Understanding Sum Insured: A Practical Guide for Indian Policyholders

Introduction

The concept of sum insured is a cornerstone of insurance policies in India. It refers to the maximum amount your insurer will pay in the event of a covered loss. Understanding this term is crucial for making informed insurance decisions, especially in sectors like health and life insurance.

What is Sum Insured?

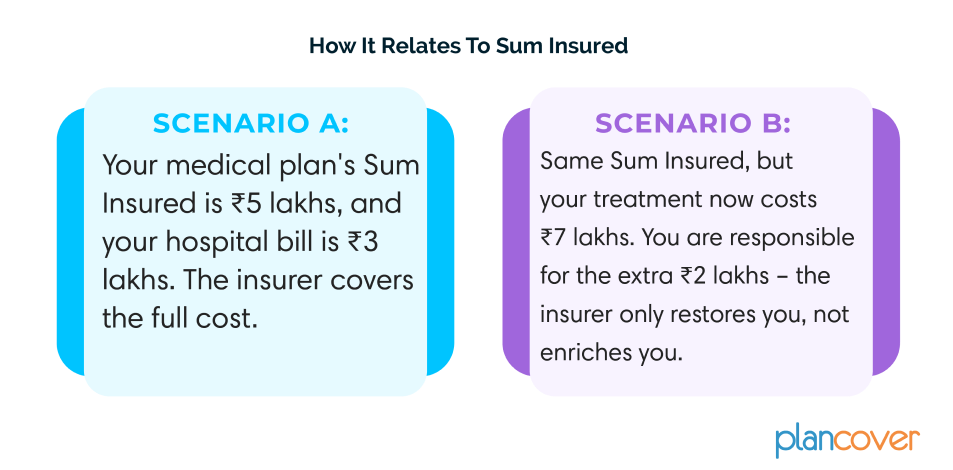

In simple terms, the Sum Insured is the maximum amount your insurance company is obligated to pay for covered losses. While most commonly discussed in health insurance, this concept extends to motor, home, and other insurance types as well. Choosing the right Sum Insured is essential to avoid underinsurance, where your coverage is insufficient when you need it most. For instance, if your health insurance plan has a sum insured of ₹5 lakhs, it means the insurer will cover a maximum of ₹5 lakhs for your medical expenses in a covered scenario.

How Sum Insured Affects Your Coverage

Imagine a scenario where you require bypass surgery, costing approximately ₹7 lakhs. If your health insurance plan has a sum insured of only ₹5 lakhs, you would be responsible for the remaining ₹2 lakhs. Choosing a higher sum insured generally means higher premiums but better financial protection during emergencies.

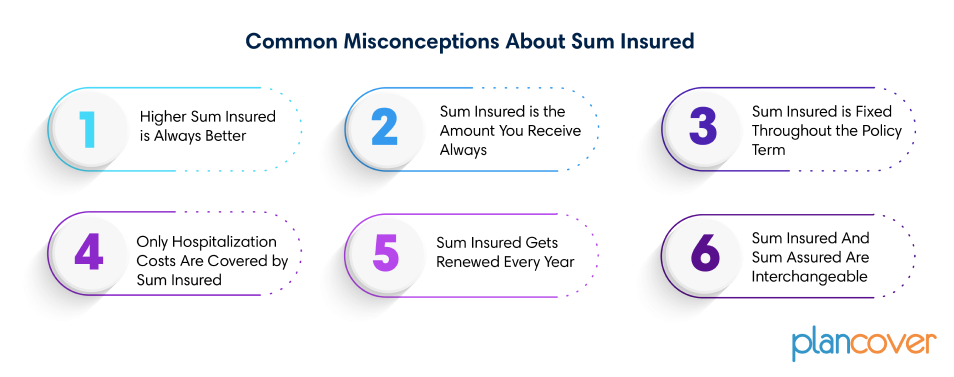

Common Misconceptions About Sum Insured

1. Higher Sum Insured is Always Better

This isn’t necessarily true. While a higher sum insured offers more c overage, it also comes with a higher premium. It’s important to choose a sum insured that aligns with your actual needs and financial situation. Over-insuring yourself can be a waste of money.

