses:

Health Insurance Coverage: Health insurance plans often cover post-hospitalization expenses for a duration that typically ranges from 60 to 90 days after discharge.

Important Considerations: Similar to pre-hospitalization coverage, there may be exclusions for certain therapies or procedures. The extent of coverage is determined by the specific insurance policy.

Reimbursement Model

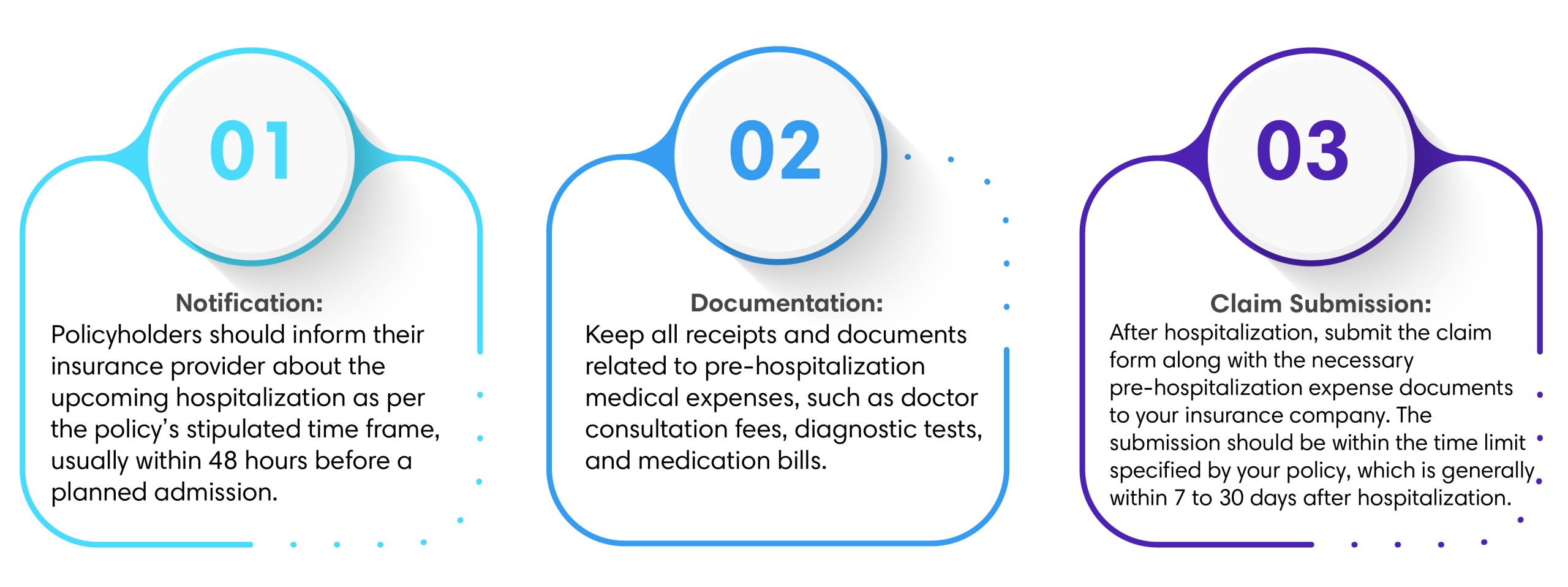

Both pre-hospitalization and post-hospitalization coverages typically operate on a reimbursement model. Insured individuals pay for the medical expenses upfront and later file a claim with their insurance company for reimbursement, subject to the policy’s terms and limits.