Illustration: Consider Mr. Sharma, a healthy 30-year-old with no dependents. He opts for a health insurance policy with a sum insured of ₹50 lakhs, paying high premiums. However, his actual healthcare needs are much lower, making the high sum insured unnecessary and the premiums a financial burden.

2. Sum Insured is the Amount You Receive Always

The sum insured is the maximum payout limit set by the insurance company. In some cases, the actual claim amount might be lower depending on the expenses incurred. This could happen due to policy exclusions, deductibles (initial amount you pay before insurance kicks in), or if the hospital bill is lower than the sum insured.

Illustration: Mrs. Gupta has a health insurance policy with a sum insured of ₹5 lakhs. She undergoes a surgery costing ₹3 lakhs. The insurance company covers the surgery cost, not the full sum insured, as the actual expense was lower.

3. Sum Insured is Fixed Throughout the Policy Term

Some policies allow you to increase the sum insured over time. This can be useful for factors like inflation or increasing life coverage needs due to a growing family. However, there might be limitations or additional medical checkups required for increasing the sum insured.

Illustration: After a decade with his ₹3 lakh health plan, Sanjay, now in his 50s, wants to increase coverage due to the higher risk of ailments. His insurer allows it, but his age requires a fresh medical checkup to re-assess his premiums.

4. Only Hospitalization Costs Are Covered by Sum Insured

While hospitalization is a major expense covered, some policies might extend the sum insured to cover other costs like pre-hospitalization and post-hospitalization expenses, doctor fees, medication, or ambulance charges. Make sure to understand what’s included in your specific policy.

Illustration: Mr. Singh has a health insurance policy covering not only hospitalization costs but also pre- and post-hospitalization expenses. When he falls ill, his policy covers the cost of diagnostic tests before hospitalization and follow-up visits after discharge.

5. Sum Insured Gets Renewed Every Year

The sum insured is typically fixed for the entire policy term (e.g., 1 year, 5 years). However, some policies, like term life insurance, might end after the term, so you would need to renew the policy with a new sum insured if needed.

Illustration: Mrs. Kapoor has a health insurance policy with a sum insured of ₹5 lakhs for a term of 3 years. Even if she doesn’t make any claims, the sum insured does not renew or increase each year. It remains ₹5 lakhs for the entire policy term.

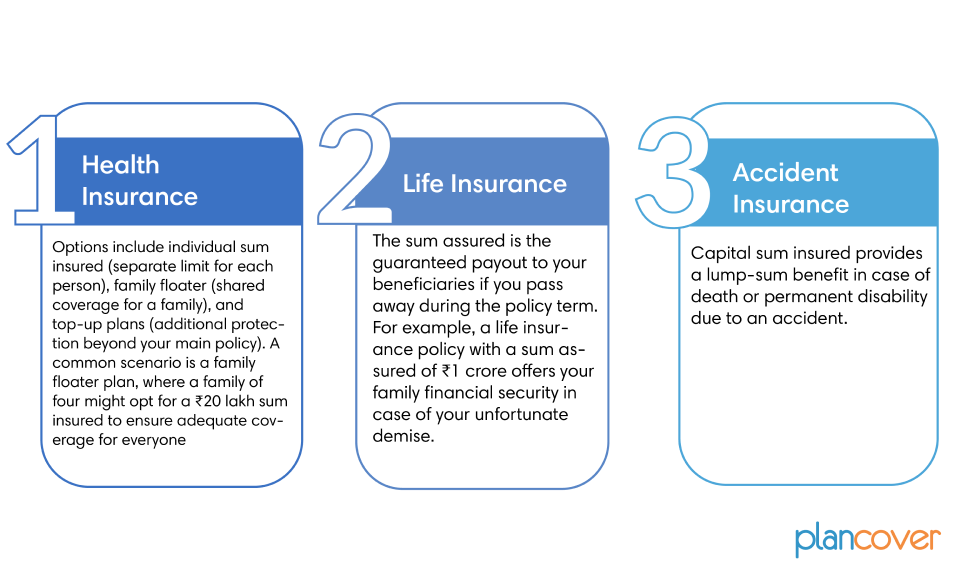

6. Sum Insured and Sum Assured Are Interchangeable

While both terms relate to the amount associated with an insurance policy, they serve different purposes. In the context of life insurance, the sum assured is the guaranteed payout to your beneficiaries if you pass away during the policy term. On the other hand, the sum insured in health insurance refers to the maximum amount for a particular year payable by the insurance company to you in case of hospitalization.