Pre-Hospitalization Claim Process

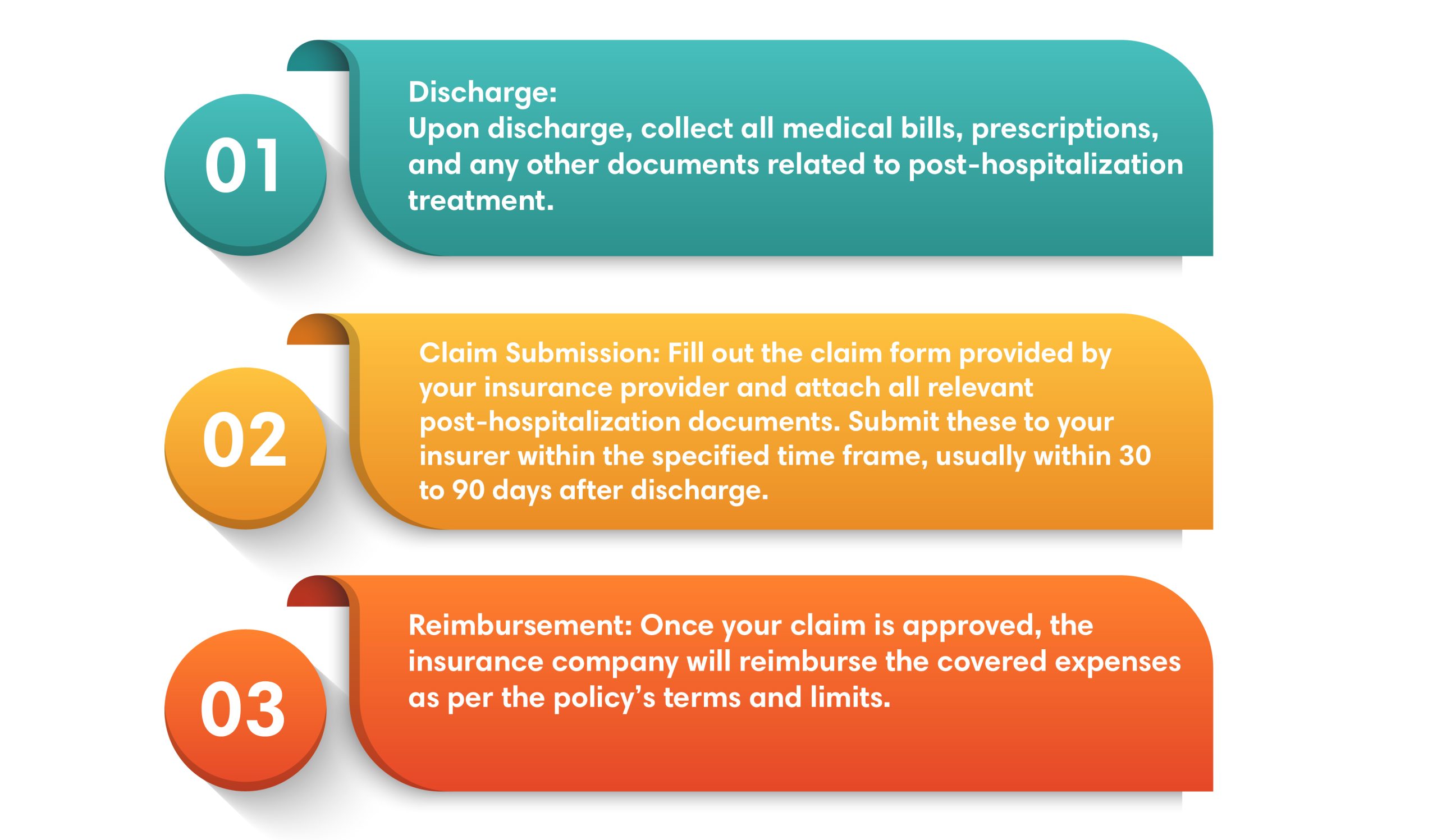

Post-Hospitalization Claim Process

Important Tips:

- Ensure that all claims for pre and post-hospitalization are for treatment for the same condition for which the patient was admitted.

- Submit all claims within the mentioned time period for each of these covers.

- Keep a copy of all submitted documents for your records.