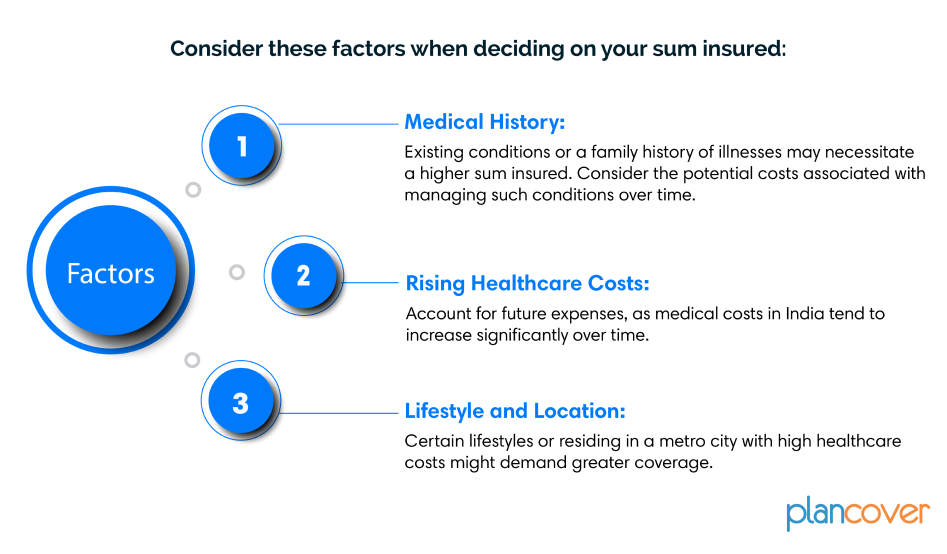

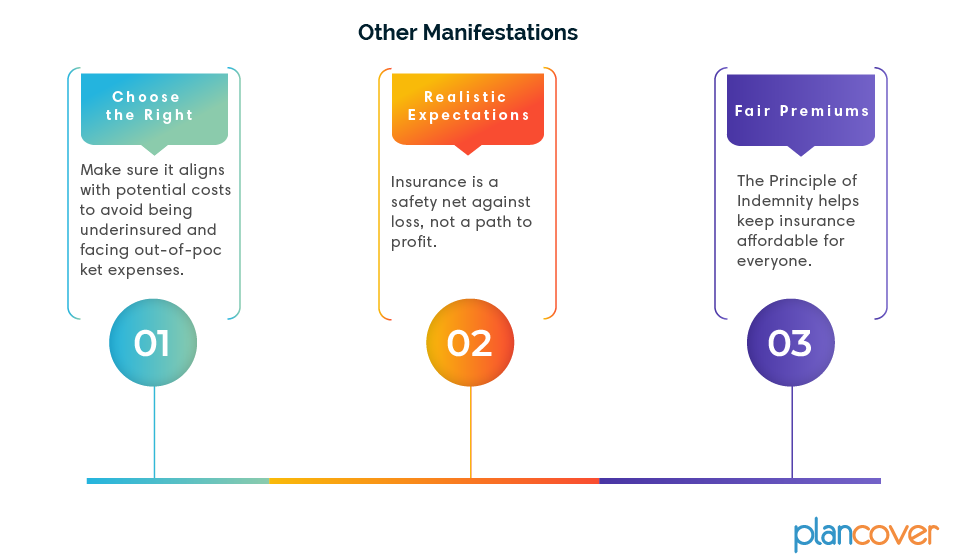

Choosing the Right Sum Insured

The Importance of Understanding Sum Insured

Choosing the right sum insured is essential for ensuring adequate financial protection against unexpected events. Failure to do so carries the risk of serious out-of-pocket expenses, potentially undermining your financial well-being.

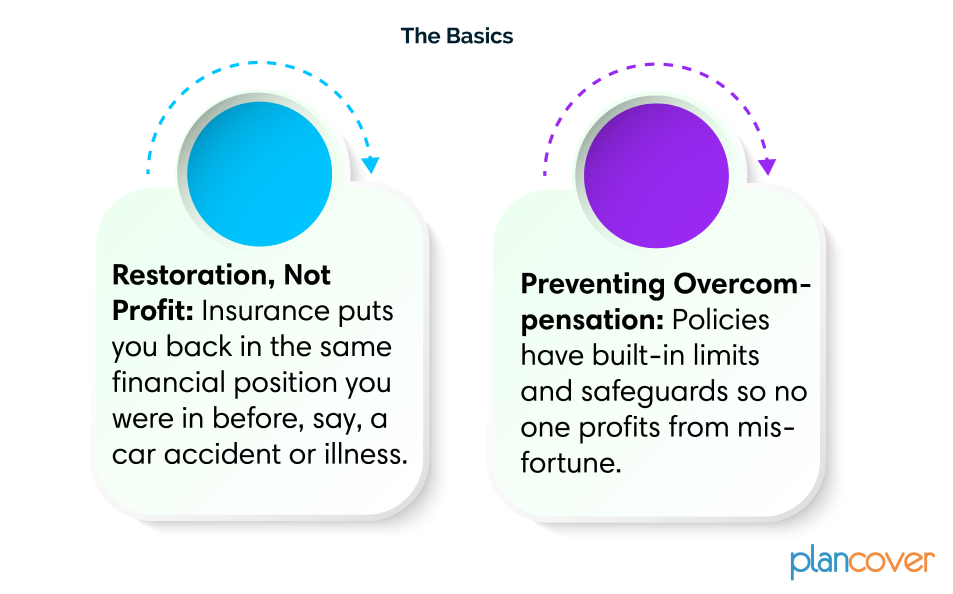

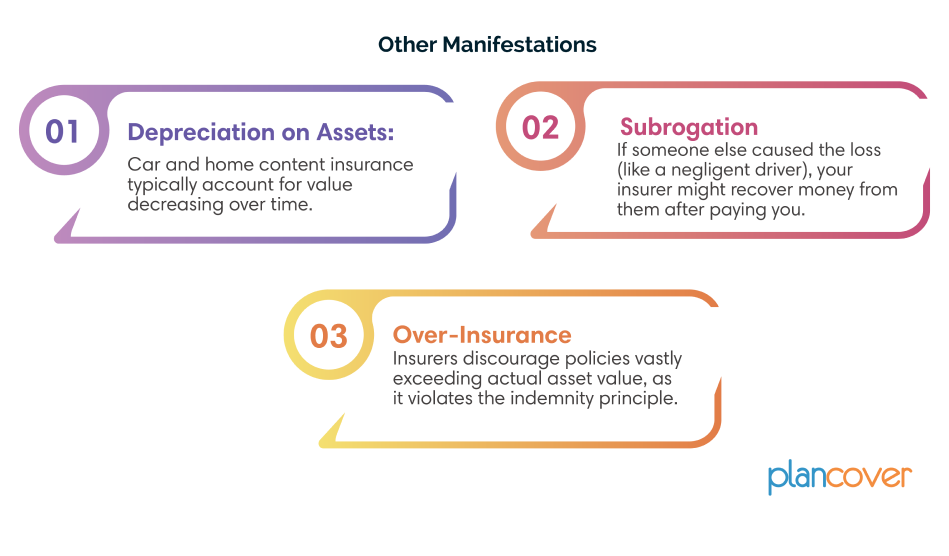

Understanding the Principle of Indemnity: Your Guide to Fair Insurance

In the world of insurance, the Principle of Indemnity is foundational. It means your insurance is designed to compensate you for losses, not to make you financially better off after a mishap.

Insurance offers valuable protection during difficult times. By understanding the concept of sum insured, you can make informed decisions, tailor your coverage to your specific needs in the Indian context, and safeguard yourself from unwelcome financial surprises.